Bybit: ETH Gas Dominance Suggests Continued Interest in NFT, Miami to Roll Out NFT Collection

Chart of the Day

The rally in the broader crypto market gained more traction, with traders paring bets on rate hikes amid a pessimistic economic print. Despite the reveal of more sobering data pointing to a looming recession, major digital assets climbed for a third consecutive day, with BTC breaking above the realized price for the second time in two weeks and ETH raging toward the $1,800 handle. As of the time of writing, BTC is consolidating above the $23.5k mark after posting a 2.4% gain in the last 24 hours. A short-term contracting triangle with resistance near $24k is taking shape on BTC’s hourly chart. A clear break above this level could likely inspire stronger bullish sentiment to charge towards the $25k level. Bybit blog reports.

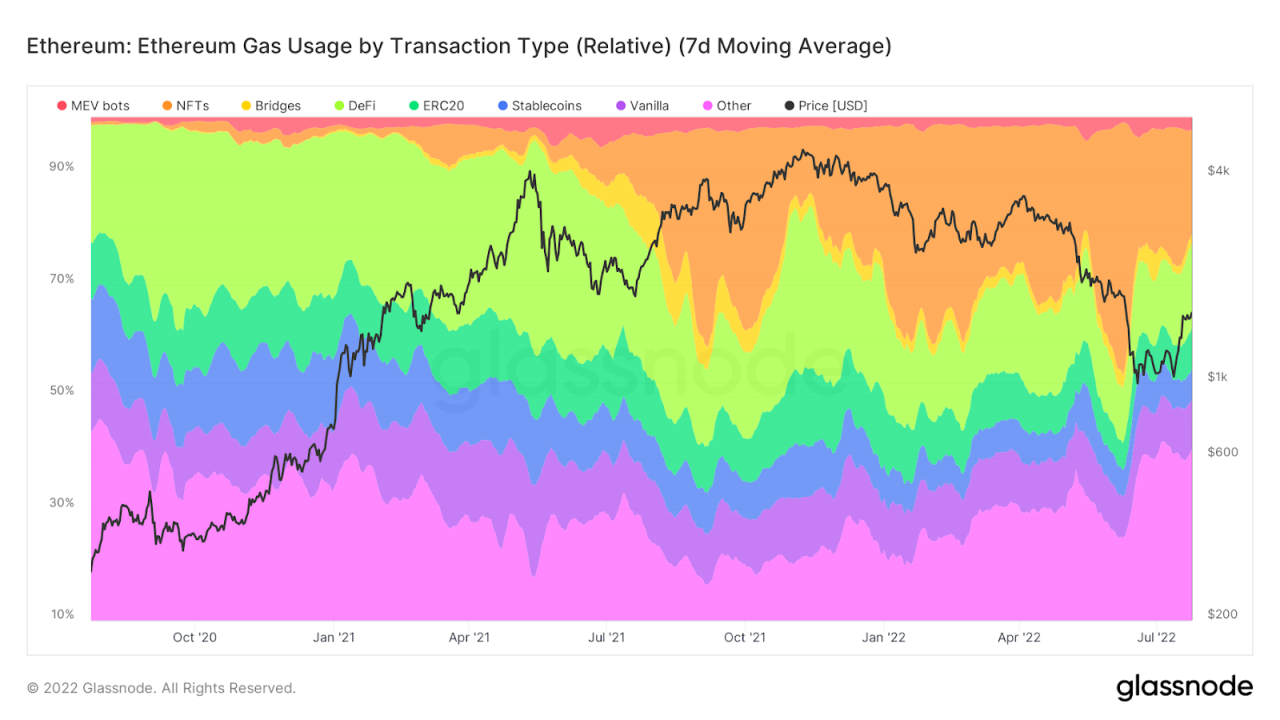

In a similar vein, ETH reached a multi-week high near $1,780 before experiencing a moderate downside correction. The second-largest cryptocurrency by market cap has since established a stronger foothold above the $1,700 handle after rising by 3.6% during the same period. A breakdown of ETH gas fees by transaction types shows that the relative gas consumption on NFT activities has grown 6.2% since November last year, suggesting a sustained interest in the NFT space. Meanwhile, gas domination of DeFi applications has nearly halved after being caught in a crossfire of implosions within the crypto space and macroeconomic turbulence. The figure aligns with the plummeting market cap of DeFi protocols, which nosedived 60% in the last quarter. However, the relative strength of DEX and the growth in synthetic adoption suggest that there is always hope.

Most major altcoins remain in the green with the exception of ADA and DOT, which saw marginal percentage losses over a similar time frame.

Talk of the Town

The city of Miami has always been in the vanguard of crypto adoption and tech revolution, and now it is making NFTs. On Thursday, Mayor Francis Suarez shared plans to collaborate with some of the biggest names across industries to release 5,000 NFTs later this year. Specifically, the NFT project will be helmed by TIME magazine, which will define strategies and facilitate the execution of the roll-out, with Mastercard providing exclusive benefits and Salesforce overseeing the minting and primary sales process. The Miami NFT collection is set out to embody “the tremendous diversity within the city” and unlock unique experiences for its holders.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.