Bybit: Miner to Exchange Volume in Decline, Polkadot’s Stablecoin aUSD Depegs After Acala Misconfiguration

Chart of the Day

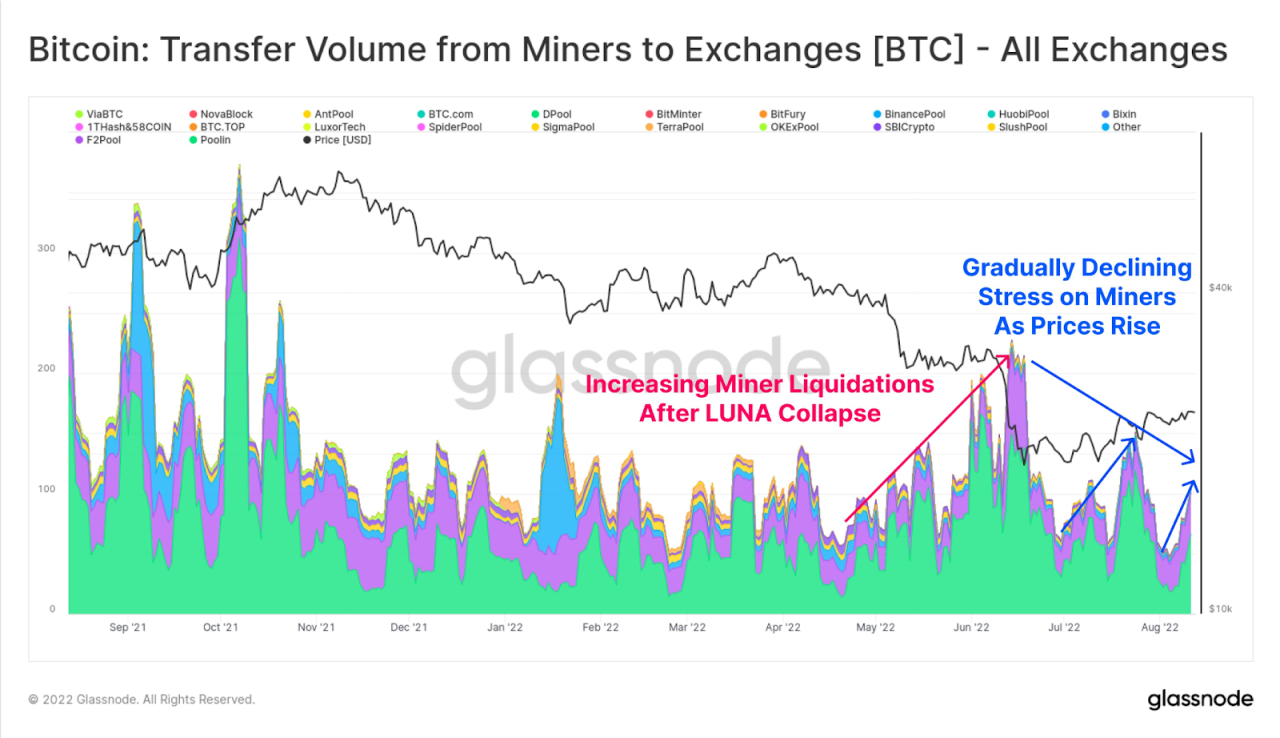

The broader crypto market largely moved sideways over the weekend on light volume. BTC crossed over the $25k handle, reaching a local peak near $25,045, before retreating to previous support levels for consolidation. As of the time of writing, the largest cryptocurrency by market cap is trading in the upper region of $24k, after posting a 1.2% increase in the last 24 hours. A key bullish trend line with support near $24.4k is taking shape on BTC’s hourly chart. With hourly MACD gaining pace in the bullish zone, the bulls will likely push for more upside momentum once BTC manages to close above the $25k key resistance zone. Meanwhile, the transfer volume from miners to exchanges has decreased notably over the past weeks, suggesting that distribution has eased despite the continued pressure to shore up balance sheets in the mining industry. Bybit blog reports.

In a similar vein, ETH soared above the $2,000 psychological barrier on weekend trading, but has since gone south to consolidate losses near the $1,980 region. With The Merge around the corner, Lido’s staked ETH is still trading at a slight discount against ETH, but the gap seems to be gradually narrowing. Major altcoins saw mixed performances, with memecoin SHIB topping the gainers’ chart on an impressive 30% gain over the last 24 hours.

