Bybit: BTC Mining Profitability Continues to Decline; Lamborghini-Backed GT Team to Certify Car Parts With NFTs

Chart of the Day

The broader crypto market dipped yet again on Tuesday after its brief recovery lost steam. BTC has been fluctuating above its newly found range near the $20k key psychological support level. The recent rejection near the $20.5k level has sent BTC’s price down south, but the $19.5k zone still manages to hold and prevent further losses. As of the time of writing, the largest cryptocurrency by market cap is trading slightly below $20k after shedding 2% of its market value in the last 24 hours. The immediate upside resistance sits in the $20.2k to $20.5k range. A steady close above this range would likely open the door to further upside gains.

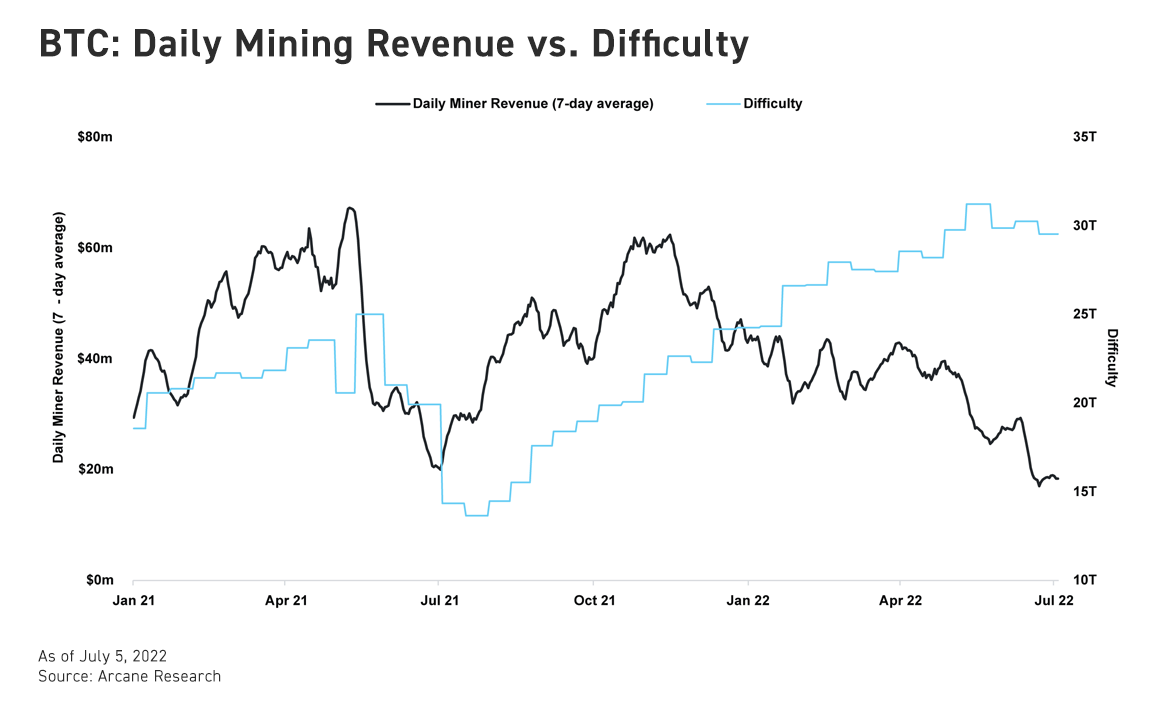

While volatility in the spot market eases slightly, the bears continue to exert pressure on miners. Since November 2021, the BTC mining industry has seen its daily revenue plummet from its peak of $62 million to $18 million. The mining industry, one that derives revenue from a commodity, tends to follow a cyclical pattern. Over-investment in new production capacity, especially after the extremely profitable year of 2021, has yielded disproportionately low profits amid weakening spot prices and macroeconomic uncertainty. The selling pressure on miners will ultimately lead to a withdrawal of production capacity, and in turn reboot the cycle, where the revenue of mining BTC will begin to rise again.

In the altcoin market, ETH is moving in tandem with BTC and is currently trading above the $1,100 handle. Most major altcoins have flipped red after the Tuesday recovery wave lost its momentum. Lido’s staked ETH, which was at the epicenter of controversies last month, has somewhat regained its peg with ETH, although the current gap still represents a discount of roughly 3%.

Talk of the Town

The Vincenzo Sospiri Racing GT team, backed by Lamborghini, recently announced the adoption of NFTs to certify and authenticate factory car parts. In a statement released on Tuesday, the company mentioned that the NFT rollout, a pilot scheme in collaboration with Go2NFT, could also be extended to authenticate merchandise and other official products. The development of the NFT platform marks the beginning of a long-term commitment to bringing NFT functionalities into the Lamborghini ecosystem, with the ultimate goal of transforming cars into digital assets in the form of NFTs.