Bybit: Is $19k the new $20k for BTC, 3AC Files for Bankruptcy

Chart of the Day

The broader crypto market remained relatively range-bound despite the unfortunate unfolding of Three Arrows Capital’s bankruptcy among other disappointing news. On a more positive note, BTC successfully defended the $19k psychological level, turning it into a support line after the breach of the $20k support level. As of the time of writing, BTC is trading slightly above $19k after posting a marginal gain in the last 24 hours. The next critical level for BTC stands at the $17k region, which is the next line of defense should the market be mauled further by the bears. Bybit Blog reports.

On the other hand, ETH and most major altcoins were flat over the weekend. The second-largest cryptocurrency by market cap is now trading below the $1,100 handle, after a slight dip in its market value during the same period. Most major altcoins saw mixed performances, with TRX and AVAX leading the pack on a 4% increase within a similar time frame.

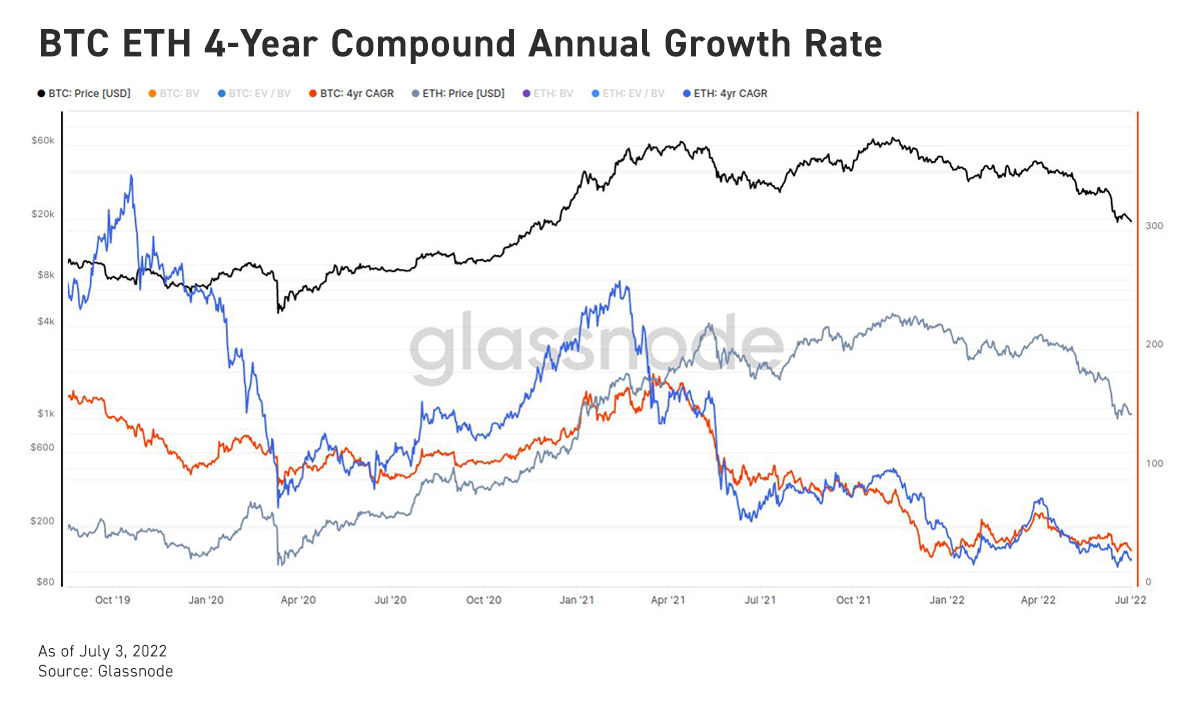

The crypto market has been struggling with a lack of liquidity for quite some time. The last 30 days saw $163.21 billion flowing out of BTC, leading to weakened price actions at the hands of agitated investors. The liquidity drain, coupled with some degree of volatility on both sides, suggests that the downside action may continue for an extended period until signs of a decline in selling momentum begin to surface. The compound annual growth rate hints that a rotation into the altcoins is still premature, as ETH has been underperforming on a four-year horizon.

