Bybit: BTC Correlation with TradFi Dips, BlockFi Report Reveals $600M Uncollateralized Exposure

Chart of the Day

The broader crypto market fluctuated violently over the weekend. Top digital assets plummeted on Saturday before staging a brief comeback on Sunday, only to dive again later. As of the time of writing, BTC is trading below the $22k handle and the 100-hour moving average, after posting a 3.6% loss in the last 24 hours. There is a break below a key bullish trend line with support near the $22.7k level on the hourly chart. The largest cryptocurrency by market cap may face further decline if the support level near $21.4k doesn’t hold. Bybit blog reports.

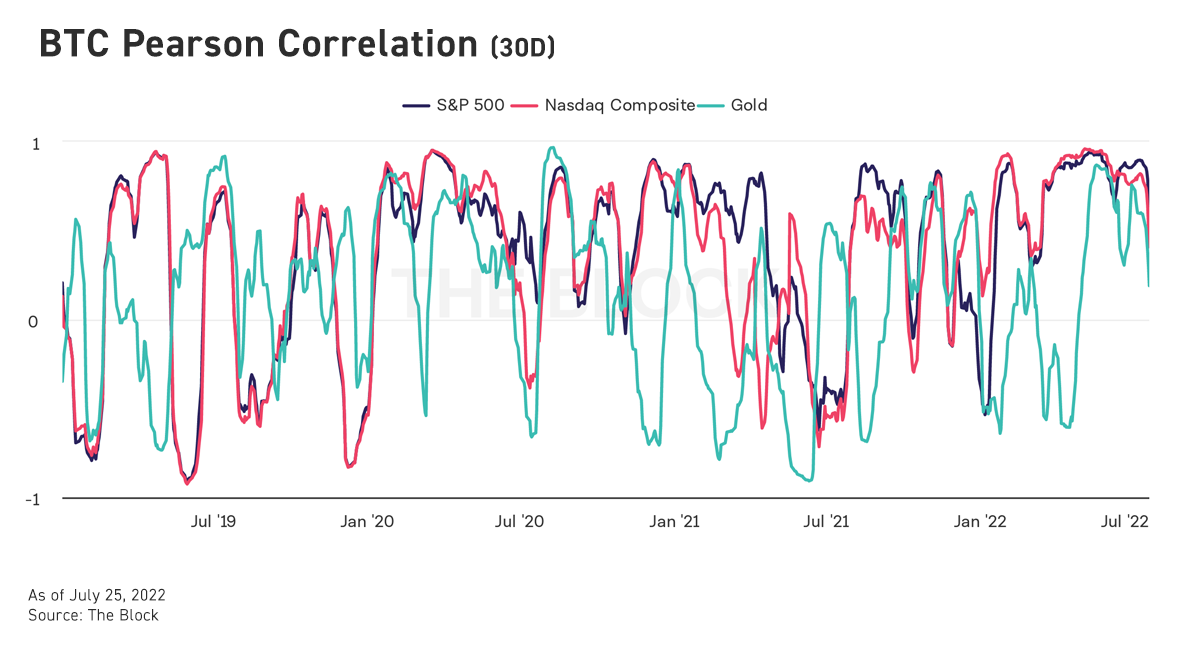

Meanwhile, BTC’s correlation with traditional financial markets has significantly decreased after reaching a local high last week. BTC’s Pearson 30-day correlation with S&P 500 dropped to 0.7, while the correlation with Nasdaq composite nosedived to below 0.5. However, this week is still important for major digital assets as the events to unfold will likely shed some light on the market’s next direction. In particular, the upcoming U.S. Federal Reserve’s interest rate decision will probably add an element of uncertainty that will dominate trades in the next few days. According to the latest estimate by CME’s Fed Watch, the probability of a 75 bps rate hike has exceeded 80%.

Similarly, ETH retraced to $1,520 after shedding 5.5% of its market value during the same period. However, Ethereum’s gas fee remains low despite decisive spot price actions on the bullish Merge news. Major altcoins have flipped red, with AVAX and ATOM leading the downside correction on 7% losses over a similar timeframe.

Back to (the) Futures

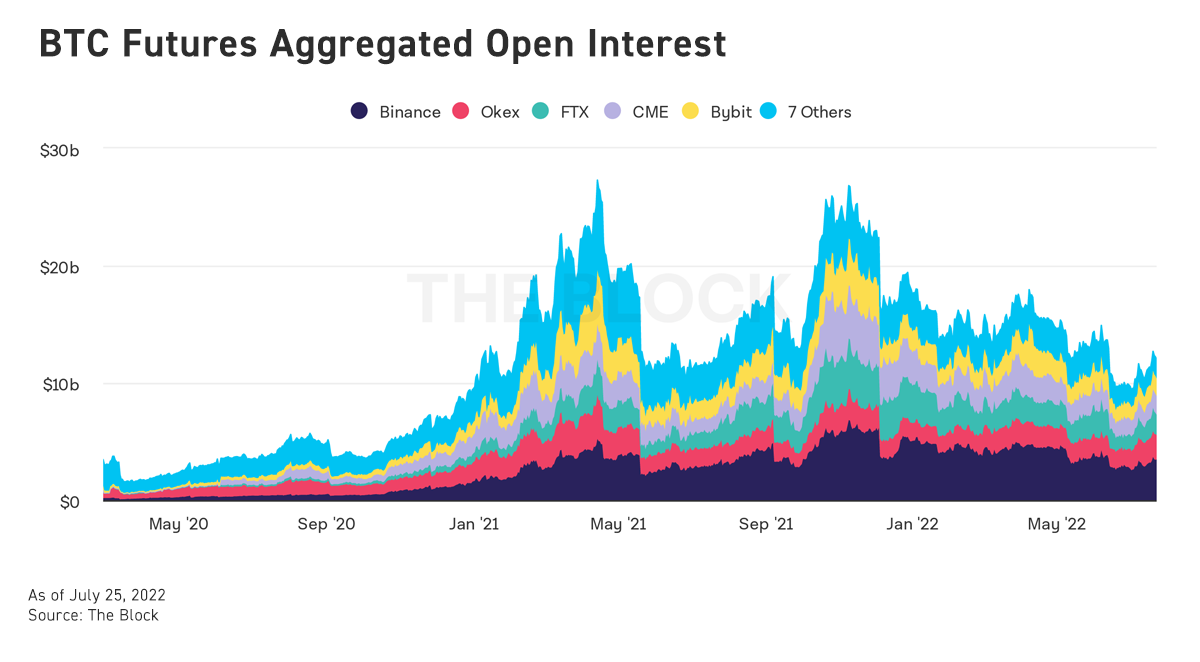

In the derivatives market, the aggregated open interest declined despite spot prices rebounding from a near-term bottom. BTC’s perpetual funding rates remain elevated, even with a recent slight dip from local highs. In the options market, the gamma exposure of BTC experienced some fluctuations over the weekend. BTC’s IV saw a spike on July 29, but the curve will likely ease if a 1% rate hike doesn’t materialize. ETH’s lead on the back of positive dev news was also felt in the options’ flows.

Talk of the Town

BlockFi, a centralized crypto lender, has released its quarterly transparency report that reveals that the company has $1.8 billion in outstanding loans to clients. As the platform does not require all of its borrowers to post collateral, around $600 million of these loans are uncollateralized. The company has since established a set of guidelines to navigate liquidity risks and meet its obligation toward institutional and retail borrowers.