Bybit: ETH Median Gas Plunges to Two-Year Low, Aave DAO Approves GHO

Chart of the Day

The broader crypto market rose last Friday alongside major equity indices, as investors braced for disappointing earnings and signs of the economy heading into a recession. BTC fell below the $24k handle after the brief spurt on Saturday failed to maintain the price above the $25k level. As of the time of writing, the largest cryptocurrency by market cap is trading in the lower end of the $23k region after posting a 1.7% loss in the last 24 hours. On the hourly chart, BTC has moved below a key bullish trend line with support near $23.7k. Should BTC wish to open the door to more upside gains, it must first clear the $24k handle. Bybit blog reports.

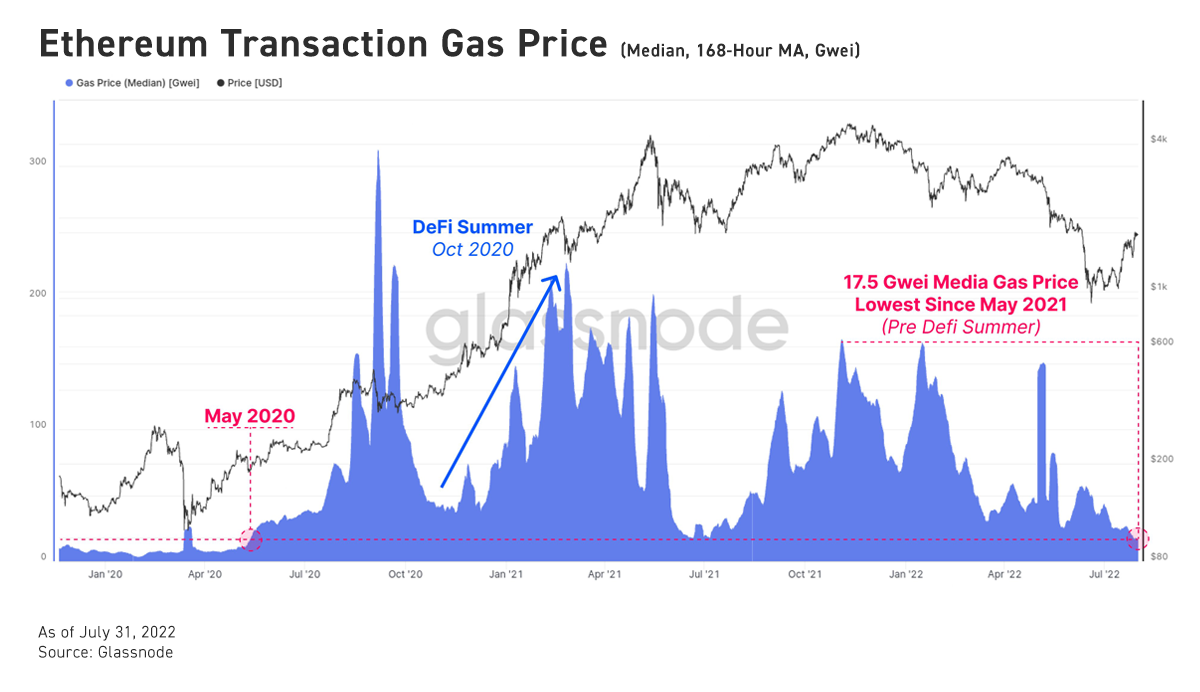

ETH has rallied significantly more than BTC over the last week, securing a 75% move off of the range low. The second-largest cryptocurrency is poised to charge again at the $1,700 handle despite a marginal loss over the same period. However, the current ETH-led rally seems to be largely moved by speculative trading. On-chain metrics show that the median gas fee on Ethereum has descended to levels last seen in May 2020, when the spot price of ETH went as low as $220. For the time being, the plummeting gas fee does not inspire much confidence in the sustained demand for ETH.