Back to (the) Futures

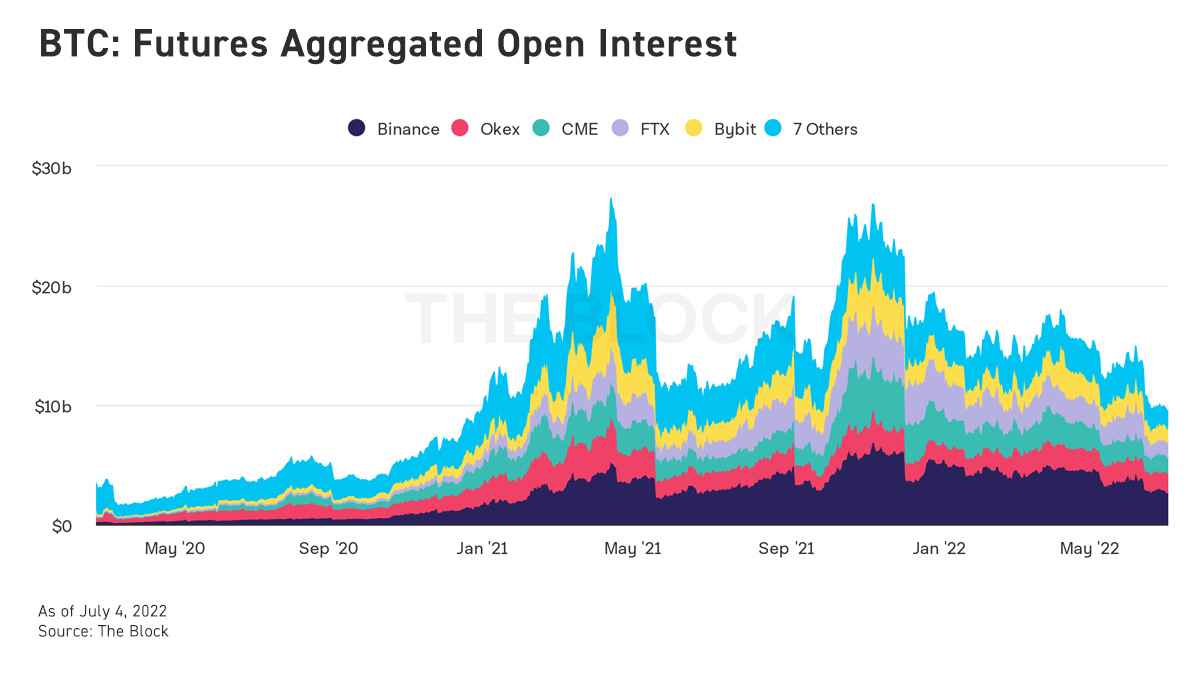

BTC’s perpetual contract funding rates experienced much volatility last week, but continue to show signs of trending back to neutral territory. The aggregated open interest for BTC futures saw a sharp decline while trading volume plunged by 11% in a week. Panic selling due to contagion fears may have temporarily stopped, but the inability to reclaim the $20k region suggests a very bearish outlook in the near term.

Talk of the Town

The controversy around Three Arrows Capital’s escalating financial woes is now in the hands of the court, as the crypto hedge fund has been ordered into liquidation in the British Virgin Islands. Following the commencement of the case, 3AC has filed for Chapter 15 bankruptcy, a move that aims to protect its U.S. assets while the liquidation is carried out. The collapse of one of the largest borrowers in the crypto space has triggered a wave of contagion, leading to fallouts at top companies that have exposure to the embattled hedge fund. Crypto trading platform, Voyager Digital, announced that it has temporarily halted all withdrawals, deposits, and trading due to market conditions.