Bybit: Major Crypto Remain Range-Bound Despite Macro Uncertainty, Magic Eden Moves to Optional Royalty Model

Chart of the Day

Stocks went on a rollercoaster ride last Friday, with major benchmarks seeing a historical turnaround after the revelation of scorching hot inflation data. The equities market defied all the hallmarks of a post-CPI selloff, with S&P 500 adding 5% on an intraday level before closing the week with a 1.3% drop. This week’s earnings featuring big reports across the banking, pharmaceuticals, and entertainment sectors may offer some market-moving directions. Bybit blog reports.

The crypto market may be at the outset of a brief decoupling from the traditional financial markets. Most major cryptocurrencies remained largely range-bound last week amid rapid liquidity evaporations in global markets. As of the time of writing, BTC is well-bid above the $19k pivot level after another quiet weekend, as investors grappled with the raging inflation and looming recession. ETH is changing hands precariously above the $1,300 handle after posting a 1.34% increase in the last 24 hours. Mid-to-large cap altcoins saw mixed performances, with QNT leading the pack with its CBDC-driven momentum from late September, and posting an 8% gain in a similar time frame.

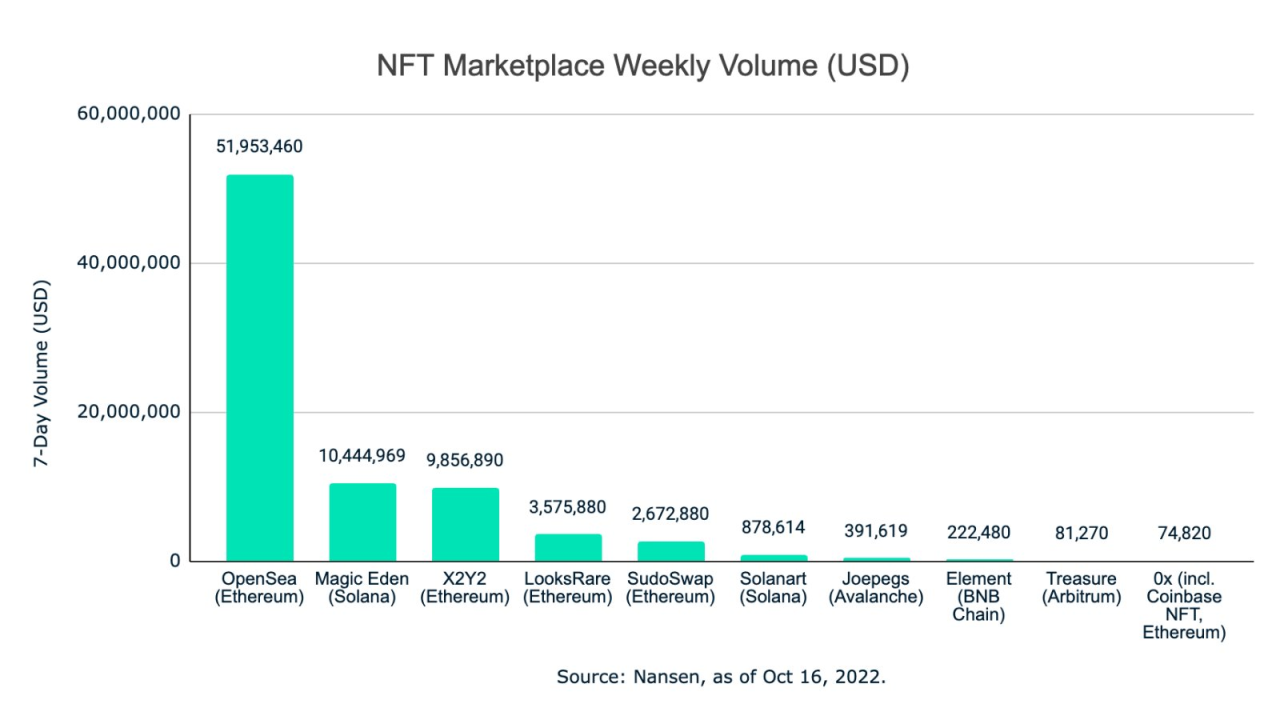

In the NFT market, OpenSea dominates the weekly chart with $52 million in trading volume, more than twice the volume of all the other marketplaces combined. Magic Eden seems to lose its competitive edge after the recent battle of NFT royalties. X2Y2 is a close third as its weekly volume approaches $10 million.

