Bybit: Demand for BTC Remains Muted, CryptoPunk Sales Skyrocket as Tiffany Releases NFT Pendants

Chart of the Day

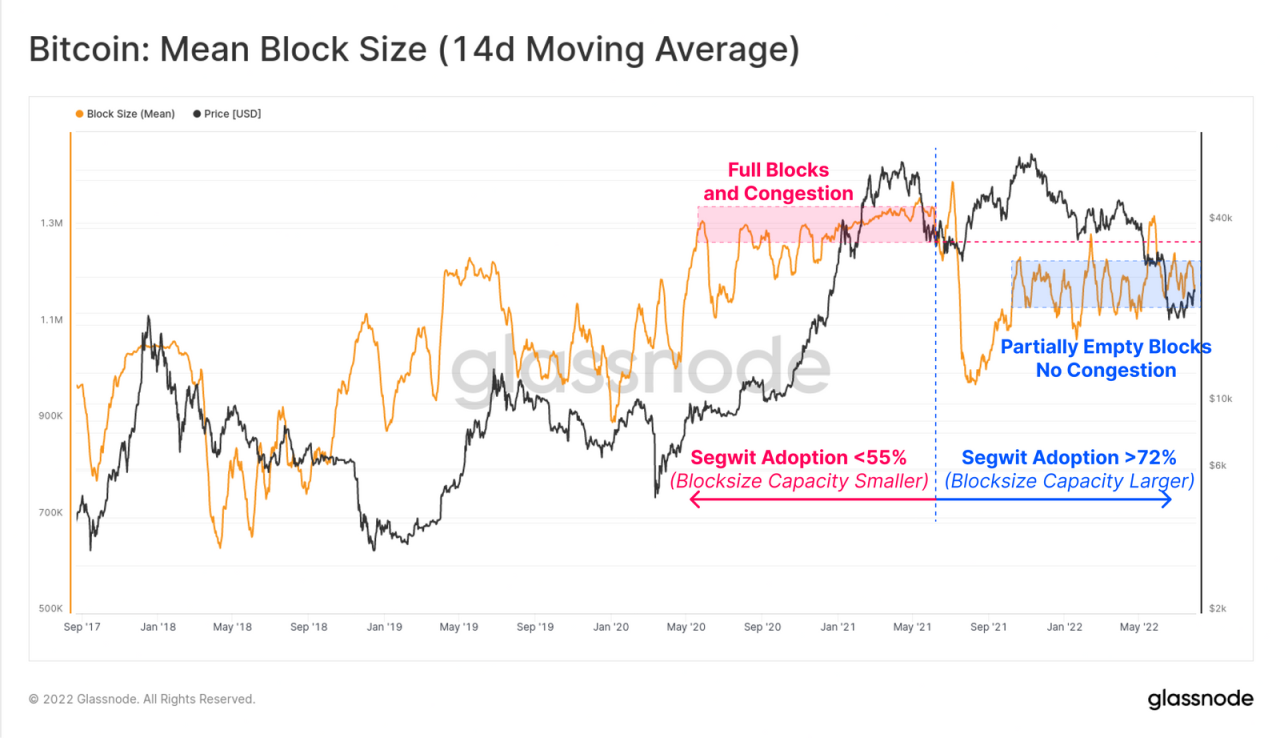

In the early Asian trading hours on Tuesday , the risk asset market saw a significant decline as geopolitical uncertainty intensified. As of the time of writing, BTC is consolidating losses just below the $23k handle on lower-than-average volume, after shedding 1.7% of its market value in the last 24 hours. The largest cryptocurrency is facing major resistance near the $23.3k level, and could likely move down to test support at the $22k threshold. On-chain demand remains muted for BTC, as transaction fees are still knee-deep in bearish territory. Meanwhile, the current block size is even lower than the capacity utilized before the Segwit adoption. Block congestion frequency has plunged to levels last seen in May 2021, indicating that the Bitcoin network is still primarily dominated by HODLers, while new demand remains scarce. Bybit blog reports.

ETH experienced a steeper decline, hinting at the possibility that the recent Merge-inspired rally may be driven by sentiments and thus lack material support. The second-largest cryptocurrency by market cap is now trading below the $1,600 mark after shedding 5.5% of its market value in the same period. The 7-day implied volatility for ETH options rose again, alongside a further decline in skewness. In the altcoin market, most major altcoins have flipped red, with DOT leading the correction on a double-digit percentage loss over a similar time frame.

Talk of the Town

CryptoPunk, one of the OGs in the NFT space, has seen renewed interest in its collection after Tiffany & Co. released an exclusive offer for CryptoPunk holders. The sales volume of the NFT collection skyrocketed by a staggering 248% in the last 24 hours. The iconic jewelry brand has also revealed plans to launch a separate line of NFT called NFTiffs, as part of its effort to take NFT to the next level. The surge came after a lackluster quarter for the broader NFT space, where the monthly marketplace volume deepened its decline amid recent market downturn.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.