Crypto ETFs: From Concept to Market Game-Changer

Crypto exchange-traded funds (ETFs) have rapidly evolved from a novel idea into a major force bridging traditional finance and the digital asset world. In just a few years, these regulated investment vehicles have garnered tens of billions of dollars and opened the cryptocurrency market to a broader range of investors. This article explores what ETFs are (and how crypto ETFs work), chronicles the landmark approvals of the first crypto ETFs around the world, examines their impact on the crypto market, reviews how much capital they’ve attracted, and looks ahead to the next wave of crypto ETFs on the horizon. The focus spans the global landscape – from Canada and Europe’s early moves to the United States’ recent leadership – with a balanced tone that is both informative and accessible.

What Are ETFs, and What Are Crypto ETFs?

An exchange-traded fund (ETF) is a type of investment fund traded on stock exchanges, much like a stock. ETFs typically hold a basket of assets (such as stocks, bonds, or commodities) and aim to track the performance of an index or asset price. They offer investors a convenient way to gain exposure to an asset or strategy through the familiar stock market framework. For example, an ETF might track the S&P 500 index or the price of gold.

A crypto ETF is simply an ETF that provides exposure to cryptocurrencies or related digital assets. In other words, a crypto ETF allows investors to buy and sell shares that reflect the value of a cryptocurrency, without the investor having to directly purchase or custody the digital coins. As one definition puts it, “A crypto ETF is a type of exchange-traded fund that provides exposure to cryptocurrency and digital assets, allowing investors to buy and sell shares of the ETF on traditional stock exchanges. Crypto ETFs are designed to track the performance of one or more cryptocurrencies… offering a way for investors to gain indirect exposure to crypto without directly owning the digital currency.” In practice, some crypto ETFs track a single cryptocurrency (like Bitcoin or Ethereum), while others might track a basket of several coins or even invest in crypto-related equities and blockchain technology firms.

Spot vs. Futures Crypto ETFs: It’s important to note that crypto ETFs can be structured in different ways. A spot crypto ETF holds the actual cryptocurrency – for example, a spot Bitcoin ETF directly holds Bitcoin in custody on behalf of investors. By contrast, a crypto futures ETF holds derivatives such as futures contracts linked to the cryptocurrency’s price, rather than the asset itself. Both types trade on exchanges and aim to mirror the price of the underlying crypto, but their mechanics differ. Spot ETFs tend to more closely track the actual asset price (since they hold the coin itself), while futures-based ETFs might have slight performance variances due to rolling futures contracts and other factors (known as “tracking error”). Notably, until recently the United States only allowed Bitcoin futures-based ETFs, whereas other countries moved sooner on physically-backed (spot) crypto ETFs.

Why use a Crypto ETF? For investors, crypto ETFs offer a host of potential advantages: accessibility via regular brokerage accounts, avoiding the complexities of digital wallets and private keys, institutional-grade custody of assets, and the ability to include crypto in tax-advantaged or traditional investment portfolios. They also bring the familiar liquidity and regulatory oversight of traditional exchanges. In short, a crypto ETF lets someone invest in Bitcoin or other coins by buying a share on (say) the New York Stock Exchange or Nasdaq, just as they would buy a stock, which dramatically lowers the barrier to entry for mainstream investors.

Of course, there are trade-offs. Crypto ETFs charge management fees, and the ETF’s price might not perfectly track the crypto market due to expenses or derivative usage. Still, the emergence of crypto ETFs is widely seen as a significant step in integrating digital assets with traditional finance, providing a “wrapper” of familiarity and regulation around what was once a fringe asset class.

The First Crypto ETFs: A Brief History of Green Lights from Regulators

The road to crypto ETFs has been a decade in the making, involving numerous regulatory hurdles and milestones across different countries. The journey began as early as 2013, when entrepreneurs Cameron and Tyler Winklevoss filed the first-ever Bitcoin ETF proposal with the U.S. Securities and Exchange Commission (SEC). That proposal (and many that followed in the U.S.) was initially rejected, largely over concerns about market surveillance and the potential for fraud or manipulation in the underlying crypto markets. These early rejections marked the beginning of a long wait for crypto advocates in the United States.

