Bybit: ETH Deposits on Beacon Chain Stabilize; Solana-based NFT Activities Soar

Chart of the Day

Over the weekend, the broader market saw a rebound after risk assets staged a comeback. Most major cryptocurrencies held fast above key support levels as investors remained cautiously hopeful of the release of positive inflation data later this week. BTC spiked more than 10% at one point last Friday, outperforming ETH and momentarily reclaiming its market cap dominance. In the early hours of Monday, BTC briefly smashed the $22k threshold after gaining pace above the $21.2 to $21.5k resistance zone. As of the time of writing, BTC is consolidating above the $21.5k level after posting marginal gains over the last 24 hours. The largest cryptocurrency by market cap will likely gain more momentum once it overcomes key resistance near $22k, but the possibility of a downside correction to the $21.2k support or even lower is not entirely ruled out. Bybit blog reports.

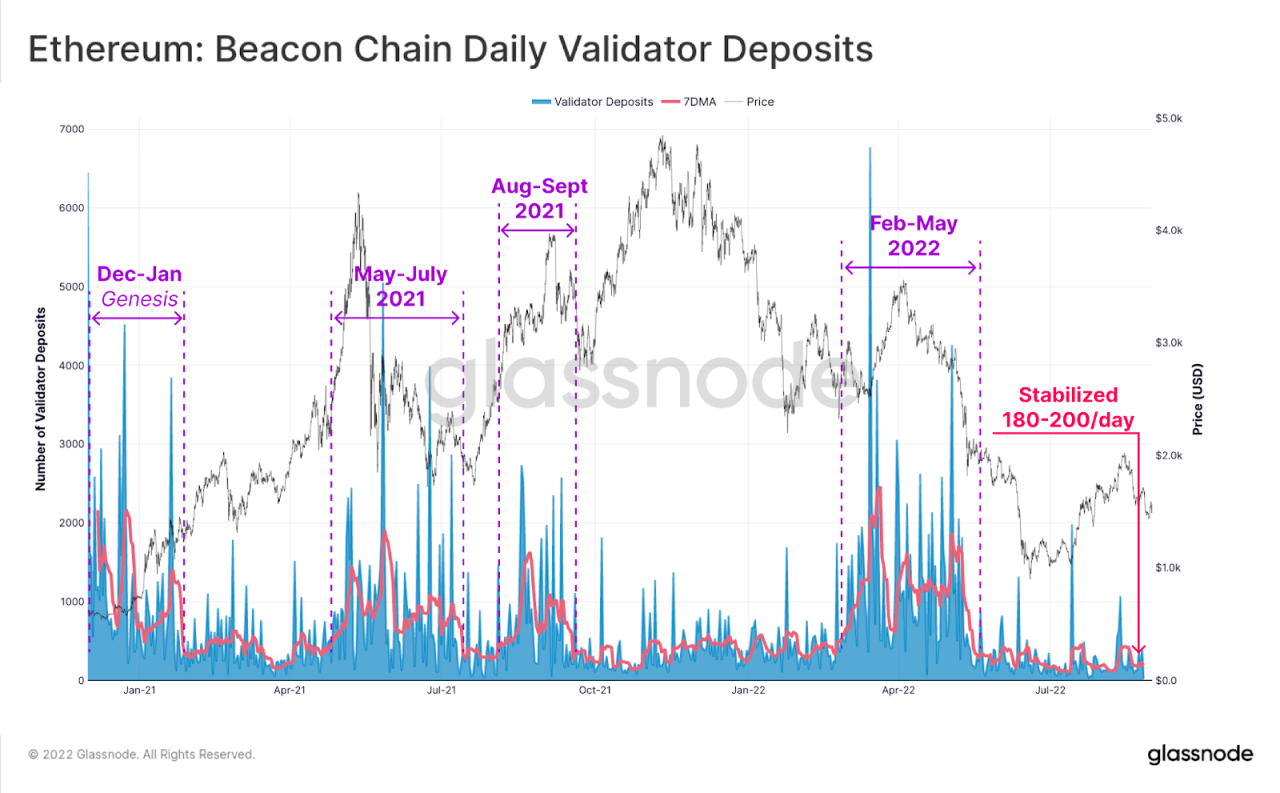

ETH experiences a 2.2% decline in the same period but remains well-bid above the $1,700 handle. The second-largest cryptocurrency by market cap still inspires much optimism in the market as the network’s major milestone is to be completed in the next couple of days. In the journey that leads to the final Merge, ETH deposits have continued to flow into the Beacon Chain contract, with a stable baseline of around 200 to 250 deposits per day since the genesis block. The number saw notable peaks during past market euphoria and maintained a stable baseline during the darkest moments of the industry. In total, investors have completed more than 418,527 deposits of the staking requirement of becoming a validator, reaching a total of 13.4 million staked ETH on the Beacon Chain. Most major altcoins saw mixed performances, with APE leading the pack on double-digit percentage losses, while EOS shed 5% of its market value over a similar time frame.

