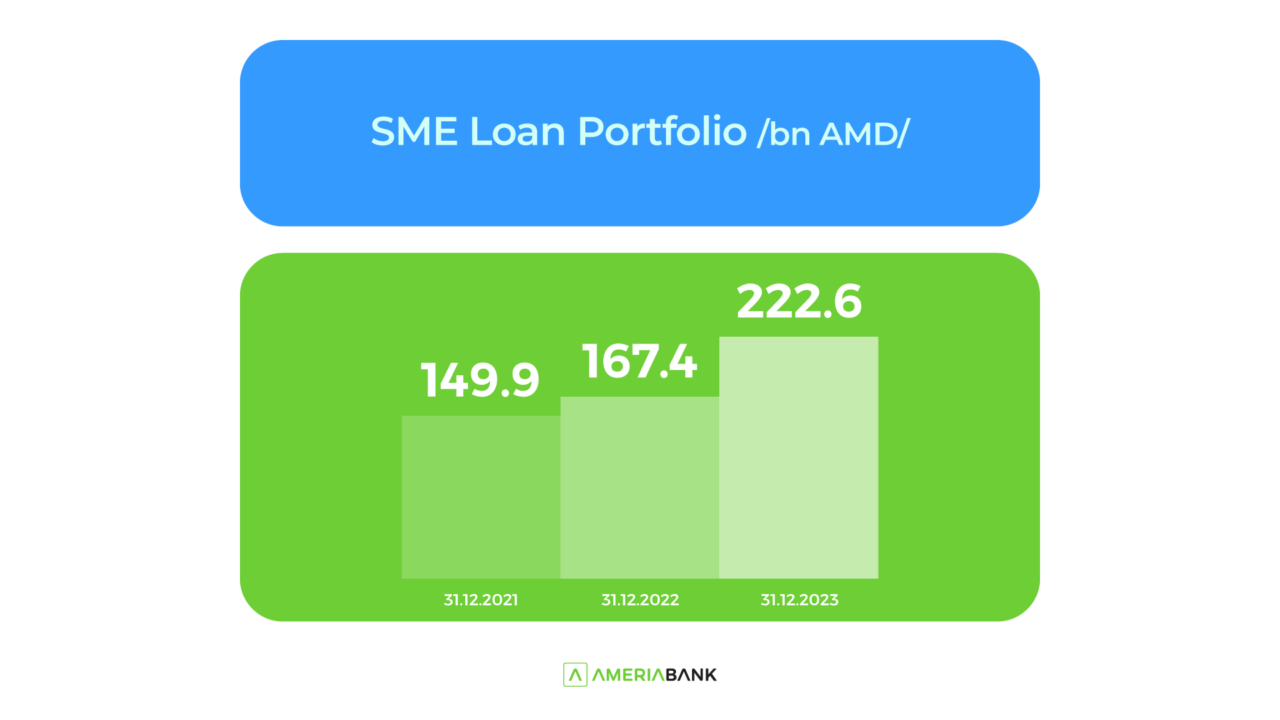

In 2023, the SME Loan Portfolio of Ameriabank Reported More Than 30% Growth

The small and medium enterprise (SME) loan portfolio of Ameriabank increased by more than 30% in 2023 to reach to AMD 222.6 billion as of December 31, 2023. The number of SME clients of Ameriabank has also grown considerably, almost tripling over the past 3 years.

In 2023 72% of Ameriabank’s SME clients applying for a loan within AMD 10 million received their loans online the via business.ameriabank.am platform. Notably, the share of clients onboarding online using the same platform also increased in 2023, reaching 18% vs 11% of the previous year.

In 2018 Ameriabank launched the Ameria Business ecosystem – a one-stop shop platform complete with such functionalities as opening an account with Ameriabank, getting a card and Online/Mobile Banking, as well as applying for a loan and using other services and benefits offered by the Bank, without visiting the Bank.

This year Ameria Business has been enriched with two more services. Thus, it is now possible to activate a POS terminal on a cash register and order a handheld POS terminal via business.ameriabank.am. In both cases clients can apply online, activate POS terminals at several addresses at a time, and track the application status online.

Ameriabank is a leading financial and technology company in Armenia, a major contributor to the Armenian economy, with assets exceeding AMD 1 trillion. In the course of digital transformation, it has launched a number of innovative solutions and platforms going beyond banking-only needs of its diverse customer base, thus creating a dynamically evolving financial technology space. Ameria was the first in Armenia to create ecosystems for both businesses and individuals, which give one-window access to a range of banking and non-banking services, among them – Estate.ameriabank.am, Automarket.ameriabank.am, Business.ameriabank.am. As a truly customer-centric company, Ameria aims to be a trusted and secure financial technology space with seamless solutions to improve the quality of life.

The Bank is supervised by the Central Bank of Armenia.