Meanwhile, other jurisdictions moved faster. Canada led the way in launching the world’s first Bitcoin ETF. In February 2021, the Ontario Securities Commission approved the Purpose Bitcoin ETF, which became the globe’s first physically-backed Bitcoin ETF to begin trading. This landmark product, listed on the Toronto Stock Exchange, invests directly in Bitcoin and allows investors to buy units that track Bitcoin’s price. The news was met with excitement because it gave investors a regulated, liquid vehicle to gain Bitcoin exposure through standard investment accounts. (Prior to this, North American investors could only use less direct means like closed-end bitcoin trusts or Bitcoin futures.) The launch of the Purpose Bitcoin ETF was extremely successful, attracting more than $500 million in assets within its first few weeks, and it signaled that regulators in at least some major economies were willing to green-light crypto ETFs.

Europe was not far behind. Several crypto exchange-traded products (ETPs, a broad term that includes ETFs and similar vehicles) had already existed in Europe – for example, Sweden’s Nasdaq Stockholm exchange listed a Bitcoin exchange-traded note back in 2015, and various Swiss ETPs launched in late 2010s. But Europe’s first true spot Bitcoin ETF (under the EU regulatory framework) came in August 2023, when Jacobi Asset Management launched its Jacobi FT Wilshire Bitcoin ETF on Euronext Amsterdam. (Jacobi had obtained approval in 2021 but delayed the launch until market conditions improved.) This made Europe join Canada in offering a spot Bitcoin ETF even before the United States – a somewhat ironic development given the U.S. capital markets’ size.

The United States took a more cautious approach at first. The SEC repeatedly denied spot Bitcoin ETF applications throughout the 2010s, including high-profile attempts by firms like VanEck, WisdomTree, and the Winklevoss twins. Regulators cited concerns about investor protection and the inability to prevent market manipulation on unregulated crypto trading venues. However, in October 2021 U.S. regulators allowed a futures-based Bitcoin ETF to proceed, marking the first American crypto ETF of any kind. The ProShares Bitcoin Strategy ETF (ticker BITO) launched on the NYSE on October 19, 2021 and made headlines as the first U.S. Bitcoin-linked ETF. Investor enthusiasm was enormous – BITO amassed over $1 billion in assets in just two days, making it the fastest ETF ever to reach the $1 billion AUM mark. This debut was arguably a proof of concept that demand for Bitcoin exposure in an ETF wrapper was real, even if it was through futures contracts.

Why allow futures but not spot? The SEC was more comfortable with futures ETFs initially because Bitcoin futures trade on regulated commodities exchanges (like the CME) that the SEC and CFTC can oversee. A spot Bitcoin ETF, by contrast, would rely on pricing from crypto exchanges, some of which the SEC viewed as prone to manipulation or lacking robust surveillance. Thus, through 2022 and into 2023, the only U.S. crypto ETFs available were those holding Bitcoin futures (and later, Ethereum futures), as well as ETFs holding stocks of blockchain or crypto-related companies.

All that changed in late 2023 and early 2024. A turning point was the legal victory of Grayscale Investments in August 2023, when a U.S. federal court ruled that the SEC was wrong to deny Grayscale’s bid to convert its large Bitcoin Trust (GBTC) into an ETF. The court essentially said the SEC’s rejection was arbitrary because the SEC had already approved Bitcoin futures ETFs – which are priced based on the same underlying spot markets. This paved the way for a wave of spot Bitcoin ETF applications to gain traction. By the end of 2023, multiple heavyweight institutions – including BlackRock, Fidelity, Invesco, and others – had filed or re-filed applications for spot Bitcoin ETFs, increasing optimism that approval was imminent.

Indeed, in January 2024, U.S. regulators finally gave the green light. The SEC simultaneously approved a batch of spot Bitcoin ETFs – reportedly 11 funds at once – allowing the first-ever spot crypto ETFs to launch in U.S. markets. It was a watershed moment: after years of delays, America’s first spot Bitcoin ETFs began trading on January 10, 2024, opening the floodgates for U.S. investors to directly buy ETF shares backed by Bitcoin. This development was quickly followed by the SEC’s approval of the first U.S. Ethereum (Ether) ETFs in mid-2024. By July 2024, several spot Ether ETFs started trading as well, making Ether the second cryptocurrency (after Bitcoin) to have a spot ETF in the U.S. market.

