Lessons From History: A Retrospective on Bitcoin Halvings and Industry Dynamics

Bitcoin halvings, designed to regulate the supply of new BTC tokens, historically impact the token supply dynamics, market sentiment, and adoption.

Halvings tend to enhance Bitcoin’s visibility, leading to an increase in both prices and adoption rates. They also stimulate discussions related to blockchain technology, Bitcoin network dynamics, and crypto as a distinct asset class.

Despite historical patterns showing increased BTC prices and broadened adoption in the months following halving events, it’s important to note that the upcoming April 2024 halving has already proven to be unprecedented in several important ways.

The Bitcoin halving, an event embedded in the core of the original cryptocurrency’s value proposal, isn’t merely a footnote in the annals of digital finance; it’s a shift that has impacts across the entire ecosystem, reshaping market dynamics and investor sentiment with each occurrence. In this article, we take a closer look at the multifaceted impact of Bitcoin halvings on the digital-asset industry, uncovering its implications beyond short-term price movements. The next halving event, expected to occur in the third week of April, is drawing close, and it is instructive to look at historical data. However, the observed patterns are by no means a guarantee of similar outcomes this time around: the current cycle is unfolding against a unique background, and it has already proven to be different from historical precedent in some important ways.

It’s Ancient History

Halving is a fundamental mechanism baked into the Bitcoin protocol that is designed to regulate the issuance of new tokens by decreasing mining rewards at regular intervals. This deliberate reduction, which is meant to suppress the rate of the creation of new BTC, plays a pivotal role in shaping Bitcoin’s tokenomics and supply dynamics, reinforcing its deflationary nature and underpinning its value proposition.

Bitcoin halvings have historically produced powerful effects on the crypto industry and broader financial ecosystem. Through the lens of history, tracing back through halving events in 2012, 2016, and 2020, we can observe certain recurring patterns in how halvings affect the world of crypto. These events act as inflection points, catalyzing fluctuations in market sentiment and investor behavior, and punctuating the narrative of Bitcoin’s evolution as the locomotive of the crypto ecosystem.

150 Days Later

In dissecting the aftermath of halving events, one cannot overlook their impact on the BTC price and market capitalization. At the heart of the halving mechanism lies the principle of scarcity, a quality that appeals to investors seeking assets with limited issuance, thus propelling the asset’s value upward. As supply diminishes and demand increases over time, the stage is set, at least theoretically, for upward price movement, which often comes to fruition gradually, within the following several months rather than immediately.

