Bybit: BTC Hash Rate Reaches New Highs, Aptos Airdrops 20M Tokens to Early Participants

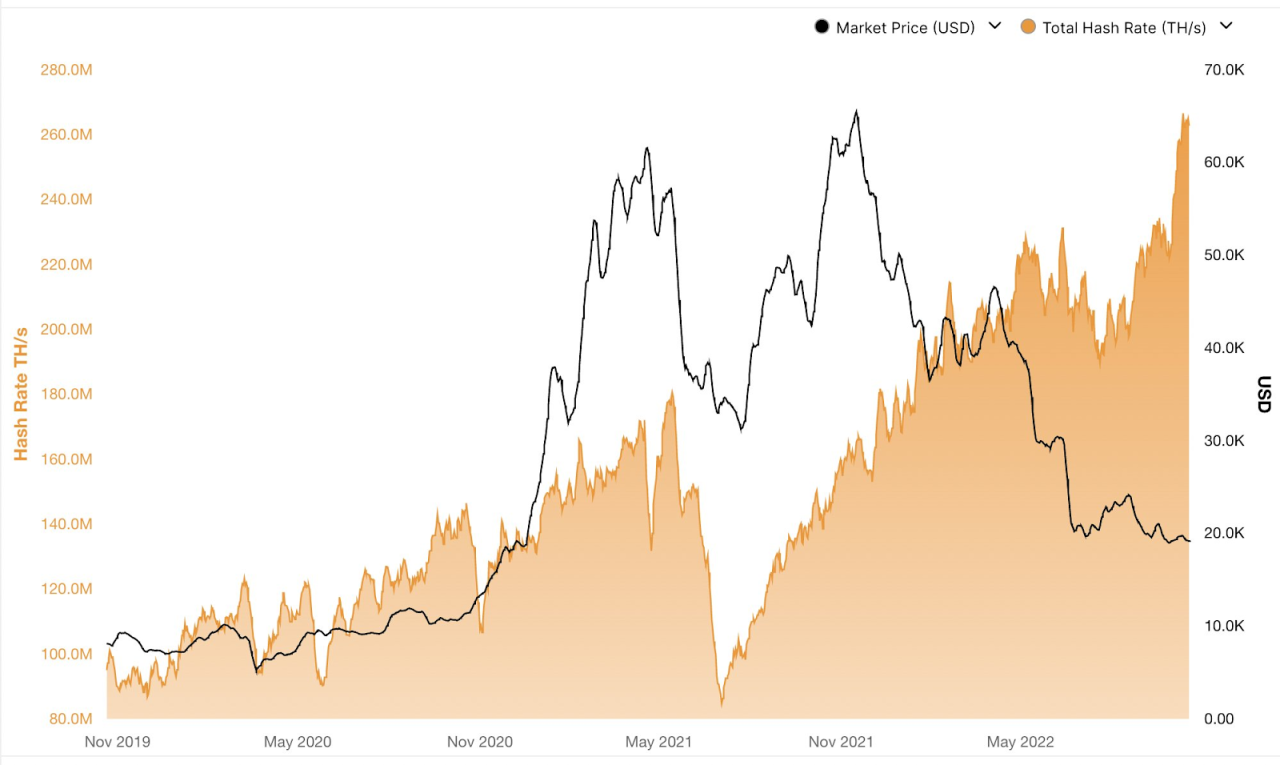

Chart of the Day

Major equity benchmarks fell on Wednesday, raising doubts about sustaining any rebound attempts amid Treasury yields creeping back to multiyear highs. Investors are raising their expectations for the peak policy rate closer to 5%, a leap from the current range between 3% and 3.25%. Concerns about the hawkish monetary policy triggering a hard landing continue to dampen investors’ sentiments. Bybit blog reports.

The crypto market fell alongside stocks with BTC trailing its 20-day moving average. As of the time of writing, the largest cryptocurrency by market cap is changing hands at the lower end of the $19k zone after posting a marginal loss over the last 24 hours. ETH is trading just below the $1,300 handle after drifting slightly into the red in the same period. In the options market, the short-term skewness for both BTC and ETH is trending down significantly, pointing to the prevalence of bearish sentiments. Meanwhile, mid-to-large cap altcoins saw mixed performances, with XCN moving up 10% in a similar time frame.

On a separate note, the difficulty adjustment last week did not put a stop to the surging hash rate that continues to push for new heights this week. However, it did put a dent in the block production rate, which moved south to approach the target level of 6 blocks per hour. The declining production rate heats up competition for transactions to be included per block, raising transaction fees by 25% over the past week. However, the lower rate also saw daily miner revenue decline to $18 million per day.