Back to (the) Futures

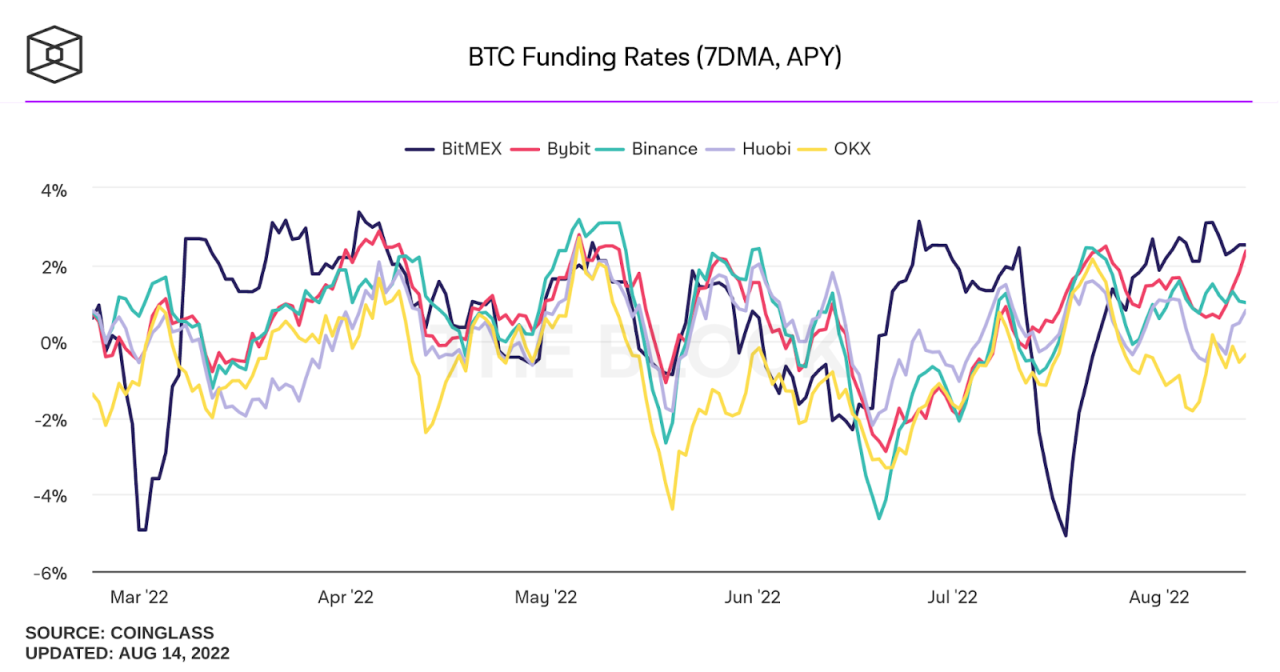

Last week’s favorable macro readings provided some long-awaited relief to the markets as expectations of tapered inflation have restored some positive sentiments in risky assets. The number of BTC perpetual swap contracts with negative funding rates has decreased, reflecting growing confidence in an altcoin-driven market. Upside demand increases in the futures market as open interest soars and the basis spread widens. The Merge in September is perceived to be an excellent catalyst, as evidenced by ETH options OI reaching new highs, and investors becoming willing to pay up for the exposure.

Talk of the Town

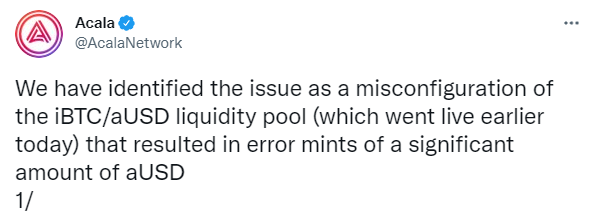

Another stablecoin lost its peg over the weekend. Polkadot and Kusama’s decentralized stablecoin aUSD depegged from the $1 mark, at one point dropping to as low as $0.58, after its underpinning protocol, Acala Network, succumbed to a breach. According to Acala’s tweet, the team has identified the issue as “a misconfiguration of the iBTC/aUSD liquidity pool”, one that resulted in the error mint of a substantial amount of aUSD. The team confirmed that the issue has been rectified, while the on-chain investigation is underway to uncover the affected addresses.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.