To put this milestone in perspective, the U.S. – the world’s largest financial market – had finally joined the crypto ETF party, which greatly expanded the global reach of these products. Other countries have continued to innovate too (for instance, Brazil launched a Bitcoin ETF in 2021, and Australia approved crypto ETFs in 2022), but the U.S. is now undoubtedly the main player in terms of assets and influence on this front.

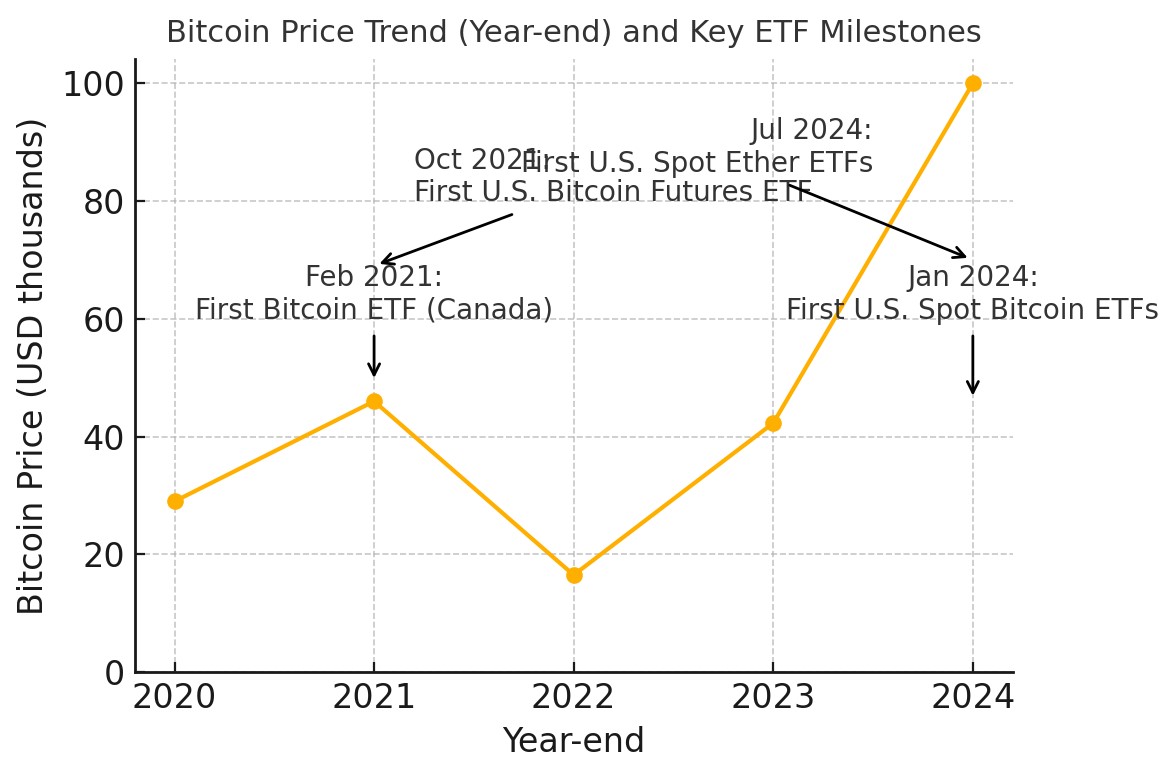

Figure 1: Bitcoin price trend (year-end values) from 2020 through 2024, with key crypto ETF launch milestones annotated. The approval of the first spot Bitcoin ETFs in the U.S. in Jan 2024 coincided with a strong rally, as did the first U.S. Bitcoin futures ETF in late 2021. (Price in USD is shown in thousands.)

How Crypto ETFs Have Changed the Crypto Market

The advent of crypto ETFs has had a significant impact on the cryptocurrency market’s dynamics, liquidity, and adoption. By channeling mainstream capital into crypto assets via regulated funds, ETFs are reshaping the market in several ways.