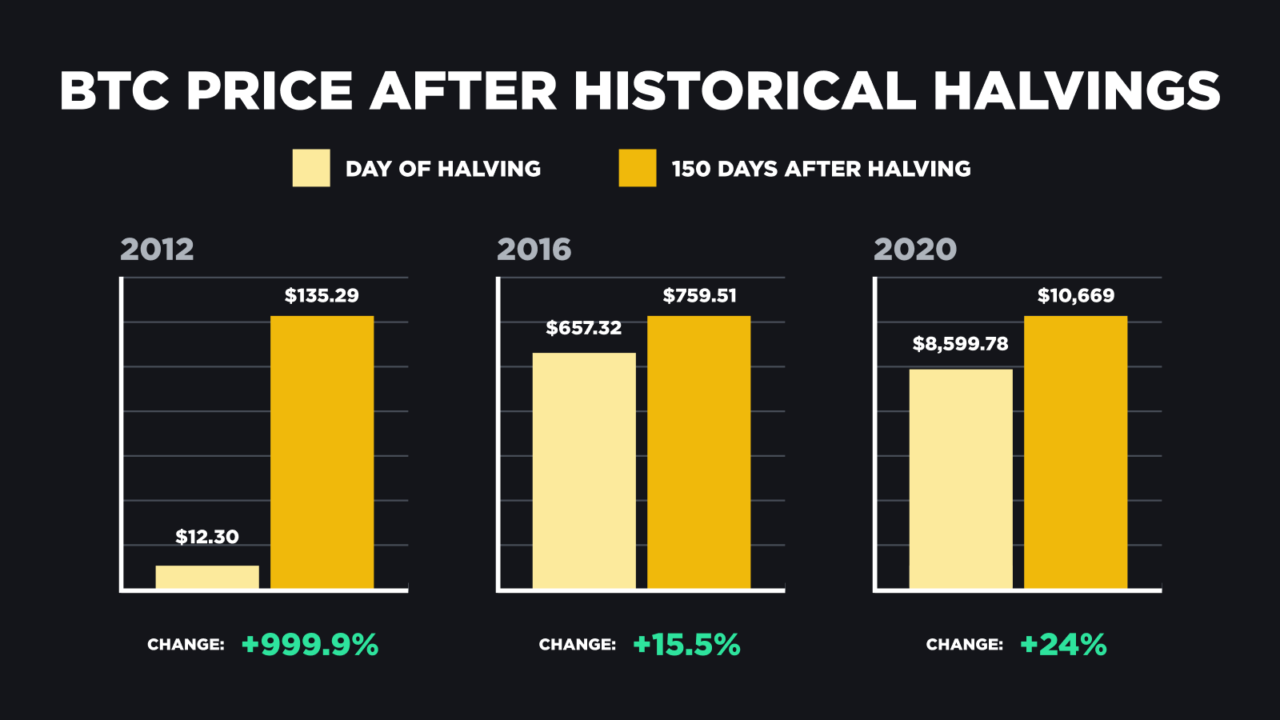

Historically, bitcoin has experienced notable price increases within the 5-6 months following each halving event. For example, 150 days following the previous three halvings in 2012, 2016, and 2020, BTC prices have increased by 999%, 15%, and 24%, respectively.

BTC reached new all-time highs in each four-year period between the previous halving events. In the 2020-2024 cycle, this new all-time high was achieved in October 2022, when Bitcoin breached the $66K mark. The uniqueness of the upcoming 2024 halving lies in the fact that for the first time in its history, bitcoin has hit a new record high before the halving, in early March 2024. It remains to be seen whether it was a warm-up ahead of new highs after the halving or the coveted peak achieved prematurely.

The mechanism whereby halvings exert influence on prices is likely via shaping market sentiment and investors’ perceptions. In addition to building anticipation among the crypto community, halving events fuel narratives about the advantages of algorithmic monetary policy and digital assets’ deflationary qualities, sparking interest among those outside of the crypto space and driving new participants into it.

Beyond the Price

In addition to price-related effects and increased attention – and partly through them – halvings are associated with a profound, long-term increase in adoption metrics. Bitcoin’s heightened visibility during pre- and post-halving periods stimulates more newcomers to explore and potentially purchase the digital currency, contributing to the expansion of its user base.

Furthermore, BTC halvings prompt a reevaluation of the cryptocurrency’s underlying technology and network dynamics as miners navigate the transition. Discussions around network security, transaction fees, and scalability solutions intensify. Enhancements in these areas fortify the robustness of the Bitcoin network, bolstering confidence among users and businesses, thereby fostering a conducive environment for adoption. Halvings also tend to reduce miners’ profitability margins, generating additional BTC sell pressure from miners and accelerating consolidation in mining operations and mining pools.

With each halving event, the need for efficiency and innovation becomes more pronounced, driving technological advancements that not only enhance the performance of the Bitcoin network but also increase its attractiveness to a broader audience.

