Bybit: BTC MVRV Reaches “Pain Zone”, GameStop Releases Long-Awaited NFT Platform

Chart of the Day

Possibilities for a quick recovery for stocks or cryptocurrencies continue to look bleak, as the former is having its worst year in at least three decades. In addition, the cryptocurrency market sank further in the early hours on Tuesday (Asian trading hours), as investors await a hot inflation reading among other signals of whether the economy is heading into a recession. The retracement of BTC’s gains over the past week weighed heavily on the broader crypto market. As of the time of writing, the largest cryptocurrency by market cap is consolidating losses below the $20k psychological threshold after shedding 2.8% of its market value over the last 24 hours. BTC will likely revisit the $19.5k support level if it fails to rise above the immediate resistance zone near the $20.1k to $20.5k region. Bybit blog reports.

In a similar vein, ETH has failed to defend the $1,100 level after experiencing a 5% slump over the same period. However, ETH-focused funds saw around $7.6 million inflow last week. After enduring an 11-week outflow streak, the modest inflow suggests a slight turnaround in sentiment. Most major altcoins are submerged in a sea of red with UNI leading the plunge on an 11% loss over a similar time frame.

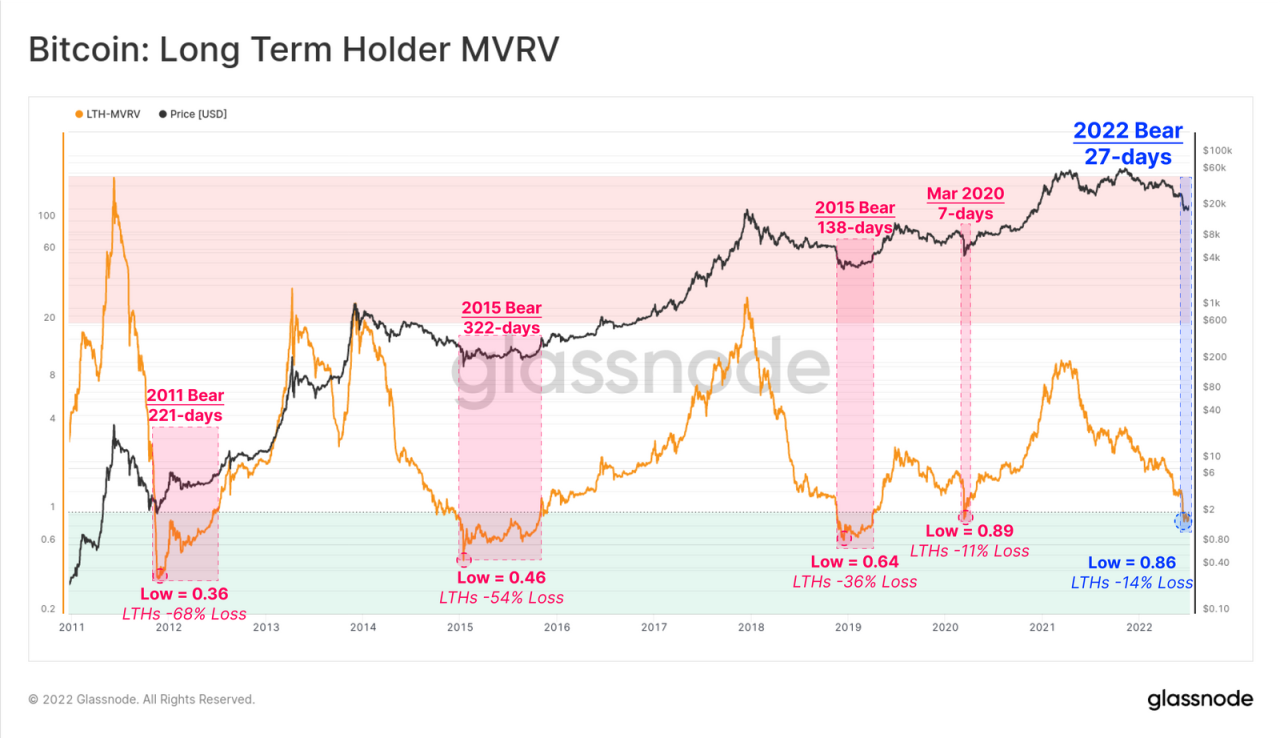

Meanwhile, long-term holders of BTC are under greater stress as the spot price sinks below the average cost basis. Collectively, the cohort is holding an aggregate unrealized loss of 14%. The market value to realized value ratio (MVRV) for these holders has also nosedived into the oversold territory, reaching levels last seen during the liquidity crunch in 2020.

Talk of the Town

Video game retailer GameStop has finally released the public beta of its long-awaited NFT platform. The said platform was first conceived during the NFT summer in 2021, and arrived just in time for the crypto winter. Currently, the platform is host to more than 200 collections and has around 53,000 NFTs listed on the marketplace. In addition to its growth, GameStop has laid out even bigger plans for the platform. According to a press release, the company is looking to “expand functionality” into web3 gaming, in a bid to become a major player in the NFT gaming arena.