Bybit: BTC Mining Difficulty Hits ATH, OECD to Present Crypto Transparency Framework to G20

Chart of the Day

The U.S. equity market fell for the fourth consecutive day as the anticipation of policy tightening weighed on investors’ sentiment, which remained fragile ahead of Thursday’s inflation data. A hot inflation reading, coupled with the strong labor print last week, will likely force the Federal Reserve’s hand to extend aggressive rate hikes beyond this year. Meanwhile, the dollar rose to a monthly high amid escalating geopolitical tensions. Bybit blog reports.

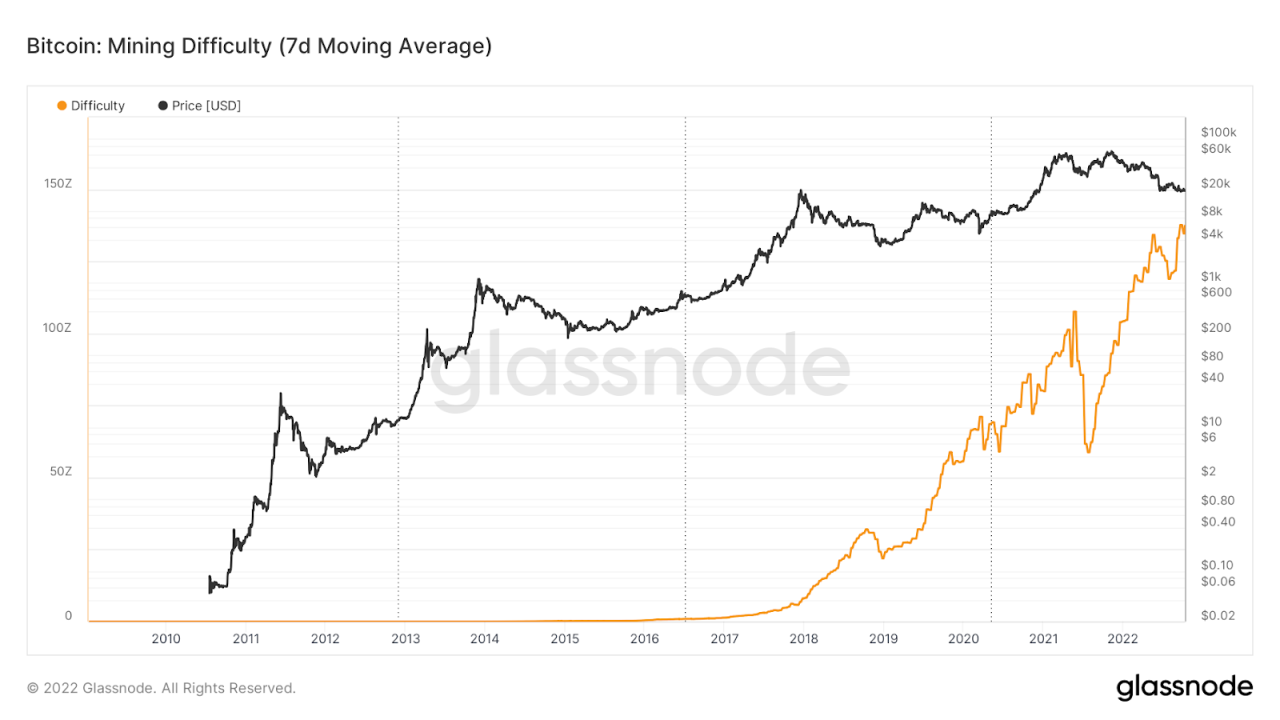

Major cryptocurrencies dipped in the early hours of Tuesday (Asian trading hours). BTC is currently trading precariously above the $19k handle after seeing a 2% drop in the last 24 hours. A connecting bearish trend line with resistance near $19.2k is forming on BTC’s hourly chart. Failure to rise above this level would send the price to revisit support levels in the $18.5k zone. Meanwhile, BTC mining difficulty increased by 13.5%, the largest adjustment in 14 months as hash rate continues to soar to new heights. The consecutive positive adjustments, though putting pressure on BTC miners’ profit margins, are considered positive for the network’s security.

Similar to BTC, ETH dipped below the $1,300 mark after falling by 3.1% in the same period. The prospect for the second-largest cryptocurrency by market cap remains less optimistic as bears at the $1,280 zone may exert further pressure, pushing the price to retest support levels in the $1,200 to $1,250 zone. Mid-to-large cap altcoins have mostly flipped red, with ETC and CHZ leading the downside correction on double-digit percentage losses.

Talk of the Town

On Monday, the Organization for Economic Co-operation and Development (OECD) submitted a new global tax transparency framework to provide for the reporting and exchange of information with respect to digital assets. The Crypto-Asset Reporting Framework (CARF) is a response to the G20 request for a framework that facilitates the automatic exchange of information among countries on digital assets. The CARF will be presented to G20 finance ministers and central bank governors for discussion during their next meeting on October 12 to 13 in Washington D.C. The proposed framework and amended standards may spell the beginning of a global effort to consolidate varied patchworks of international regulations to clamp down on crypto fraud and tax evasion.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.