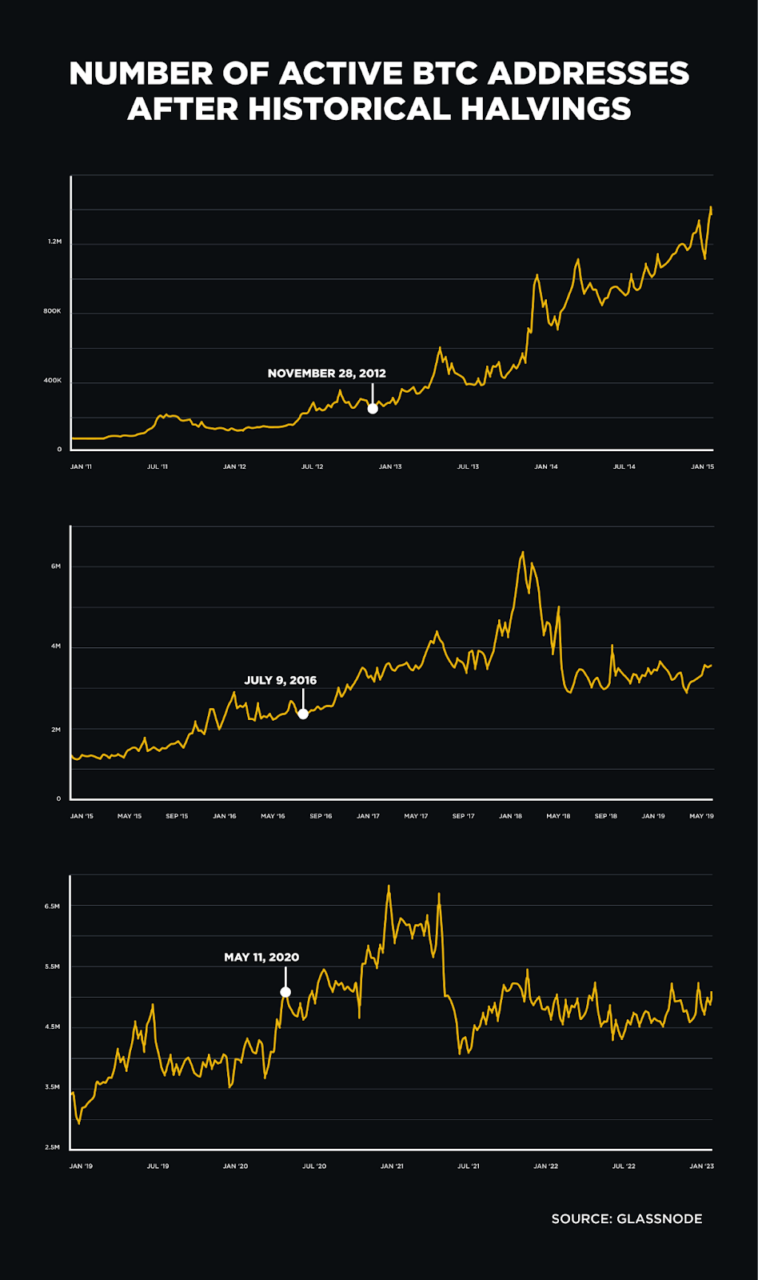

Let’s examine a straightforward adoption indicator – the number of active BTC addresses – using the same 150-day window as price dynamics. Within the first 150 days of each of the previous halvings, the number of new BTC addresses grew: by 83% in 2012, 101% in 2016, and 11% in 2020.

The number of addresses holding $100 or more – a rough proxy for the number of retail investors – increased by 12% and 6% in 2012 and 2016, respectively, and remained roughly the same 150 days after the 2020 halving. Although these are imperfect indicators of adoption dynamics and sentiment (for example, one person can create multiple wallets), they suggest the directionality and magnitude of the trends in the aftermath of the past halvings.