Most major altcoins saw mixed performances over the weekend. While many flipped red on an average ~2% decline, FIL experienced substantial gains of more than 20% over the last 24 hours. Meanwhile, NFT trading volume continues to trend low. The leading NFT platform, OpenSea, has posted slight month-over-month gains in total NFT sales and unique users, but the overall sales volume denominated in USD has nonetheless declined. In addition, NFT trading across Solana marketplaces has also cooled in July.

Back to (the) Futures

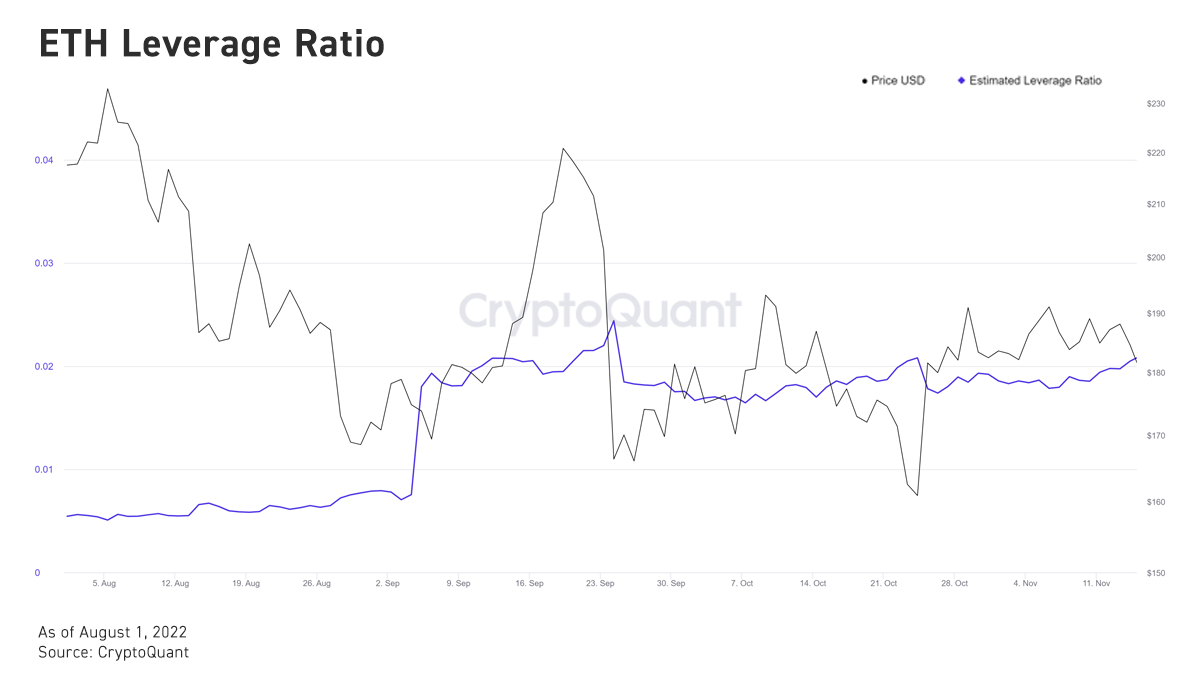

The market rebound seems to extend to the majority of the crypto market, with many L1 and Merge-related protocols experiencing tremendous upside gains over the past week. In the derivatives market, BTC’s funding rates across major centralized exchanges have largely exited the negative territory. Despite ETH leading the market rebound on the Merge narrative, ETH futures premiums are rather depressed compared to BTC, with DEC22 in backwardation, and Mar23 and Jun23 remaining close to zero. In the options market, ETH is seeing both open interest and volume flippen, on the bet of ETH going back to the $2,500 range in the near term.

Talk of the Town

The Aave DAO’s new stablecoin proposal has been approved by 99.9% of voters, who have pledged a total of half a million AAVE to approve the measure to create GHO, a stablecoin backed by collateral consisting of various cryptocurrencies. Users who look to mint GHO will need to deposit cryptocurrencies accepted by Aave, while still being able to earn interest on the underlying collateral. The amount deposited will have to be greater than the value of GHO borrowed, which will then be burned after the users repay the loans or become liquidated. Despite being approved by an overwhelming majority, the introduction of GHO will still take some time to implement.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.