Driving Mainstream and Institutional Adoption: One immediate effect of high-profile ETF launches has been to legitimize crypto in the eyes of more traditional investors and institutions. For example, when the first U.S. spot Bitcoin ETFs debuted in January 2024, there was a rush of trading activity. On their very first day, the newly launched Bitcoin ETFs attracted over $4 billion in combined trading volume/inflows, a figure that analysts noted was “easily the biggest Day One splash in ETF history.” BlackRock’s iShares Bitcoin Trust (IBIT) alone saw over $1 billion in volume that day, and the conversion of Grayscale’s Bitcoin Trust into an ETF brought in over $2 billion of additional inflows immediately. Within just six months, more than 600 institutional investors – including major banks like JPMorgan, Morgan Stanley, and others – had bought into Bitcoin ETFs, a sign of rapidly broadening acceptance. In short, ETFs have made it far easier for pensions, hedge funds, and corporate treasuries to dip their toes into crypto, since they can now do so by buying an ETF through the same channels as any other security.

Increased Liquidity and Market Stability: By pooling liquidity on traditional exchanges, crypto ETFs can enhance the overall liquidity of the crypto market. Observers have noted that “enhanced liquidity could lead to more stable prices and easier price discovery in the Bitcoin market” as ETFs grow. In fact, as of mid-2024, Bitcoin ETFs were accounting for an estimated 10–15% of total Bitcoin spot trading volume on global exchanges. This is a remarkable statistic – it means a significant chunk of Bitcoin’s daily trading activity had migrated into these regulated fund vehicles, which tend to have clear rules and operate during market hours (for the U.S. ETFs). The influx of more liquidity through ETFs can tighten bid-ask spreads and reduce some of the wild price swings, especially as more buy-and-hold institutional money comes in. Analysts have even observed that Bitcoin’s famed volatility has started to decline, and that the market showed fewer signs of excessive leverage in late 2024 – indications of a maturing market possibly aided by the stabilizing presence of ETF investment.

Another data point highlighting market impact is the share of Bitcoin supply now held by ETFs. By late July 2024, the newly launched Bitcoin ETFs had accumulated holdings representing over 3% of Bitcoin’s total circulating supply. This financialization of Bitcoin – siphoning a portion into ETFs – underscores how deeply integrated into traditional markets Bitcoin has become. Each bitcoin that moves into an ETF’s custody is effectively taken out of the wild and held by a regulated custodian on behalf of investors, which could, over time, reduce circulating supply in the open market and potentially dampen volatility. (By comparison, gold ETFs hold roughly 1–2% of the world’s above-ground gold supply; Bitcoin ETFs achieving 3% of supply in such a short time is notable.)

Price Reactions and “ETF hype”: Major ETF developments have often coincided with crypto price movements. Bitcoin’s price rallied to a then-all-time high near $69,000 in late 2021 right after the launch of the first U.S. futures ETF, reflecting huge optimism and new money entering the market. Similarly, the anticipation and then approval of spot ETFs in 2023-2024 was a big part of why Bitcoin rose from around $20,000 in early 2023 to over $40,000 by year’s end, and then further past $100,000 in 2024. The promise of ETF approval has at times been a bullish catalyst in itself – for instance, rumors and filings in mid-2023 (like BlackRock’s application) gave Bitcoin a noticeable boost. Once the products launched and started accumulating assets, that sustained demand likely contributed to price strength. In essence, ETFs provided a new on-ramp for capital that previously stayed on the sidelines due to regulatory or operational constraints.

On the flip side, there’s caution that ETFs also introduce new dynamics: for example, arbitrage flows between the ETF and spot markets, or the risk that in a downturn, large redemptions from an ETF could put selling pressure on the underlying crypto. Thus far, however, the narrative has been largely positive – the “ETF-ization” of crypto is viewed as a step towards market maturity, analogous to how gold’s market deepened after gold ETFs were introduced in the early 2000s.

