Bybit: Investors Bet Big on The Merge, Curve Finance Resolves Frontend Hack

Chart of the Day

The broader crypto market experienced a slight dip as some investors began to offload their risk assets amid uncertainties around the impending CPI data release. Major cryptocurrencies returned some of their gains over the past week. BTC has snapped its four-day winning streak, and is trading below the $23k handle after dropping by 3.8% in the last 24 hours. The largest cryptocurrency by market cap is facing an immediate resistance level near the $23.2k to $23.5k region. A close above this resistance zone would likely usher in a steady increase. Alternatively, BTC may head south to test its past support levels in the $22k to $22.5k zone. In the derivatives market, whilst leverage remains high, the underlying margin appears to be more stable as the proportion of coin-backed margin has returned to the normal baseline of around 40%. Bybit blog reports.

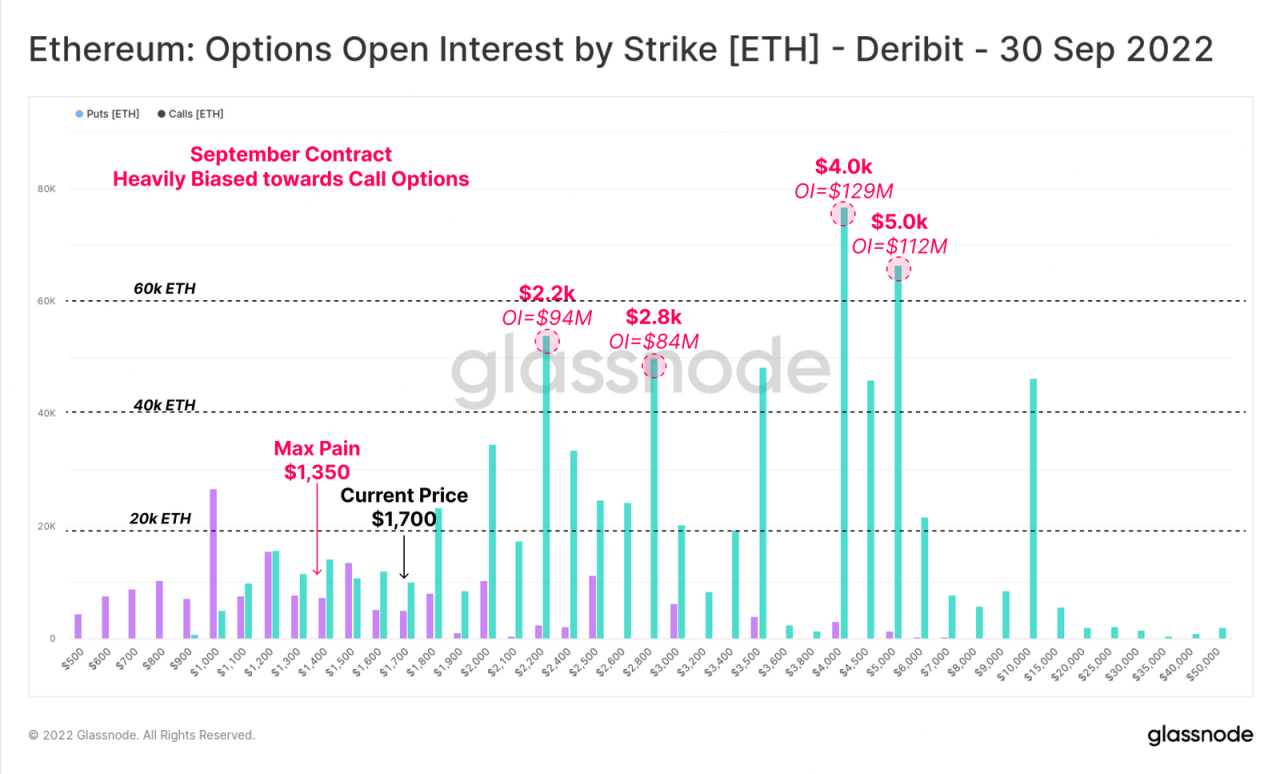

In a similar vein, ETH is changing hands above the $1,600 mark after shedding 6% of its market value in the same period. The negative basis in the ETH futures market has not improved, as investors eye both upside speculation into The Merge and the potential selling pressure afterward. The max pain price sits near $1,350, way below the current spot, which may set up for interesting price actions to unfold. Coins that topped the gainers’ chart are giving back their gains. FIL, for one, tumbled 8% in a similar time frame, as most major altcoins flipped red.

Talk of the Town

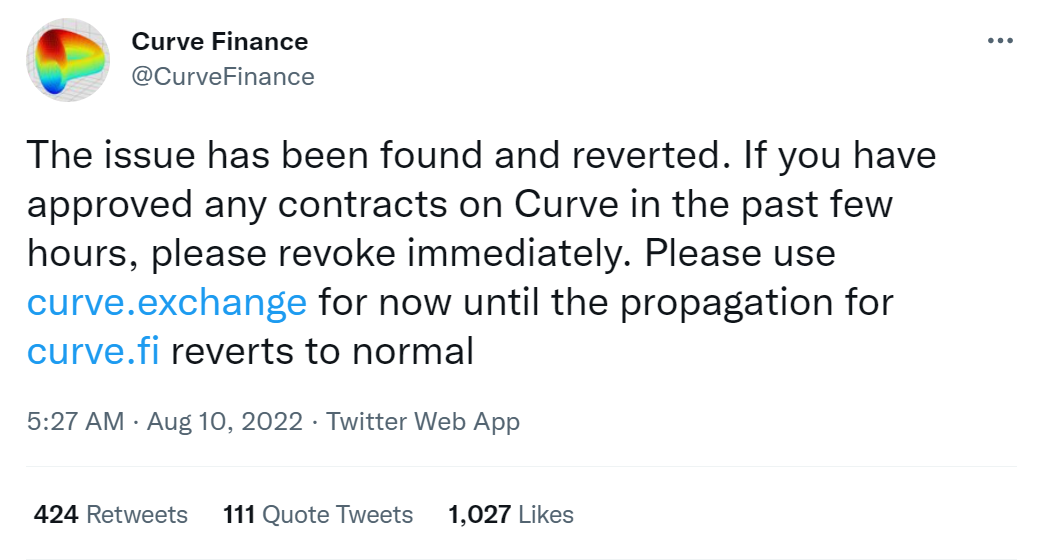

Decentralized trading platform Curve Finance is the latest victim that succumbed to a series of exploits targeting blockchain companies and the crypto space. The hackers staged a frontend attack on a Curve website that redirected unsuspecting users to a malicious destination. According to on-chain sleuth Zachxbt, the attackers may have stolen up to $570k in ETH, which was sent to FixedFloat for money laundering. Curve Finance announced in an update early Wednesday (Asian hours) that the hack has been found and resolved, while asking users to revoke any contract approvals on its platform.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.