Bybit: BTC Spent Output Shows Bearish Signals; BarrelDAO Sells Out NFT-Linked Solana-Themed Beer

Chart of the Day

Risk assets nosedived after Federal Reserve chair, Jerome Powell, reiterated the bureau’s hawkish stance on battling inflation. The prospect of high rates, which may continue for an extended period, has dampened market sentiments as spooked investors sold off top cryptocurrencies. Bybit blog reports.

Over the weekend, BTC struggled to cling to support above $20k, while ETH’s price weakened despite ongoing Merge narrative. As of the time of writing, the largest cryptocurrency by market cap is inching towards the $20k threshold after posting a marginal loss over the last 24 hours. On the upside, BTC is facing strong resistance in the $20k to $20.2k zone. Failure to close above this resistance zone will likely accelerate its downside correction to test support levels in the $18.5k to $19.5k region.

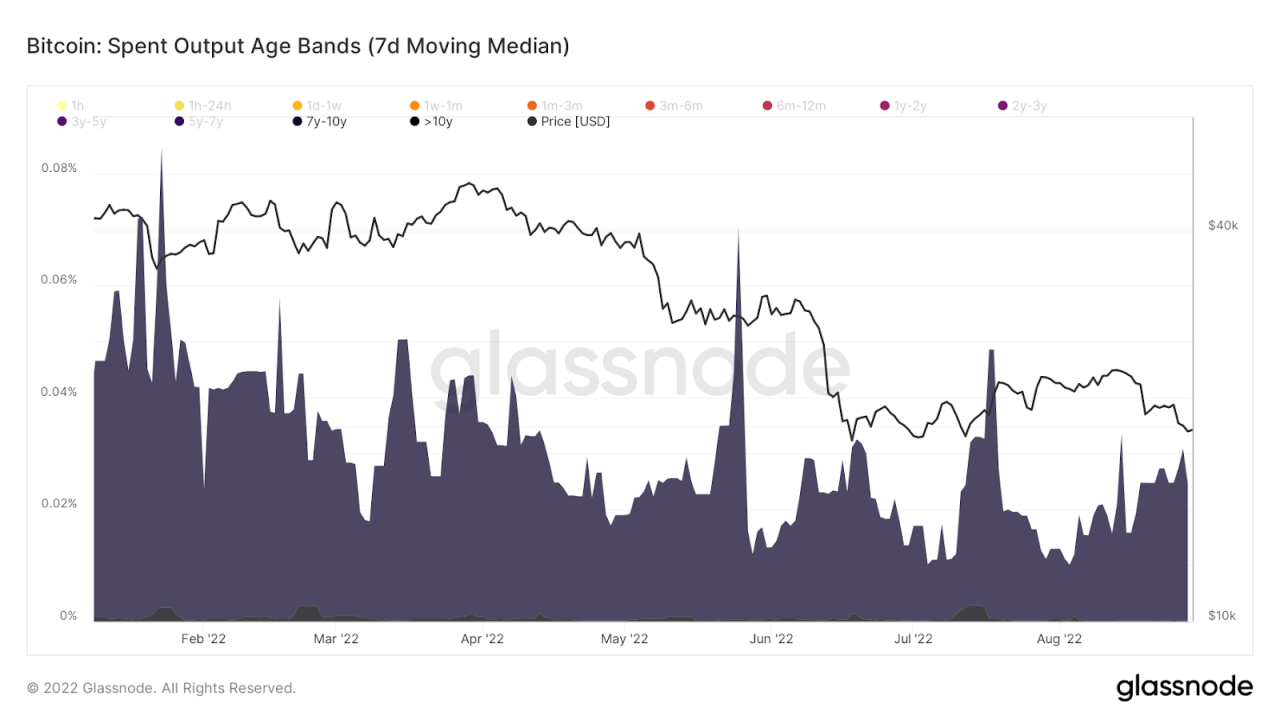

Meanwhile, a sharp spike is observed in BTC spent output for coins aged between seven to ten years, suggesting that these aged coins have been moved amid the recent price plunge. This spike in transaction bears similarities to the one on May 13, where a substantial amount of old coins were moved during a capitulation, followed by a month-long consolidation and further downside price actions. The 7-day EMA of spent output value also shows an uptrend among older coins, which typically coincides with a period of downward price discovery.

Similarly, ETH is trading below the $1,500 handle after shedding 2.7% of its market values in the same period. Most major altcoins saw mixed performances, with AVAX leading the correction on a 7% loss over a similar time frame. It is crucial to look out for the bearish follow-through after Friday’s speech. The broader crypto market will likely skid into September with lackluster token performances on the back of increasing liquidity pressure.