Record-Breaking Launches: The impact of crypto ETFs is perhaps best encapsulated by the astonishing numbers from their initial launches. When U.S. spot Bitcoin ETFs launched, not only did they break volume records, but the largest fund (BlackRock’s IBIT) became the most successful ETF launch in industry history by assets, as it rapidly amassed several billion dollars in its first weeks. The ProShares BITO futures ETF in 2021 was similarly one of the biggest ETF debuts ever. These milestones indicate that crypto ETFs didn’t just fill a small niche – they arrived with massive investor interest, immediately ranking among the largest ETFs globally in terms of inflows. For the crypto market, this meant a wave of new buyers and heightened public attention. It also underscored the competitive scramble among asset managers to enter this space (for instance, multiple issuers launched Bitcoin ETFs in the same week in 2024, engaging in fee wars to attract investors).

In summary, crypto ETFs have brought more liquidity, more participants (especially institutional ones), and a measure of credibility to the crypto market. They have started to temper volatility and integrate Bitcoin and other cryptocurrencies into the fabric of traditional portfolio management. Yet, this integration also means crypto is increasingly influenced by macroeconomic factors and traditional market sentiment (since many ETF holders treat it as part of a broader portfolio). The crypto market is no longer a semi-isolated realm; it’s intertwined with Wall Street like never before, for better or worse.

How Much Money Is in Crypto ETFs? The Assets Are Piling Up

One of the clearest indicators of crypto ETFs’ impact is the sheer amount of assets they’ve accumulated in a short span. Each new regulatory approval has unleashed a surge of investor capital into these funds. Let’s look at the numbers.

