Bybit: BTC STH Losses Approaches Full Saturation; Fed Leader Pushes Stablecoin Legislation

Chart of the Day

The broader crypto market saw what resembles a spark of hope late Wednesday with major cryptocurrencies finding support above key levels. The rally follows one in the U.S. equity market as investors begin to price in expectations of further rate hikes. According to CME’s Fed Watch, the speculation of the probability of a 75 bps rate hike in September is now above 80%. As of the time of writing, BTC is consolidating gains above the $19k handle after posting a 3% increase in the last 24 hours. However, upside momentum for the largest cryptocurrency by market cap remains limited as investors shy away from risk assets amid continued liquidity pressure from quantitative tightening and global macroeconomic uncertainty. Bybit blog reports.

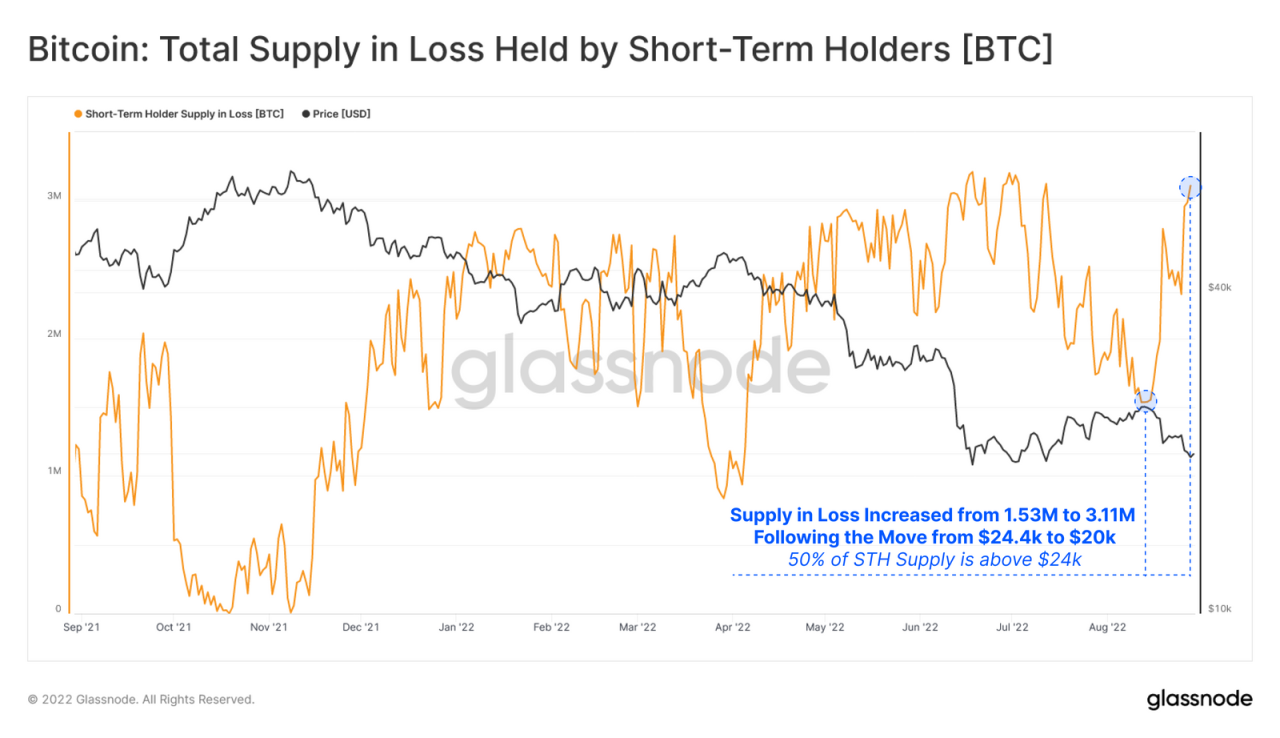

On-chain metrics indicate that transactions in the current price ranges are predominantly initiated by short-term holders. Short-term supply in loss is approaching a full saturation as 96% of the short-term holdings are now underwater. Full loss saturation events have occurred three times in the current downtrend, and have all coincided with local bottom formation. In the derivative market, perpetual contract funding rates return to the neutral territory. Meanwhile, in the options market, BTC gained a bit of positive gamma around the strike price of $18k, suggesting more room to fall back should sentiments continue to sour.

ETH reversed its losses earlier this week and outperformed BTC again over the same period. The second-largest cryptocurrency by market cap is back above the $1,600 level after jumping by 8% in the last 24 hours. Speculative actions prevail in the options market, with over $6.1 billion in outstanding open interest for call options, and $1.5 billion for put — resulting in a put/call ratio of 0.25. Most major altcoins have flipped green, with ATOM and ETC leading the pack on double-digit percentage gains.

Talk of the Town

During a speech at The Brookings Institute, Michael Barr, the US Federal Reserve’s vice chair for supervision, has nudged Congress to “work expeditiously to pass legislation” on stablecoins and bring them “inside the prudential regulatory perimeter”. Barr’s focus on the oversight of financial stability as part of his role may have influenced his stance. However, backed by other regulators, he is not alone in his views that stablecoin may pose financial stability risks. Stablecoins have been in the spotlight for crypto-focused legislation in the Congress in the past year, but the promise of getting a workable bill before the August recess has rung hollow, while key figures pushing prospective legislations are about to leave the Senate by the end of this year.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.