Bybit: BTC Market Cap Dominance Reaches New Lows; Final Countdown to The Merge Begins

Chart of the Day

The broader market tanked on Tuesday as anxieties over macroeconomic uncertainty gained the upper hand, pushing the price of major cryptocurrencies below key support levels. As of the time of writing, BTC is approaching new cycle lows after shedding 5.3% of its market value in the last 24 hours. On the upside, the largest cryptocurrency by market cap is facing resistance near the $19k to $19.5k zone. Failure to rise above this resistance zone may lead to further downside correction to test support near the $18.5k level. Bybit blog reports.

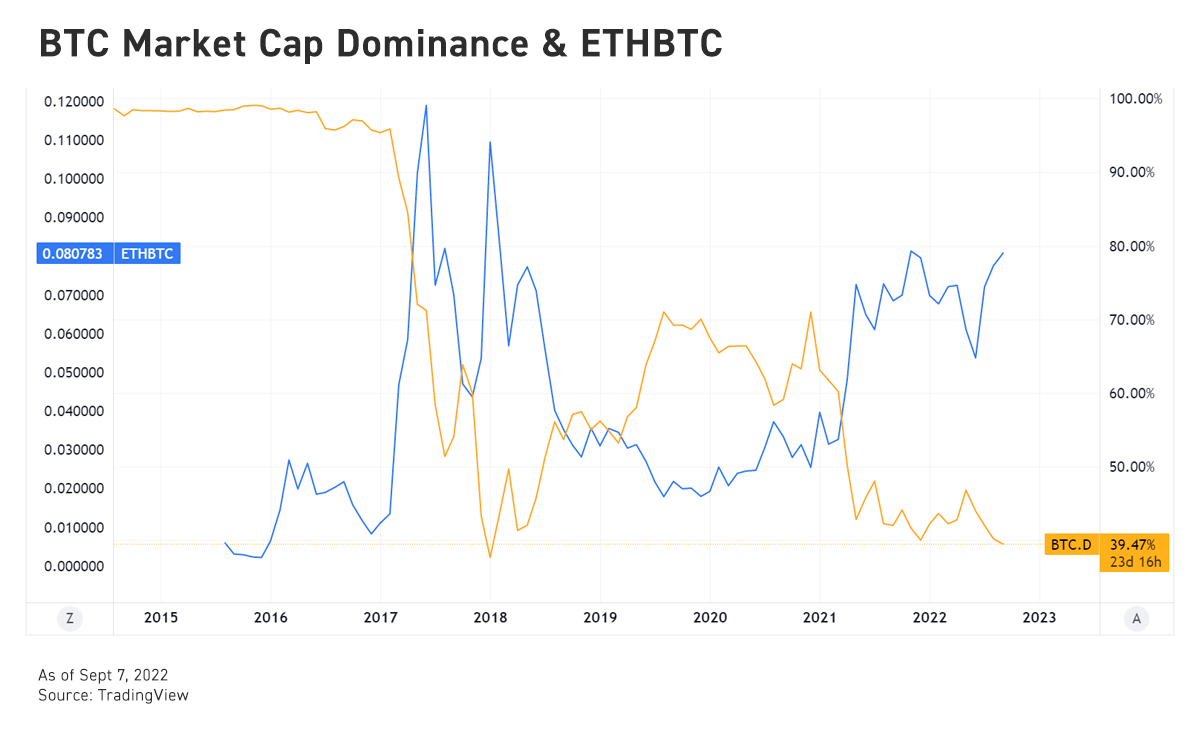

In the derivatives market, the magnitude of liquidations remains limited as investors have already braced for potential sharp declines due to dampened sentiments in the market. In the options market, the skyrocketing implied volatility and the plummeting skew both point to an even grimmer market outlook. Meanwhile, BTC’s market cap dominance has dropped to levels last seen in 2018. Although it is still too soon to draw a conclusion, the current bear run resembles the previous two cycles in both duration and depth of drawdowns.

ETH plummeted alongside BTC after rallying in the early hours of Tuesday. The second-largest cryptocurrency by market cap is now changing hands just above the $1,500 handle, after experiencing an 8% setback in the same period. The imminent shift toward an energy-efficient Proof of Stake (PoS) consensus amid the global energy crisis did not seem to bring sufficient momentum to lift the broader crypto market. Most major altcoins are submerged in a sea of red, with ETC leading the plunge on a double-digit percentage loss in a similar time frame.

Talk of the Town

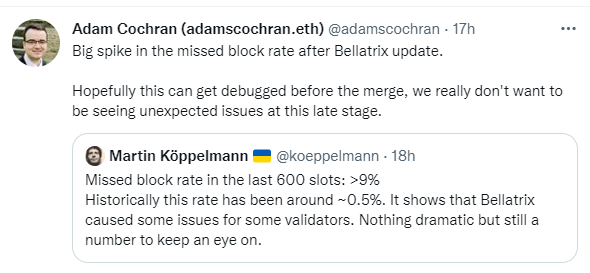

The much-anticipated Merge is officially underway after the activation of the Bellatrix upgrade on the Beacon Chain, marking the beginning of the final stage of Ethereum’s transition to a proof-of-stake consensus. The Bellatrix upgrade prepares the Consensus layer for The Merge with the Execution layer. The Terminal Total Difficulty (TTD) value triggering The Merge has been set, and is expected to be reached between Sept. 13 to 16. Despite some initial technical hiccups, Ethereum developers celebrated the successful execution of the Bellatrix upgrade, and declared full steam ahead for the ultimate Merge.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.