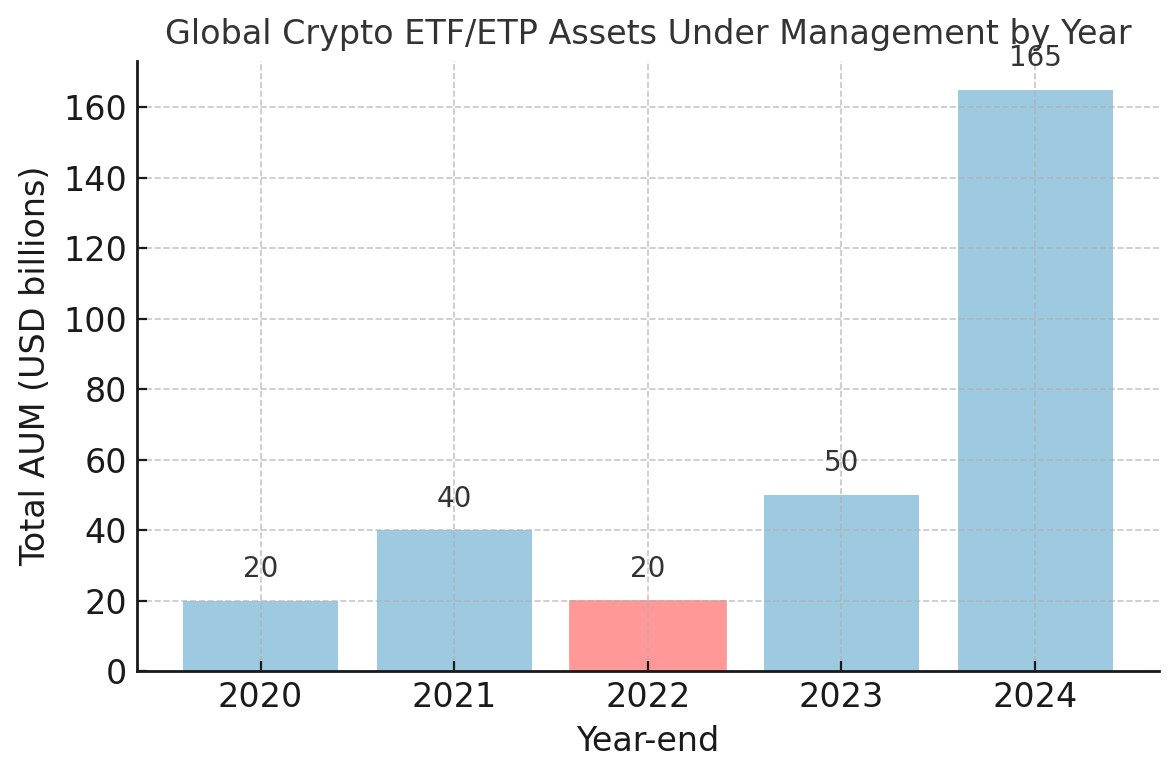

At the start of 2023, before any U.S. spot ETF existed, the total assets under management (AUM) of global crypto exchange-traded products (including ETFs and similar notes) was around $20 billion. Over the course of 2023, as crypto prices rebounded and optimism for U.S. approval grew, this AUM surged by 2.5× to reach roughly $50 billion by the end of 2023. This growth outpaced the crypto market’s overall growth – indicating net new money flowing into ETPs beyond just price appreciation. Notably, Bitcoin-focused funds dominated: about 72% of crypto ETP assets were in Bitcoin products by late 2023 (much higher than Bitcoin’s ~53% share of total crypto market cap), showing Bitcoin is the primary magnet for ETF investment.

Then came 2024. The approval of multiple spot Bitcoin ETFs in January 2024, followed by Ether ETFs in mid-2024, led to an explosion in assets. By some accounts, the first wave of U.S. spot Bitcoin ETFs attracted $65 billion of inflows in 2024 alone – more than double what some experts had optimistically predicted. Part of this was due to the conversion of Grayscale’s large Bitcoin Trust into an ETF (instantly adding about $20–$30 billion of AUM), and part was due to new purchases by investors eager to get exposure via these funds. Additionally, as Bitcoin’s price climbed above $100k in late 2024, the value of assets held by ETFs grew commensurately.

By early 2025, estimates of total global crypto ETF/ETP assets ranged from around $130 billion to $170+ billion – a massive leap from the prior year. For instance, one analysis noted that as of November 2024, global crypto ETF/ETP AUM was roughly $130 billion, and growing rapidly as new products launch (and as underlying prices rise). Another report put the figure at about $168 billion by Q1 2025, with the U.S. funds comprising the lion’s share (on the order of 80–85% of the total, reflecting the U.S.’s dominance after the 2024 approvals).

To visualize the trajectory, consider the following chart of global crypto ETF/ETP assets over recent years:

Figure 2: Estimated total assets under management in crypto ETFs/ETPs at year-end, in USD billions. The growth accelerated dramatically after 2023, especially following U.S. spot ETF approvals in 2024. (2020–2022 values include mostly non-U.S. products and trusts; 2024 includes the influx from U.S. launches and price appreciation.)

This meteoric growth in ETF-held assets underscores how much pent-up demand there was for regulated crypto investment vehicles. By comparison, $150 billion in crypto ETF assets is still modest next to traditional equity or bond ETFs (the global ETF industry is tens of trillions of dollars in size). However, within the crypto world, those ETF inflows represent significant buying pressure. In late 2023, for example, crypto ETP asset growth outpaced the overall crypto market’s gains by a healthy margin, implying substantial net capital inflows. Bitcoin-focused ETFs saw AUM jump 162% in 2023, even higher than Bitcoin’s own price rise that year, meaning investors were adding to positions via ETFs beyond just riding the price up.

Breaking down where the assets are: the largest crypto ETF as of 2024 was the Grayscale (now converted) Bitcoin ETF, with roughly $29 billion in assets at launch, making it the single biggest Bitcoin fund in the world. BlackRock’s iShares Bitcoin ETF quickly amassed over $10 billion, and other U.S. offerings from Fidelity, ARK, etc. gathered hundreds of millions to billions in short order. In Canada, the Purpose Bitcoin ETF and its peers have a few billion collectively. Ether ETFs in the U.S., launched in mid-2024, each started somewhat smaller but have been growing; Grayscale’s Ether fund conversion brought in a multi-billion-dollar fund there as well. There are also ETFs/ETPs for other single assets (like smaller bitcoin ETFs in Brazil or Europe) and a number of crypto index or basket funds that hold multiple assets. By late 2023, diversified crypto basket ETPs and single-asset (non-Bitcoin, non-Ether) ETPs were seeing triple-digit percentage growth in AUM off a small base.

One interesting angle is the penetration of crypto’s market cap via ETFs. A research report highlighted that by late 2024, Bitcoin ETFs’ holdings equated to over 3% of all Bitcoin, and Ethereum ETFs held roughly 1.4% of all Ether (this was before U.S. spot Ether ETFs launched – that share could rise). Meanwhile, newer ETF targets like Solana (SOL) had only about 1% or less of their supply in ETPs at the time, but that could change if Solana ETFs launch. These metrics are being watched as a gauge of institutional adoption: higher AUM-to-market-cap ratios suggest more of that crypto’s float is in long-term investment vehicles rather than on trading exchanges.