Back to (the) Futures

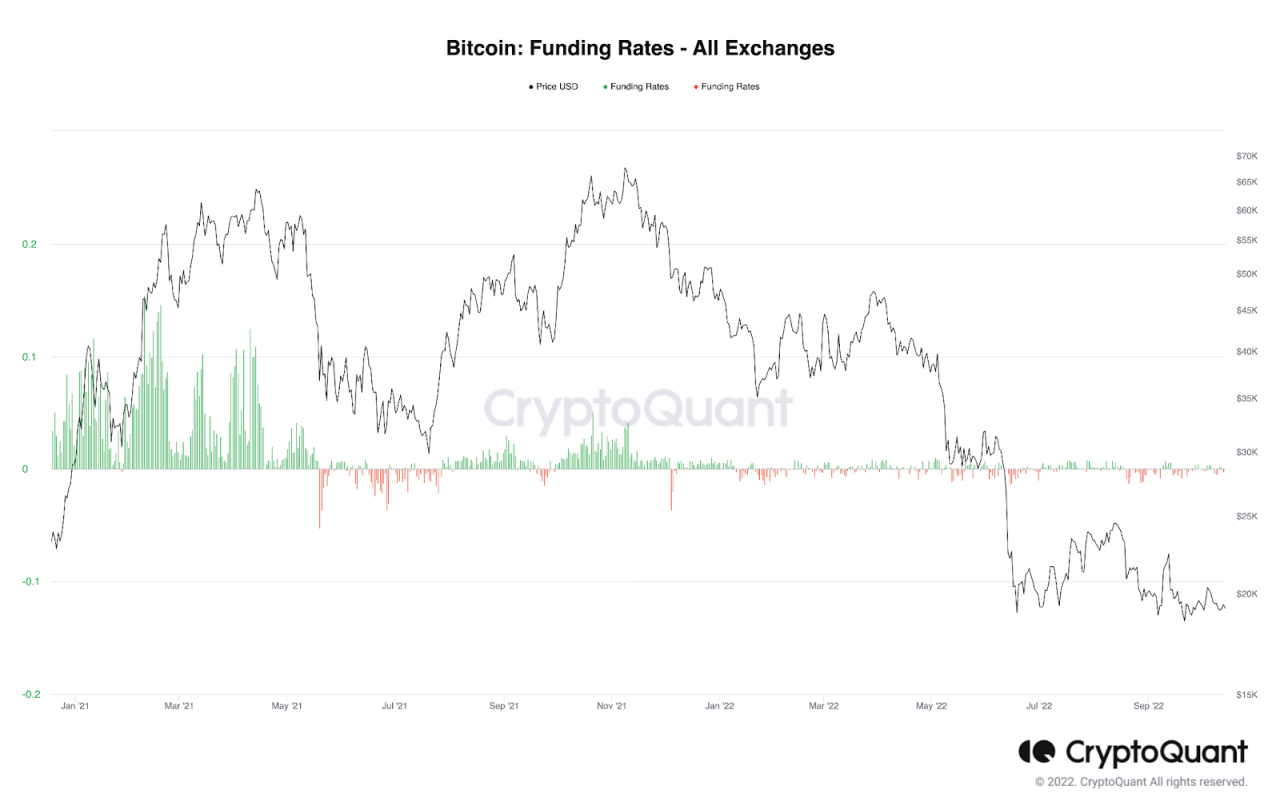

The September CPI reading validated the Federal Reserve’s aggressive approach to combat inflation and implied that more rate hikes are on the way. There has been little spot price action for BTC and ETH for three weeks in a row, causing funding rates to flatline and the DVol index to reach 12-month lows. It seems that investors are banking on continued spot price consolidation in the near term, which is reflected in the substantial volatility drain in the futures markets and the steep contango in BTC and ETH’s term structures.

Talk of the Town

Magic Eden announced last Friday that it would no longer strictly honor creator-set royalties on NFTs sold through its platform. The abrupt shift in its stance marks a big move for the largest NFT platform on Solana, which succumbed to the pressure of rapidly losing its market share to royalties-shunning competitors. Magic Eden admitted that this is not an easy decision and will likely have serious implications for the ecosystem in a Twitter thread. It also threw in platform fee waivers during a running promotional period in a bid to win back users. Meanwhile, Magic Eden is collaborating with Cardinal to explore ways of creating on-chain royalty protection through NFT wrapping.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.