Bybit: BTC Plunges Below $20k as Volatility Surges; FTX Cancels Celsius Deal

Volatility has returned to the broader crypto market amid rampant liquidity woes and dampened market sentiments. BTC retreated to $18.6k late Thursday before staging a strong comeback in the early hours of Friday (Asian trading hours). As of the time of writing, the largest cryptocurrency by market cap is consolidating losses above the $19k support after posting a marginal gain in the last 24 hours. Despite demonstrating much resilience during the latest plunge, BTC is still struggling with major resistance near the $20k to $20.5k zone, where bears remain highly active. Bybit blog reports:

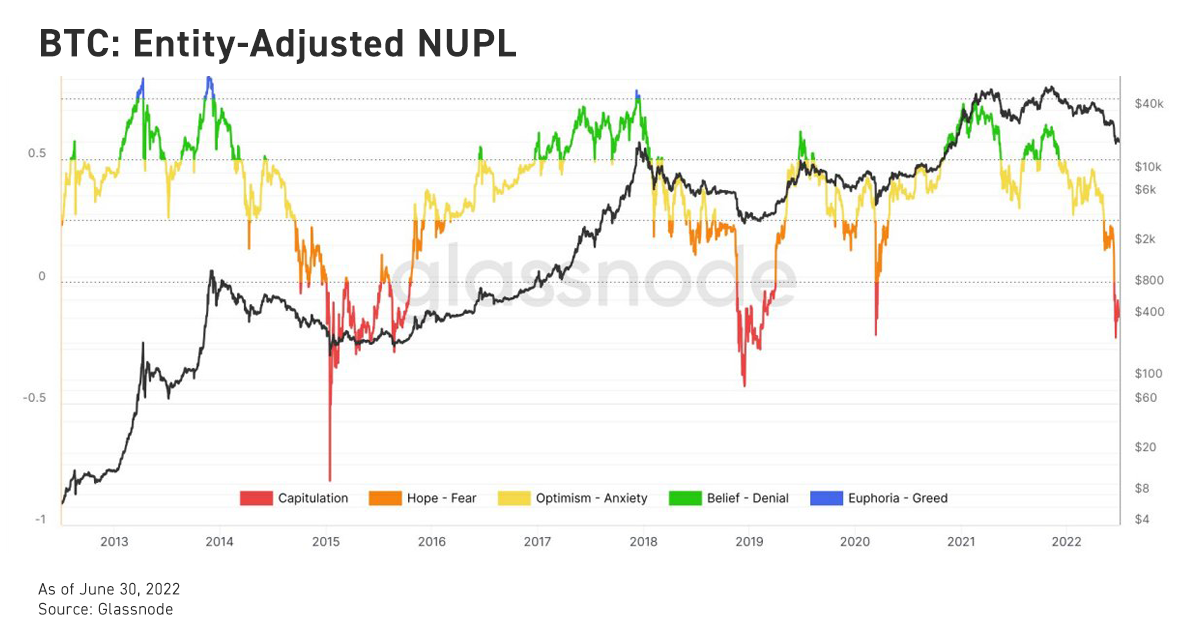

In view of the surging volatility, BTC may very well fall back under $19k and retest support levels in the $18k to $18.5k region. Meanwhile, BTC’s entity-adjusted net unrealized profit and loss (NUPL) has nosedived to levels last seen during the March liquidy crunch in 2020, suggesting that mass capitulation in the near term is not a remote possibility.

In a similar vein, ETH has been moving in tandem with BTC. The second-largest cryptocurrency by market cap plummeted below the $1,000 handle, before reclaiming the key psychological support level in a matter of hours. Most major altcoins have seen mixed performances, with ALGO leading the recovery on a 4% increase within a similar time frame.

Talk of the Town

According to sources close to the matter, crypto exchange operator, FTX, was exploring a potential acquisition of Celsius, but ultimately walked away from the deal after seeing the embattled crypto lender’s deficient balance sheet. A $2 billion hole in Celsius’ balance sheet has put a stop to all discussions of financial support, as FTX found it too difficult to deal with, says one of the sources. Meanwhile, acquisition talks between BlockFi and FTX may be approaching an end. With rumors flying around, BlockFi’s CEO Zac Prince has taken to Twitter to discredit the news of a $25 million buyout of the company, which has a valuation of $3 billion during a funding round last March.