Bybit: BTC On-Chain Demand Elevates Near $20k, Aptos Raises $150M in New Funding Round

Chart of the Day

The broader crypto market deepened its losses amid debate over the impact weaker economic data will have on the U.S. Federal Reserve’s strategies to combat inflation. The largest cryptocurrency by market cap has pared its gains from last week, and instead incurred a 7% loss on the back of profit-taking activities near the $23k level. As of the time of writing, BTC is consolidating at the lower end of the $21k region after shedding 3.3% of its market value in the last 24 hours. A bearish trend line with resistance near $21.9k is taking shape on BTC’s hourly chart. Failure to break above this level would likely send BTC to test support near the $20k to $20.5k zone. Bybit reports.

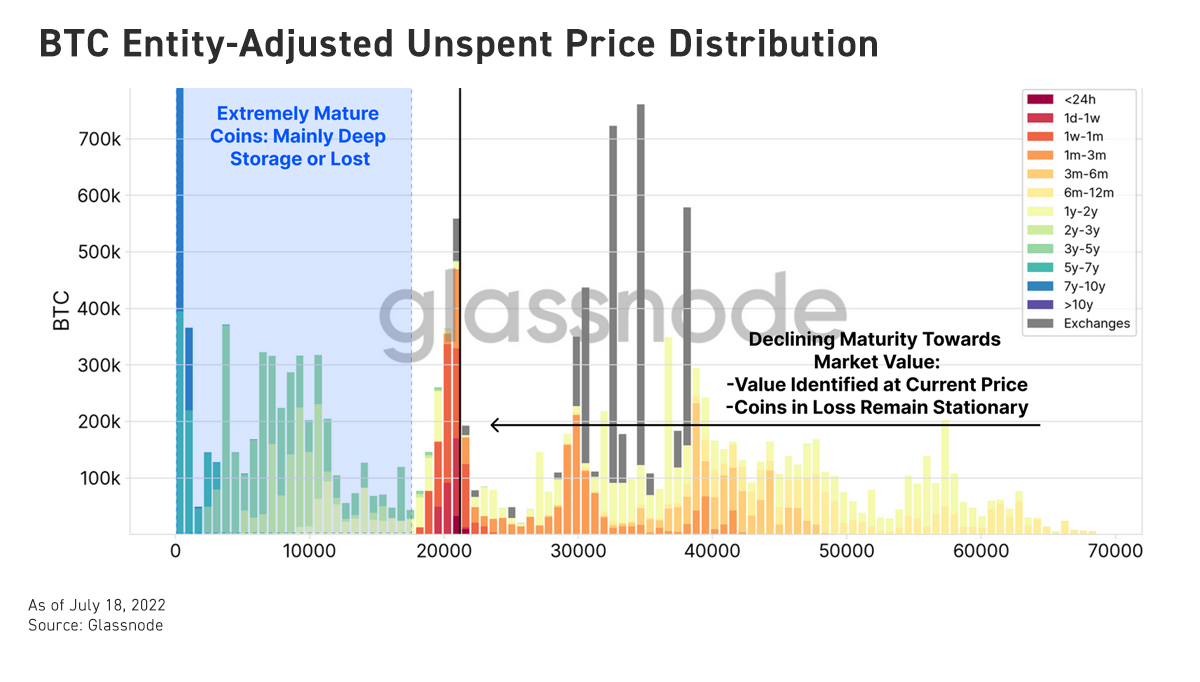

On-chain metrics saw elevated demand in the $20k region, where a lot of recent transactions take place. Recently redistributed coins continue to mature beyond the six-month threshold, despite being held at heavy unrealized losses. The nodes with concentrated supply around the $20k to $40k psychological barriers will act as solid price walls once the market decides its next direction.

ETH, the second-largest cryptocurrency by market cap, continues to extend its losses, and is currently changing hands below $1,500 after posting a 7% loss during the same period. Most major altcoins are deep in the red, with NEAR and MATIC leading the correction on nearly 10% losses over a similar time frame.

Talk of the Town

Aptos Labs, a blockchain firm founded by former Meta employees, has recently closed a $150 million funding round led by FTX Ventures and Jump Crypto. The round brings the firm’s total fund raised this year so far to a whopping $350 million in spite of the market downturn. Aptos plans to channel the funds raised to build the “safest and most production-ready blockchain in the world”. The firm will also focus on the development of a blockchain that offers a “reliable foundation” for web3 adoption — one that will usher in billions of users around the world. Find out more about Aptos here on L1/L2 Developments.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.