In short, the capital in crypto ETFs has grown from essentially zero a few years ago to a significant chunk of the crypto universe. Tens of billions of dollars have rotated into crypto through ETFs, reflecting both rising asset prices and huge net new investments. This trend not only validates the demand for such products but also means that the fortunes of the crypto market and the ETF industry are increasingly intertwined.

What’s Next? Upcoming Crypto ETFs and the Future Landscape

With Bitcoin and Ethereum now available in ETF form (especially after U.S. approvals), the natural question is: which cryptocurrencies or crypto-themed ETFs are coming next? And how will the regulatory climate evolve moving forward?

As of early 2025, there is a sense of a new “crypto ETF gold rush” in the works. Asset managers are actively planning novel products beyond the already-launched Bitcoin and Ether funds. In the United States, a change in the regulatory guard – combined with the success of the first wave – has emboldened firms to file for a variety of new crypto ETFs. In November 2024, even before a new U.S. administration took office, at least 16 new crypto ETP applications had been filed with the SEC, targeting everything from broader crypto indices to specific altcoins like Solana (SOL) and Ripple’s XRP. For example, VanEck has signaled interest in launching a Solana ETF in 2025, and other issuers have plans for Litecoin and even more niche assets like Hedera Hashgraph (HBAR) ETPs. These filings suggest that fund providers see an opportunity to cater to investor demand beyond the top two coins – though whether the SEC will approve products for these smaller cryptos remains to be seen.

The regulatory outlook does appear to be tilting more favorably. By January 2025, the U.S. was poised for a political shift that crypto proponents believe could usher in a more accommodative stance. The prior SEC chairman, Gary Gensler, had been viewed as crypto-skeptical and had only relented on Bitcoin and Ether ETFs after court losses and pressure. His expected successor (under the incoming administration) is considered more supportive of digital assets. Industry voices predict a “lighter regulatory touch” and are racing to have products in the approval pipeline, assuming the climate will be friendlier going forward. If that holds true, 2025 could see U.S. approvals for some of those altcoin ETFs or perhaps an ETF tracking a basket of top cryptocurrencies. A multi-crypto index ETF could be particularly appealing as a way to get diversified exposure, and some such products already trade in Canada and Europe (e.g., the Evolve Cryptocurrencies ETF in Canada holds both Bitcoin and Ether, launched in 2021 as the first multi-crypto ETF).

Globally, other markets continue to innovate as well. Europe may approve more single-asset crypto ETFs (beyond Bitcoin) before the U.S. does – for instance, Europe already has exchange-traded notes for assets like Solana and Polkadot, and could see a true ETF structure for those. Regions like Asia and the Middle East are also exploring crypto fund products under their regulatory frameworks, aiming to attract international investors. As one example, Hong Kong recently voiced interest in becoming a crypto investment hub, which could include ETF offerings, and Australia’s first Bitcoin and Ether ETFs launched in 2022 on the Cboe Australia exchange.

Another likely area of growth is thematic crypto ETFs. These might not hold crypto directly, but instead focus on sectors like blockchain technology, DeFi (decentralized finance) protocols, or metaverse and NFT-related assets. We already see some ETFs that hold stocks of blockchain companies or Bitcoin mining firms (for instance, the Valkyrie Bitcoin Miners ETF (WGMI) holds shares of mining companies). These thematic funds can offer exposure to the “crypto economy” without regulatory issues of holding tokens themselves, and they could gain popularity if direct crypto ETFs for smaller coins face hurdles.

In the U.S., the **next big ETF to watch might be a spot **Bitcoin ETF for an inverse or leveraged exposure (though regulators have traditionally been wary of leveraged crypto products for retail). Also, Ethereum futures ETFs were actually approved even before Ethereum spot ETFs – those launched in late 2023 in the U.S. – so one could imagine futures-based funds for other coins (like a futures-based Solana ETF if CME were to list Solana futures, for example). However, given the direction of the market, spot ETFs for the major altcoins seem like the more straightforward path in a friendlier regulatory environment.