Back to the Futures

Sporadic relief rallies amid a sustained period of bearish price actions are not uncommon. As spot prices spiked over the weekend, perpetual short positions were flushed out in what might be the most significant short liquidations since August. However, the magnitude of recent liquidation events remains limited due to muted volume. Short-term bullish sentiments resulted in an uptick in futures basis. BTC’s basis inched back to the positive territory, while ETH’s basis improved significantly with The Merge being just around the corner. In the options market, term-structure activity was mostly focused on the front end, with little change in longer expirations. The skew saw large swings in both directions, which finally culminated in the 7-day skew rising above the zero-line and marching into the positive territory for the first time this year.

Talk of the Town

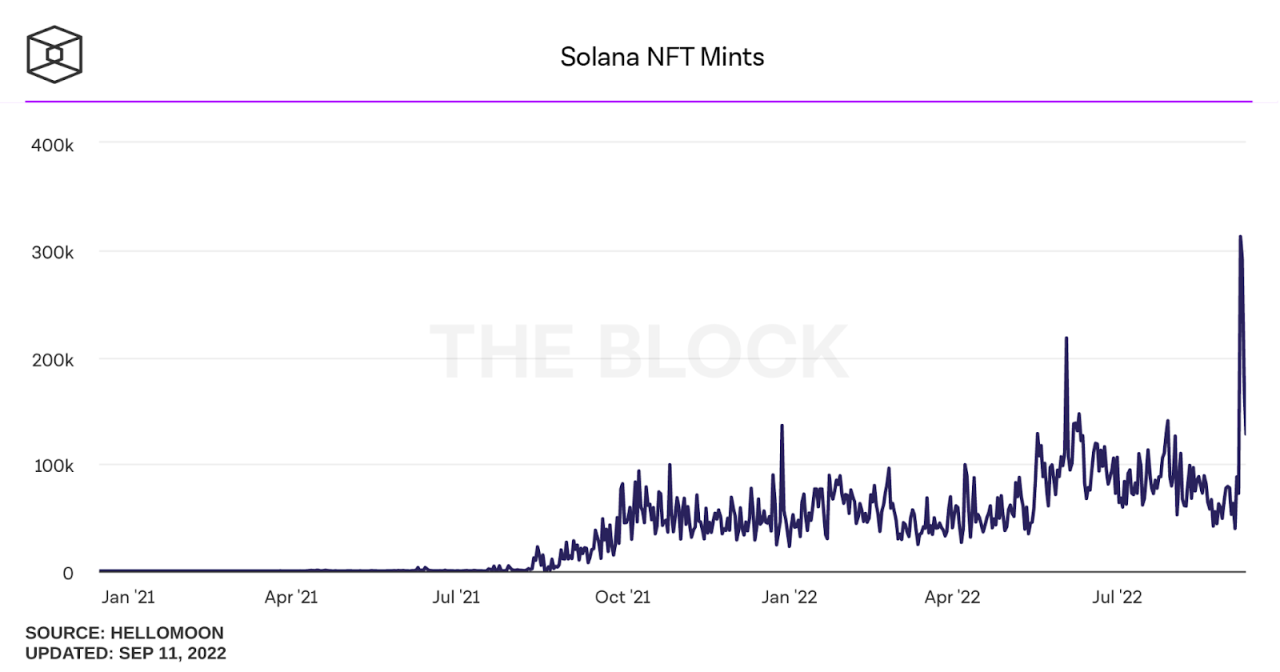

Activities around Solana-based NFTs have been surging amid a trepid NFT winter. According to The Block’s data, the number of NFTs minted on Solana reached a new high of 312,000 last Wednesday, skyrocketing by leaps and bounds from the slump of 39,000 NFTs minted just three days prior. Meanwhile, the total volume of Solana-based NFTs has hit the highest level since May. Solana marketplace, Magic Eden, has seen its market share soar by 300% within a week.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.