Bybit: BTC Mature Coins Spending Muted, CryptoPunks Floor Price Briefly Flips BAYC

Chart of the Day

The broader crypto market seems to be taking a breather after the steep plunge on Friday, as investors try to decipher inflation data and navigate the ongoing macro uncertainties. The market is anxiously anticipating the Jackson Hole symposium this Friday, where Federal Reserve officials will shed some light on the likelihood of another 75 bps rate hike at the FOMC meeting in September. As of the time of writing, BTC is consolidating its weekend losses below the $22k level and the 100-hour moving average, after posting a 1.3% increase in the last 24 hours. On the upside, the largest cryptocurrency by market cap is facing major resistance in the $21.5k to $22k zone. Failure to clear this zone will likely send BTC to retest support levels between $20.8k to $21.2k. Bybit blog reports.

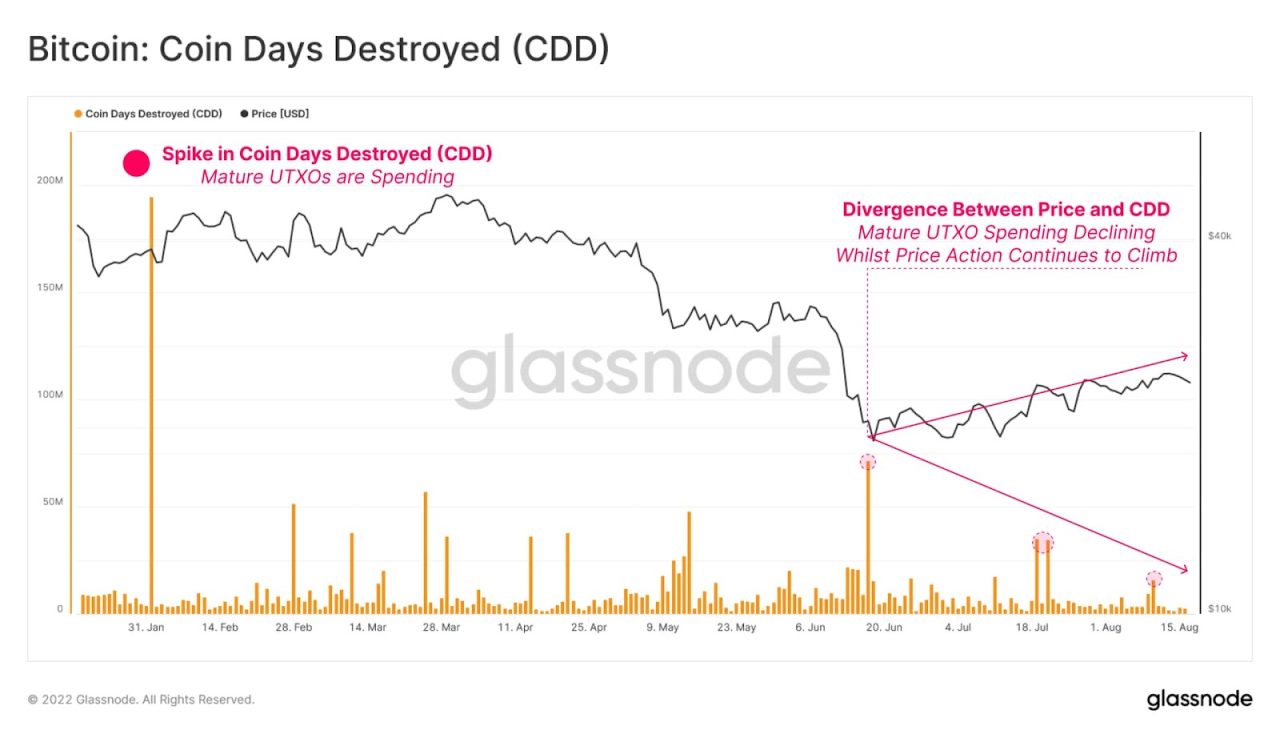

On-chain metrics suggest muted spending among mature coins. There is a stark divergence between mature UTXO volume and the current price action, indicating that some participants are exiting liquidity as the market recovers from cycle lows. Retail traders seem to be rushing in to buy the dips, while whales maintain their risk-off stance until the market reveals a clearer direction.

In a similar vein, ETH is consolidating just below the $1,600 handle, after experiencing marginal gains over the same period. However, the drawdown from the $2,000 threshold held by the second-largest cryptocurrency by market cap a week ago remains significant. Most major altcoins have flipped green, with EOS leading the recovery on an 8% increase over a similar time frame.

Back to the Futures

The derivatives market has flushed out considerable leveraged long positions after what seems to be the largest liquidation event the market has witnessed since the LUNA classic implosion. BTC perpetual contract funding rates have nosedived on major centralized exchanges, suggesting dampened sentiment across the board. In the options market, despite the rise in implied volatility for both BTC and ETH, the term structures for both remain in Contango, with a negative dip in the ETH term structure around The Merge timeline.

Talk of the Town

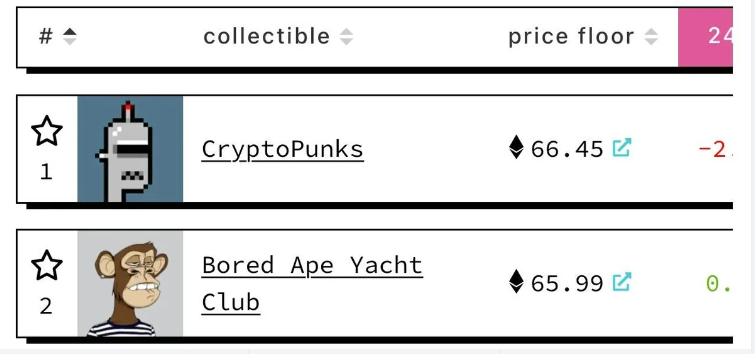

In a brief moment on Sunday, the CryptoPunks NFT collection has flipped the celebrity-coveted Bored Apes in terms of floor prices, topping the leaderboard for the first time since March this year. Although the BAYC collection re-clinched the top spot shortly after, it is no denying that CryptoPunks has been narrowing the gap in floor prices since June, on the back of exciting news including the onboarding of NFT apostle Noah Davis to oversee the collection and the handover of commercial rights to holders.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.