Bybit: ETH MVRV Z-Score Hints at Bottom Formation, Bill Introduced to Exempt Small Crypto Transactions From Taxes

Chart of the Day

On Wednesday, the broader crypto market managed to reverse some losses as investors anticipate a spike in macro uncertainties and brace for the aftershock of the U.S. Federal Reserve’s expected 75 bps rate hike. Bybit reports.

BTC has since regained lost ground after approaching a local low near $20.5k. As of the time of writing, the largest cryptocurrency by market cap is changing hands above the $21k support level after posting a marginal gain over the last 24 hours. However, BTC’s upside gains may be limited by overhead resistance levels in the $21.5k to $21.7k range. Alternatively, it may move down to retest support at the $20.5k level if key technical indicators lose pace in the bearish territory.

ETH sees greater intra-day gains, up by 1.9% during the same period, and is currently trading above $1,450. The MVRV Z-score of ether has dipped below zero, suggesting that the majority of ETH supply is now underwater with considerable unrealized losses. The negative Z-score often hints toward good buying opportunities as a market bottom formation is on the horizon. Most major altcoins have flipped green, with ETC leading the recovery on a double-digit percentage gain.

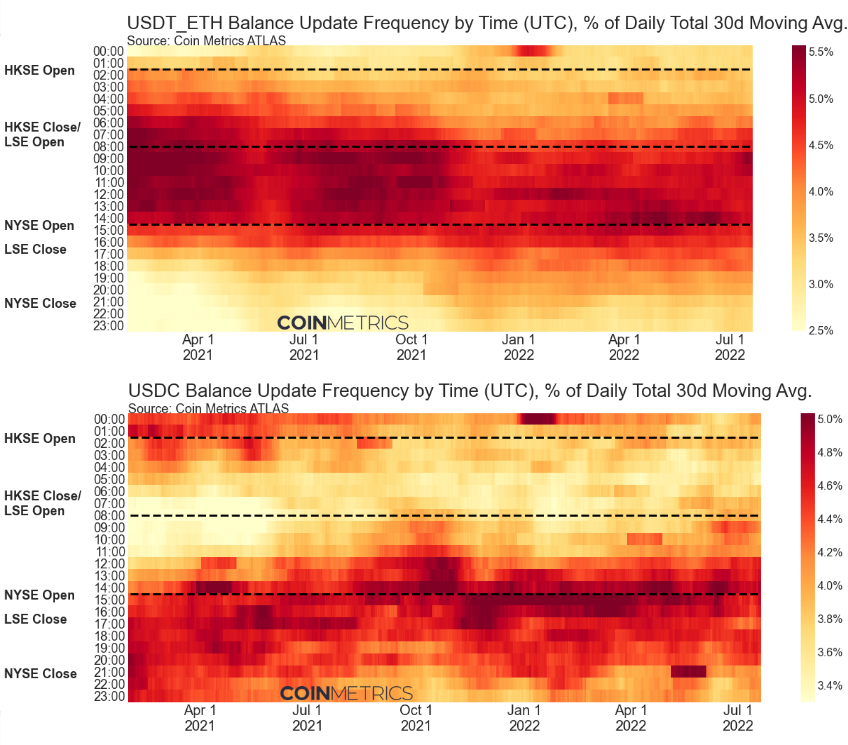

Meanwhile, CoinMetrics’ latest research reveals a time difference in stablecoin activities around the world. USDC activities are more concentrated during U.S. market hours, while USDT transactions tend to take place during Asian and European trading hours. Other stablecoins tend to be more actively involved in trading activities during U.S. business hours.

Talk of the Town

A bipartisan bill was introduced in the U.S. Senate on Tuesday that seeks to simplify the use of cryptocurrencies in everyday scenarios by easing the disclosure requirements for small transactions. The bill, entitled the Virtual Currency Tax Fairness Act, aims to create tax exemptions for transactions that are either under $50 or have a capital gain of less than $50. Senator Pat Toomey (R-PA), one of the people sponsoring the bill, commented that “digital currencies have the potential to become an ordinary part of Americans’ everyday lives” but the “current tax code stands in the way.” The Virtual Currency Fairness Act also has bipartisan support in the House of Representatives, and precedence of a similar bill introduced in February this year that sought to exempt personal crypto transactions with gains under $200.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.