Talk of the Town

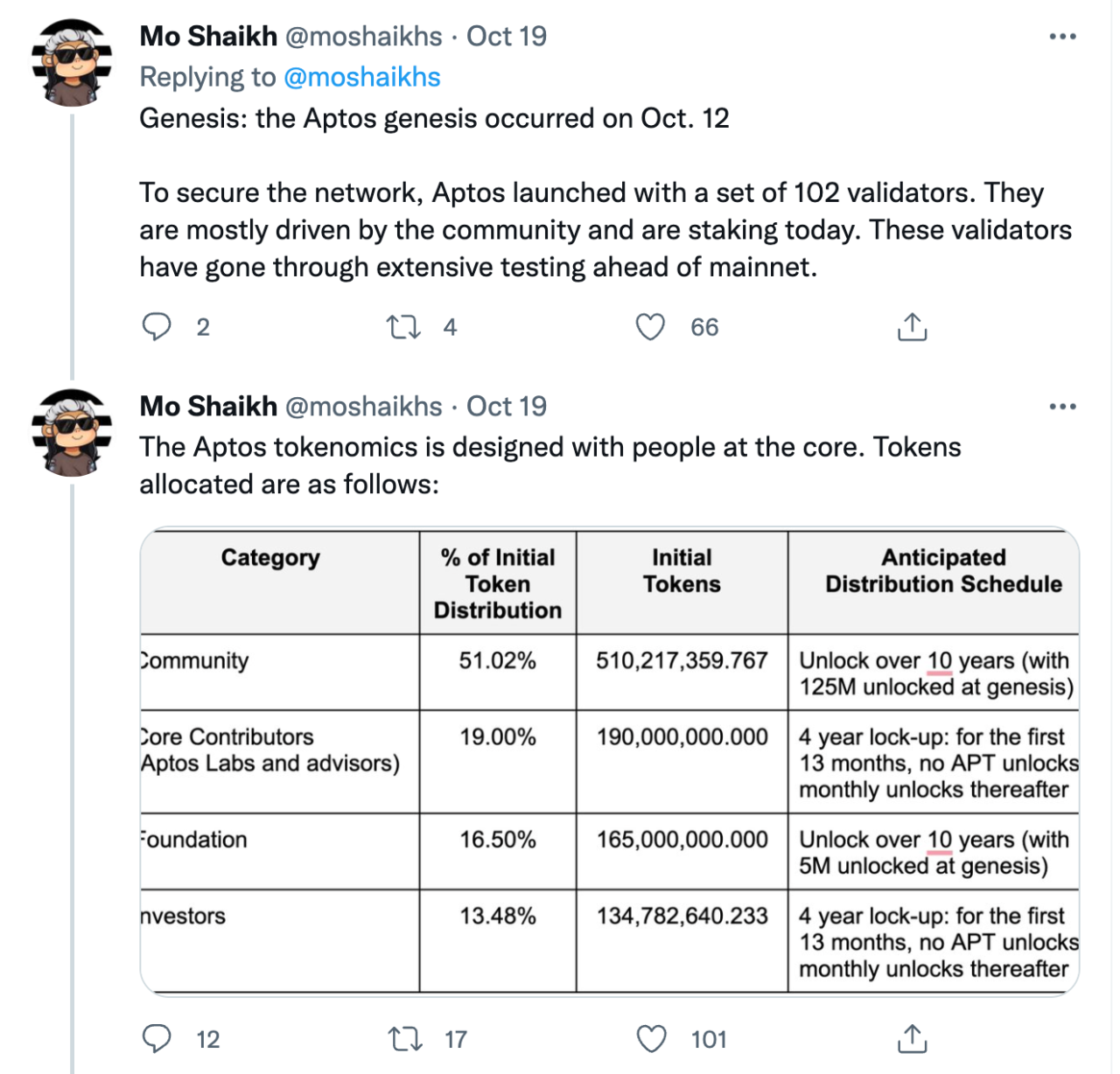

The Aptos Foundation has released a retroactive token airdrop to reward early network participants. Around 20.1 million tokens have been allocated for the airdrop, representing 2% of the initial total supply of 1 billion at the mainnet launch on Monday. A little over 110,000 addresses across two categories on Aptos are eligible to receive these tokens. These categories include participants in the Aptos Incentivised Testnet and those who minted the Aptos Zero NFT. Aptos’ co-founder Mo Shaikh addressed concerns over the project’s troubled start on Twitter, claiming that APT is “designed with people at the core”. He also published a chart listing the categories and percentages of token distribution. An in-depth analysis of the tokenomics can be found in our recent article covering the project.

Bybit will be listing the Aptos token (APT) on our Spot trading platform as the APT/USDT pair.

Deposits of APT will open on October 18, 2022 at 12PM UTC.

Withdrawals of APT will open on October 20, 2022 at 1AM UTC.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.