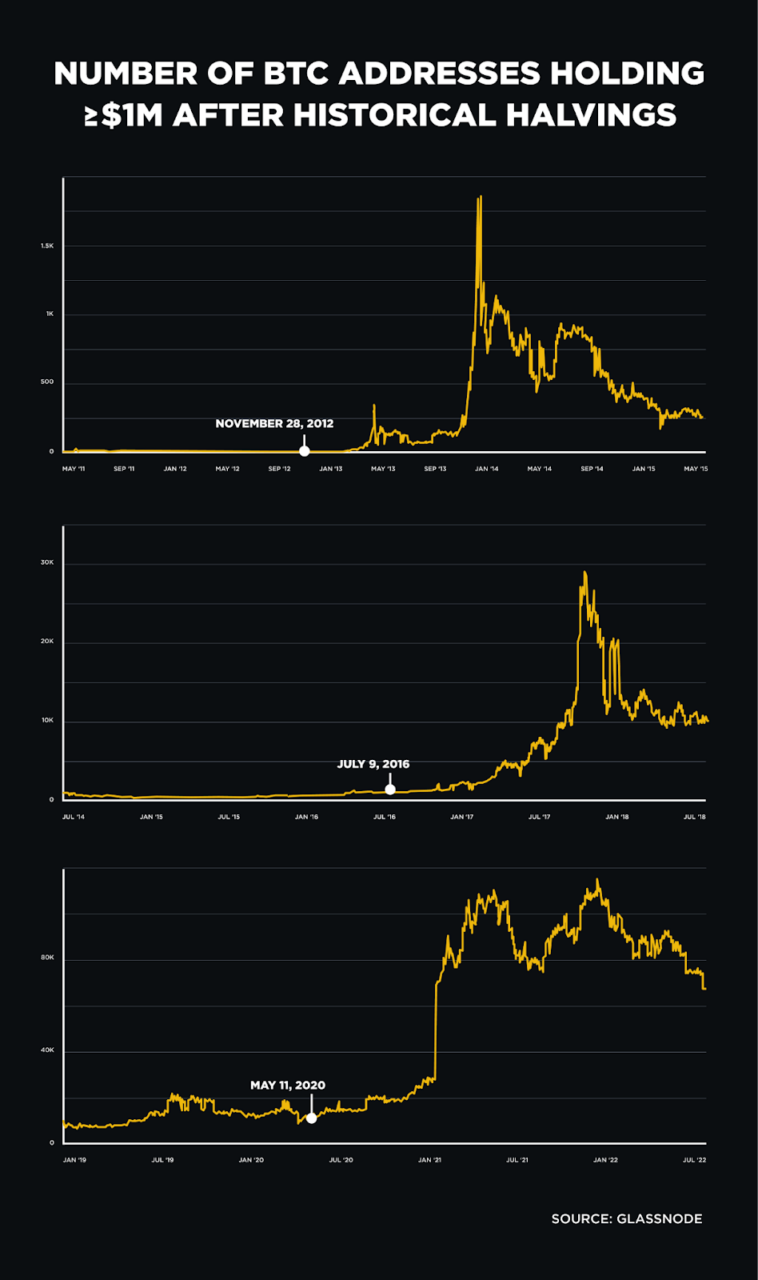

Similarly, institutional interest in Bitcoin also tends to surge around halving events, propelled by the narrative of bitcoin’s capacity as a store of value and potential hedge against inflation. High-profile endorsements from corporate treasuries and prominent investors validate BTC’s legitimacy as an investable asset class, further fueling adoption. As institutional capital flows into the cryptocurrency market, infrastructure and product offerings emerge, paving the way for widespread adoption among traditional financial institutions and retail investors alike.

For instance, the number of wallets holding more than $1 million, which can be seen as an indicator of professional or institutional investment activity, increased by thousands of percent in 2012, 10% in 2016, and 43% in 2020.

What’s Next?

The next Bitcoin halving in April is set to take place against an unprecedented backdrop of robust inflows back into the industry and centralized exchanges like Binance, along with burgeoning institutional engagement facilitated by the approval of spot BTC ETFs in the US.

Add to that a surge in layer-2 solutions and DeFi activity, which augment the network’s practical utility, and the setup begins to look remarkably favorable for the Bitcoin ecosystem and the wider crypto space.

However, it’s still important to remember that while the context surrounding the 2024 halving is auspicious, there are no guarantees that its dynamics and effects will mirror those of previous halving events. Each halving represents a distinct juncture in Bitcoin’s evolution, influenced by shifting market conditions, technological advancements, and regulatory developments. Therefore, while optimism abounds for the transformative potential of the 2024 halving, caution dictates acknowledging the inherent unpredictability of market dynamics and the need for vigilance in navigating the evolving landscape of digital assets.

Each Bitcoin halving represents a fundamental shift in the crypto industry, with far-reaching implications for adoption and market evolution. Beyond its immediate effects on price and investor sentiment, Bitcoin halving catalyzes increased interest and awareness, institutional participation, and technological innovation, laying the groundwork for the continued growth and maturation of digital finance. As we navigate the ever-evolving crypto landscape, the significance of Bitcoin halvings stands as a testament to the enduring strength and resilience of our industry.

Further Reading

- Halving Horizons: A Bitcoin Odyssey

- Decoding Bitcoin Halving: Understanding the Deflationary Shift

- 3 Simple Methods to Purchase Bitcoin & Other Cryptocurrencies: Preparing for the Bitcoin Halving

Disclaimer: Digital assets are subject to high market risk and price volatility. The value of your investment can go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice. For more information, see our Terms of Use and Risk Warning.