Bybit: Analysts Remain Pessimistic Despite Current Rebound; Magic Eden Raises $130M

On Tuesday, the broader crypto market rose slightly alongside the strong rebound of the U.S. stocks after last week’s rout. BTC gained ground for a third consecutive day, and managed to find support above the $21k handle. However, the largest cryptocurrency by market cap saw a slight drop in the early hours of Wednesday (Asian trading hours), and has been consolidating near the $20.3k mark after posting a marginal gain over the last 24 hours. BTC is now facing a major resistance near the $21k to $21.2k zone. Failure to move above this resistance zone would likely send BTC back down to retest support in the $20k region.

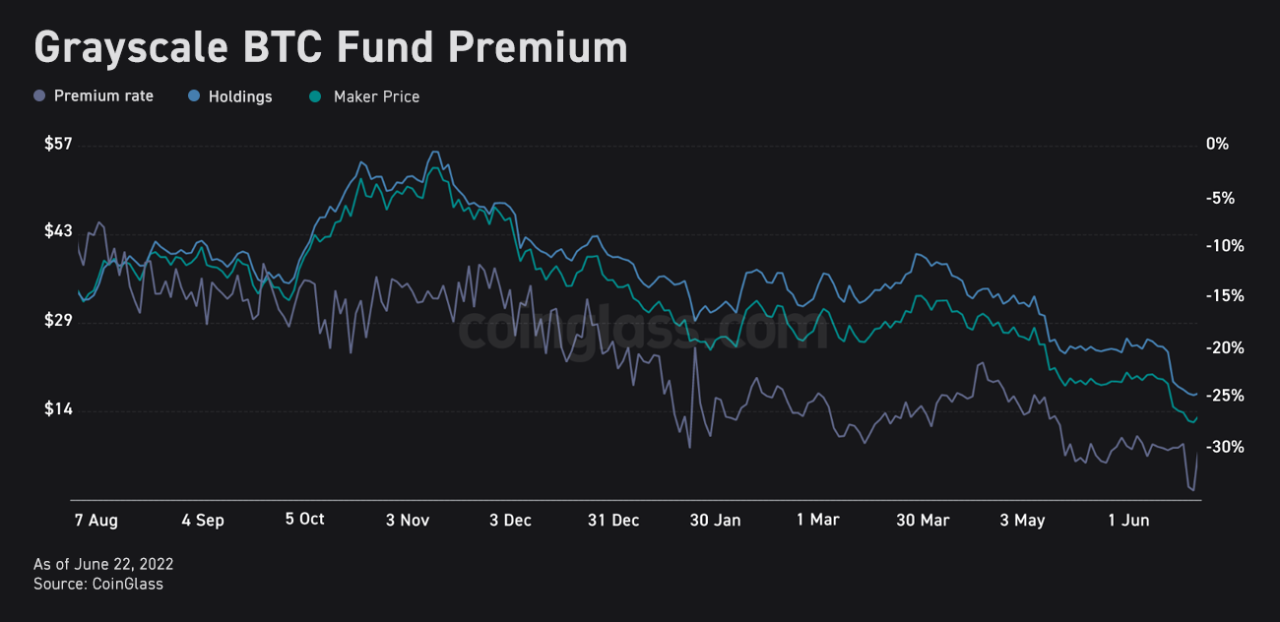

It seems that the market is showing signs of recovery amidst multiple liquidity crises and treasury blowups. However, some analysts are still pessimistic about the longevity of the current rebound. This brings attention to a rise in volatility as a result of the recent aggressive dip-buying activities and deteriorating macroeconomic conditions. Furthermore, the contagion risk that sent ripples across the broader market has yet to taper. For one, Grayscale’s Bitcoin Fund (GBTC) has been trading at a widening discount to its net asset value since the collapse of 3AC. The discount, at one point, reached 34%, the lowest value in history. Meanwhile, the bid/offer spread across centralized exchanges is reaching new highs, indicating that liquidity continues to exit the market.

In tandem with BTC, ETH experienced a worse correction on Wednesday. The second-largest cryptocurrency is now trading below the $1,100 handle after shedding 2.4% of its market value within the same period. Many altcoins with mid-to-large market caps have flipped red, with the exception of canine-inspired memecoins, which thrived on the latest rumor related to the Twitter deal, and Uniswap, which is up 7% following the acquisition of an NFT aggregator. Market Check

Talk of the Town

Magic Eden, the leading NFT platform on Solana, is gearing up for a multi-chain expansion. The Solana-based NFT marketplace has raised $130 million in a funding round with a valuation of $1.6 billion. In addition to pushing the limits of its gaming vertical, Magic Eden is planning to channel the fund to add support for NFTs on other blockchains. With its current claim of more than 90% of the NFT secondary market on Solana, Magic Eden may be poised to challenge the dominance of OpenSea once it successfully integrates with other platforms.