Bybit: BTC LTH Profitability Reaches 3-Year Lows, Warner Music Group Announces Partnership With OpenSea

Chart of the Day

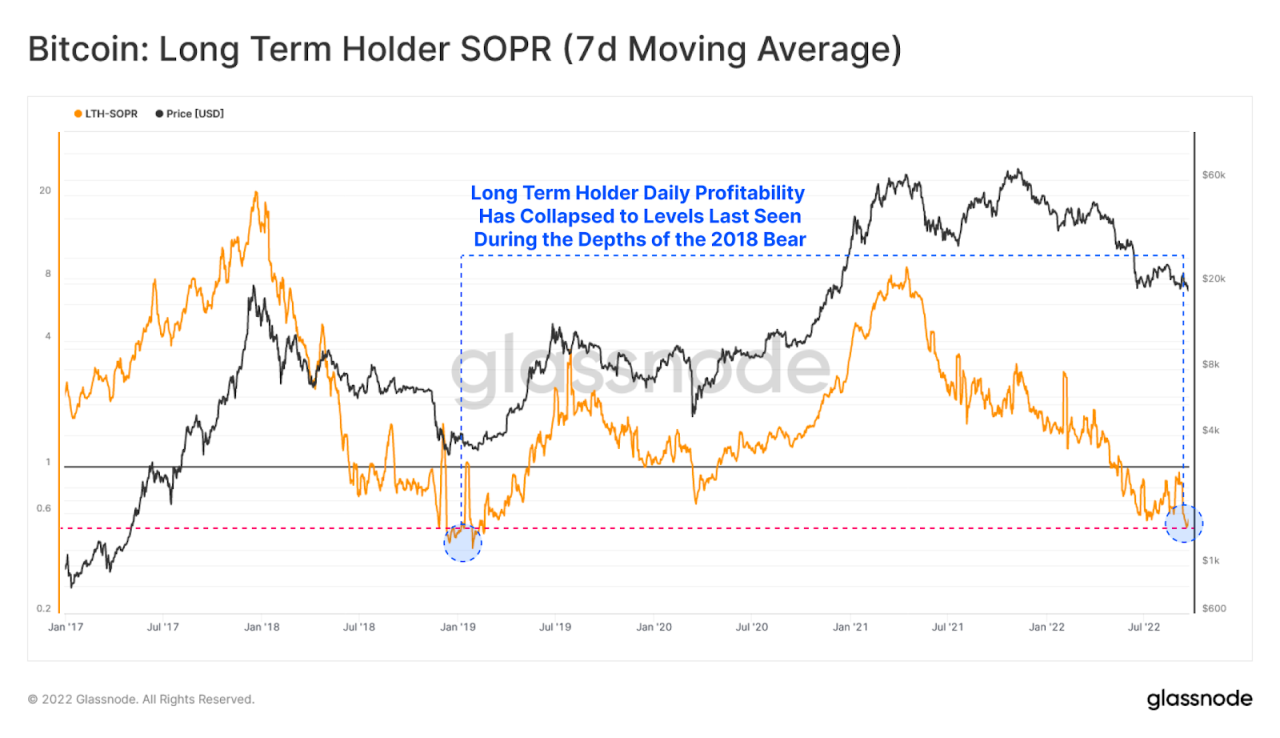

Asian stocks dropped on Friday following another plunge on Wall Street as the prospect of higher interest rates in Europe stoked fear of an imminent global recession. The broader crypto market whipsawed on Thursday, but major cryptocurrencies managed to stay in previous ranges. Although the correlation between BTC and traditional financial indices remains, the impact of the tech equity slump has yet to ripple across crypto markets. As of the time of writing, BTC is well-bid above the $19k handle after posting a marginal increase in the last 24 hours. A key bullish trend line with support near $19.2k is taking shape on the hourly chart. On the upside, BTC is facing resistance near the $19.6k zone, which will open the door to more upside momentum once cleared. On-chain metrics show that long-term BTC holders’ profitability has plummeted to levels last seen in the 2018 bear cycle. Meanwhile, the MVRV ratio has once again dipped to the oversold region, indicating that a local bottom formation is likely brewing. In the options market, BTC’s $2.2 billion quarterly expiry is around the corner. The max pain point currently sits near $21.5k, suggesting that the market may still pivot towards this level with an uptick in volatility. Bybit Blog reports.

Similarly, ETH is changing hands above the $1,300 mark with its price barely budged in the same period. Around $1.9 billion in ETH options will also expire later today, with the max pain point sitting at the $1,500 handle. Mid-to-large-cap altcoins saw mixed performances, with XRP leading the pack on a double-digit percentage gain.

Talk of the Town

On Thursday, mega record label conglomerate, Warner Music Group (WMG), announced a collaboration with the NFT marketplace OpenSea to accelerate the company’s foray into the nascent space. The partnership will provide a platform for select WMG artists to build and extend their fan communities in web3. The joint force will grant WMG artists early access to OpenSea’s new drop products, alongside improved visibility and personalized storytelling on the NFT marketplace. Artists will also receive dedicated support from the OpenSea team to strengthen their web3 fan bases and onboard existing fan communities into the web3 space. In addition, WMG artists will have their own customized drop page to host limited-edition projects, which would create new opportunities for fan engagement.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.