Bybit: BTC Exchange Outflow Hits 5-Year High; Grayscale Challenges SEC’s ETF Rejection

Chart of the Day

On Wednesday, the broader crypto market remained relatively range-bound, as investors looked for market directions by assessing comments from U.S. central bank chiefs about the economic prospects and interest rates. The possibility of a 75bps rate hike in July has been adjusted to 83.2% after the ECB forum on Wednesday, suggesting that the long-term stable recovery of risk asset markets may be challenging. Bybit reports.

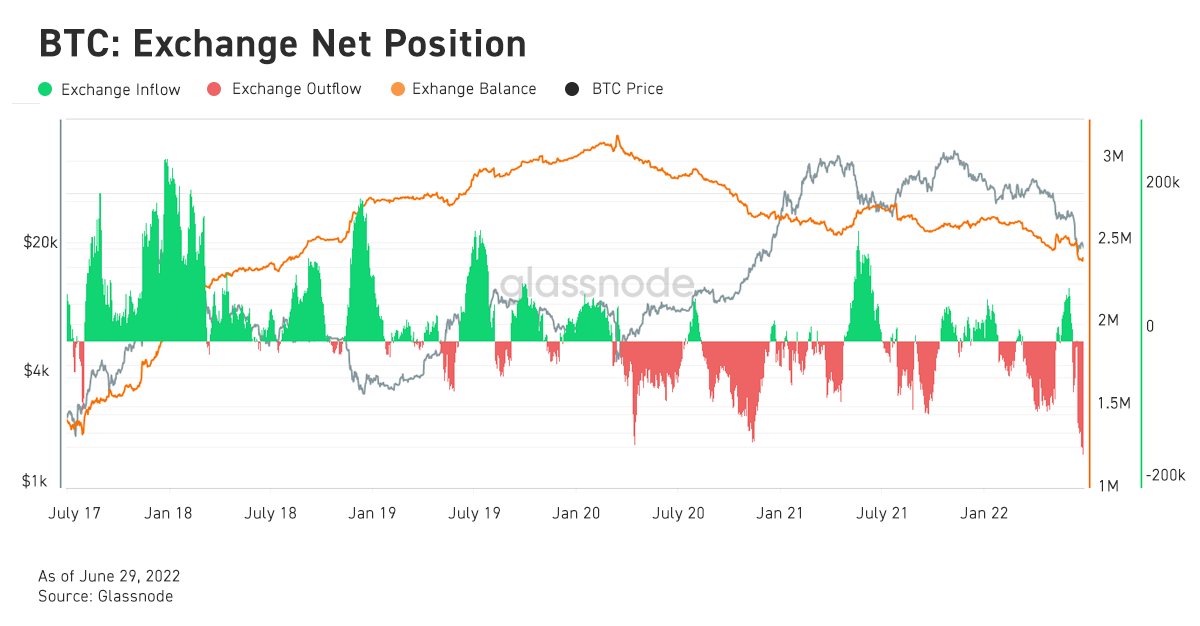

As of the time of writing, BTC is hovering near the $20k psychological support level after posting a marginal loss in the last 24 hours. The largest cryptocurrency by market cap is facing an immediate upside resistance near the $20.4k level, where a key bearish trend line is taking shape on BTC’s hourly chart. The path toward $21k is riddled with resistance levels, and failure to surpass the resistance zone will send BTC south to test support near the $18k level. In terms of on-chain flows, metrics reveal that miners have overextended their positions, while their revenue continues to be undercut by weakening spot prices. On-chain data points on exchange flows also flagged the largest 30-day outflow in almost five years.

Meanwhile, ETH is descending into a bearish zone near the $1,050 level after shedding 4% of its market value in the same period. A close below this level could likely trigger a further decline toward the $1,000 psychological support level. Most major altcoins are also in the red, with a few exceptions such as UNI, which experienced a 4% increase in a similar time frame. Stablecoin lenders on Aave and Compound saw their yields drop to 0.8% to 2.3% since the beginning of this quarter alongside their plummeting TVLs, thus suggesting a plunge in liquidity as the DeFi market unwinds excessive leverage.

Talk of the Town

Asset manager Grayscale, which manages the world’s largest BTC fund, has decided to sue the U.S. Securities and Exchange Commission (SEC) after the financial watchdog turned down its application to turn GBTC into a spot BTC ETF. Grayscale believes that converting GBTC to a spot ETF would provide U.S. investors with BTC exposure through “the familiar protections of an ETF wrapper”. The company stressed that it is “the best option for investors” as the conversion effectively eliminates the current discount to NAV while tracking BTC’s price with its shares. The company also expressed deep disappointment with the SEC’s “arbitrary action”, which cited failure to address concerns around market manipulation as the grounds for rejection despite its prior approvals of several BTC futures ETFs.