Bybit: Crypto Losses Deepen Ahead of CPI Data, STEPN Renews Token Burn With Q2 Profits

Chart of the Day

On Tuesday, the broader crypto market sank as fear of further liquidity contraction in the risk assets market spread like wildfire. BTC plunged below the $19.5k key support level, signaling aggravated pain to come and shattering the hope of the market bottoming out in the immediate future. Bybit blog reports.

As of the time of writing, the largest cryptocurrency by market cap is changing hands at around the $19.5k level, after shedding 2.3% of its market value in the last 24 hours. A key bearish trend line with an immediate resistance near the $19.7k level is taking shape on BTC’s hourly chart. Failure to break above this resistance will likely send the price to retest support near the $19.2k level.

ETH is struggling to defend the $1,000 handle after posting a 2.6% decrease during the same timeframe. The second-largest cryptocurrency by market cap is currently trapped in a bearish zone with several negative forces limiting its upside gains. Even on-chain fundamentals fail to inspire much confidence in the near term, as the number of active ETH addresses hits a two-year low, and is barely half of the value at its peak in May 2022. In the altcoin market, most major altcoins are still in the red with a few exceptions that saw marginal gains over the last 24 hours.

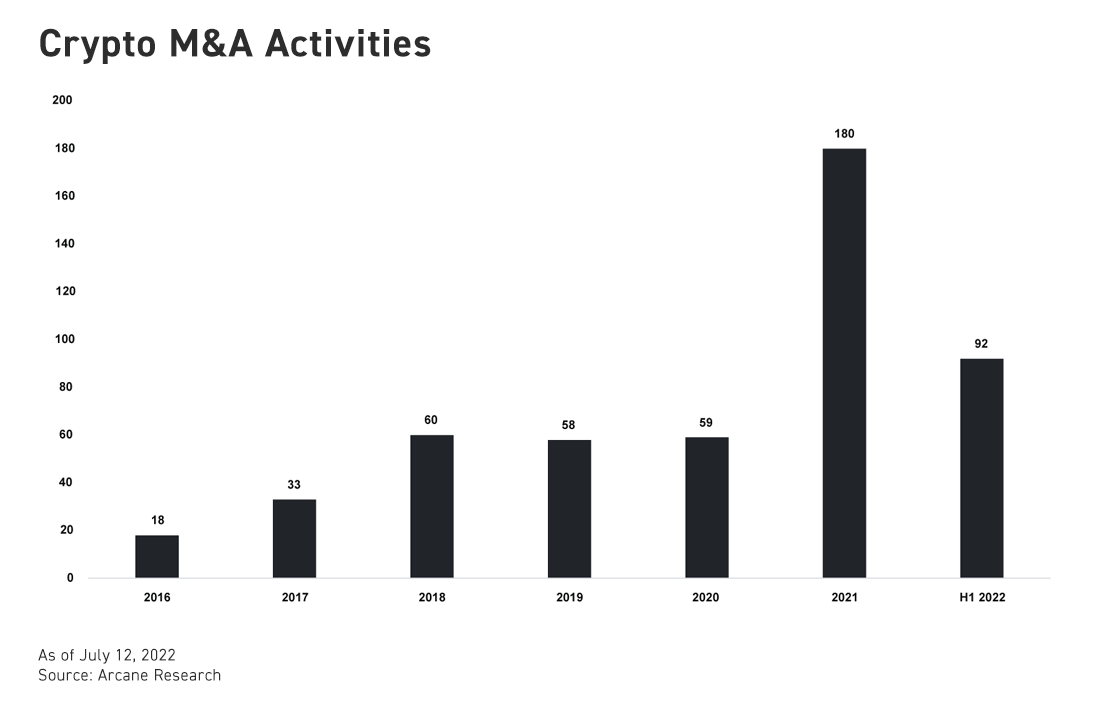

Architect Partners’ new report reveals that M&A activities in the crypto space remain high despite the market’s abysmal performance in the first half of 2022. The rate of growth of M&A activities in H1 2022 is on par with that of 2021. Architect Partners also forecasts growth in Q3 as distressed companies may become attractive targets for M&A deals, thus hinting at a long-term positive outlook on the industry.

Talk of the Town

The Solana-based move-to-earn game, STEPN, has disclosed earnings of $122.5 million from platform fees in Q2 2022. The firm announced that five percent of the earnings will be channeled to buying and burning GMT, the game’s governance token, to ensure the sustainability of the game economy.

At the current price, more than 7 million GMT tokens will be permanently removed from the circulating supply. The practice of buying back tokens with a fixed supply, a common practice among DeFi protocols, is considered less common for blockchain-based gaming projects.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.