It’s also worth noting that market infrastructure is improving alongside: exchanges are preparing for more crypto-linked listings, and custody providers are expanding to secure a wider range of digital assets for ETF sponsors. The collaboration between traditional financial giants (BlackRock, Fidelity, etc.) and crypto-native firms (Coinbase, etc., which often serve as custodians or partners for ETFs) suggests that the integration will deepen. With each successful launch, the process and precedent for the next one gets easier.

Investors and analysts are keenly observing how much of the crypto market cap will ultimately come to reside in ETFs. Some argue we are only in the early stages – if crypto ETFs start to resemble gold ETFs (which grew to hold hundreds of billions in gold), there could be hundreds of billions more flowing into crypto via these vehicles in coming years. In fact, one late-2024 estimate put global crypto ETF/ETP AUM at about $130 billion, which is roughly 1.2% of crypto’s total market value – whereas gold ETFs hold about 1.6% of gold’s supply by value. By that metric, crypto ETFs still have room to grow relative to the asset class, especially if the next bull market swells crypto prices and more fund options emerge.

Finally, the intersection of regulation and innovation will dictate the pace. If U.S. regulators under new leadership embrace more crypto products, we could see a flurry of launches (and perhaps more creative ones, like fixed-income style yield-generating crypto funds, or ETFs that actively manage a crypto portfolio). Globally, if one region slows, another may pick up the slack – for example, Europe’s openness to crypto ETFs could attract issuers to list there first for new types of assets.

In summary, the pipeline for crypto ETFs is full, with Bitcoin and Ether just the beginning. XRP and Solana could be among the next single-asset ETFs if filings are approved, and broader crypto index ETFs are likely on the way. The landscape by the end of 2025 may include a menu of ETFs covering a spectrum of digital assets, giving investors a toolbox of options to gain exposure according to their preferences and risk tolerance.

Conclusion

Crypto ETFs have transitioned from a long-shot idea to a cornerstone of the cryptocurrency market’s integration with mainstream finance. They demystify and simplify crypto investing for a broader audience, allowing anyone with a brokerage account to participate in the upside (and downside) of Bitcoin, Ethereum, and potentially other coins in the near future. The journey here was not straightforward – it took years of lobbying, improving market maturity, and even legal battles to convince regulators. But the floodgates are now open: the United States, after some delay, catalyzed a dramatic inflow of capital by approving Bitcoin and Ether ETFs, vaulting itself into the leadership position in terms of crypto ETF assets.

From the first Bitcoin ETF in Canada to the record-breaking U.S. launches, each step has brought new capital and credibility into the crypto ecosystem. The effects are visible in the numbers (billions of dollars in AUM, large shares of crypto supply now held by funds) and in market behavior (greater liquidity, somewhat reduced volatility, and strong price rallies around ETF events). Crypto ETFs have essentially turned crypto into another asset class that can be packaged and traded like stocks or commodities, which is a defining moment in the asset class’s history.

Looking ahead, the expansion of crypto ETFs seems likely to continue. Investors can expect more choices – perhaps ETFs for other top digital assets or innovative fund strategies – especially if regulators maintain an open stance. Globally, the trend is toward wider acceptance: even jurisdictions that were initially cautious are seeing the success elsewhere and warming up to the idea of regulated crypto investment products. For crypto markets, this means more integration with global financial flows and possibly more stability as the investor base broadens. For the traditional financial industry, crypto ETFs represent a new frontier of product offerings and fee generation, ensuring that Wall Street has a stake in the crypto game.

In a sense, the rise of crypto ETFs symbolizes the “mainstreaming” of cryptocurrency. Bitcoin, once an experimental digital coin traded on obscure internet forums, is now part of ETF portfolios held by retirees and institutions worldwide. The story of crypto ETFs is still unfolding, but one thing is clear: they are here to stay, and they are reshaping both the crypto market and the ETF industry in real time. Investors and observers will be watching closely as the next chapter – be it an ETF for the next big altcoin or the influx of another wave of capital – takes shape in this exciting intersection of crypto and traditional finance.