Back to (the) Futures

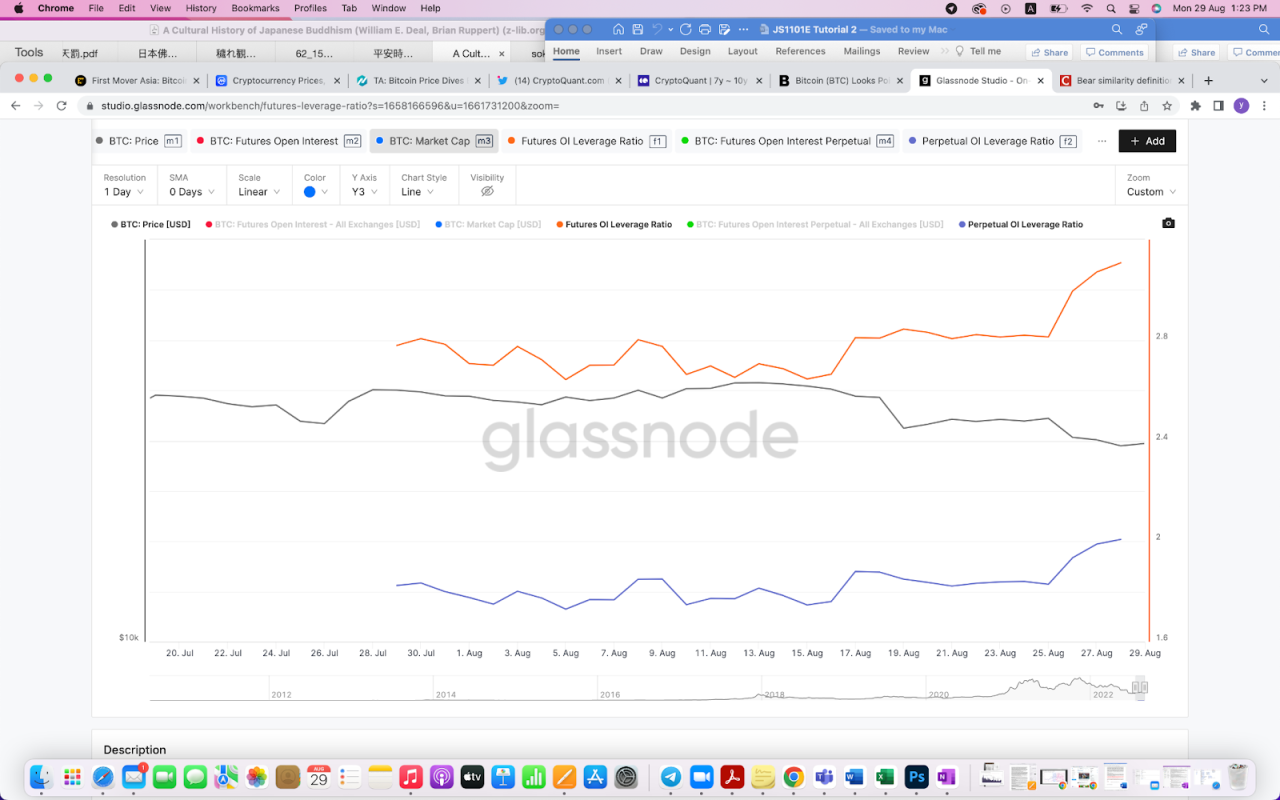

The derivatives market saw stark changes in market sentiments and expectations. BTC perpetual contract funding rates across major exchanges have dived to the negative territory after Friday’s shock. This suggests that bearish sentiments have reached the lowest levels since July, when the market tried to unwind after a series of detrimental implosions. Long-term expectations sank: The basis for BTC futures expiring in June 2023 plunges below 0.25%, while the basis for ETH futures expiring in the same period is approaching -2%. In the options market, the weakening spot prices had little effect on the Realized Volatilty, indicating that options traders may have already priced in Jackson Hole’s impact.

Talk of the Town

Brewery-focused BarrelDAO recently launched a collection of NFTs with a side of limited edition Solana-themed beer. The collection of 333 NFTs, released last Friday, has already sold out for 1.35 SOL each. As of the time of writing, several of these NFTs are listed on secondary markets with a floor price of 2.49 SOL. Each NFT purchase entitles the owner to redeem a 16-pack Solana Summer Shandy, with cans featuring NFT artworks from projects including DeGods, Degenerate Ape Academy, and many more.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.