Bybit: DeFi Sees New Growth Cycle, Beanstalk Replanted After April Exploit

Chart of the Day

The broader market saw slight gains over the weekend. BTC briefly dipped below the $23k handle early Friday on the back of surprisingly strong employment data, but managed to hold its footing above this support level in weekend trading. As of the time of writing, the largest crypto by market cap is well bid above the $23k support after posting a 1.7% increase in the last 24 hours. BTC is facing a major resistance near the $23.5k to $23.7k region. It will likely kickstart a steady increase in the near term after a clean break above this resistance zone. Meanwhile, the downside pressure on BTC’s long-term holders has eased slightly as spot prices rise above the average cost basis. However, these holders continue to hold their coins at an unrealized loss between 11% to 61% on average. Bybit blog reports.

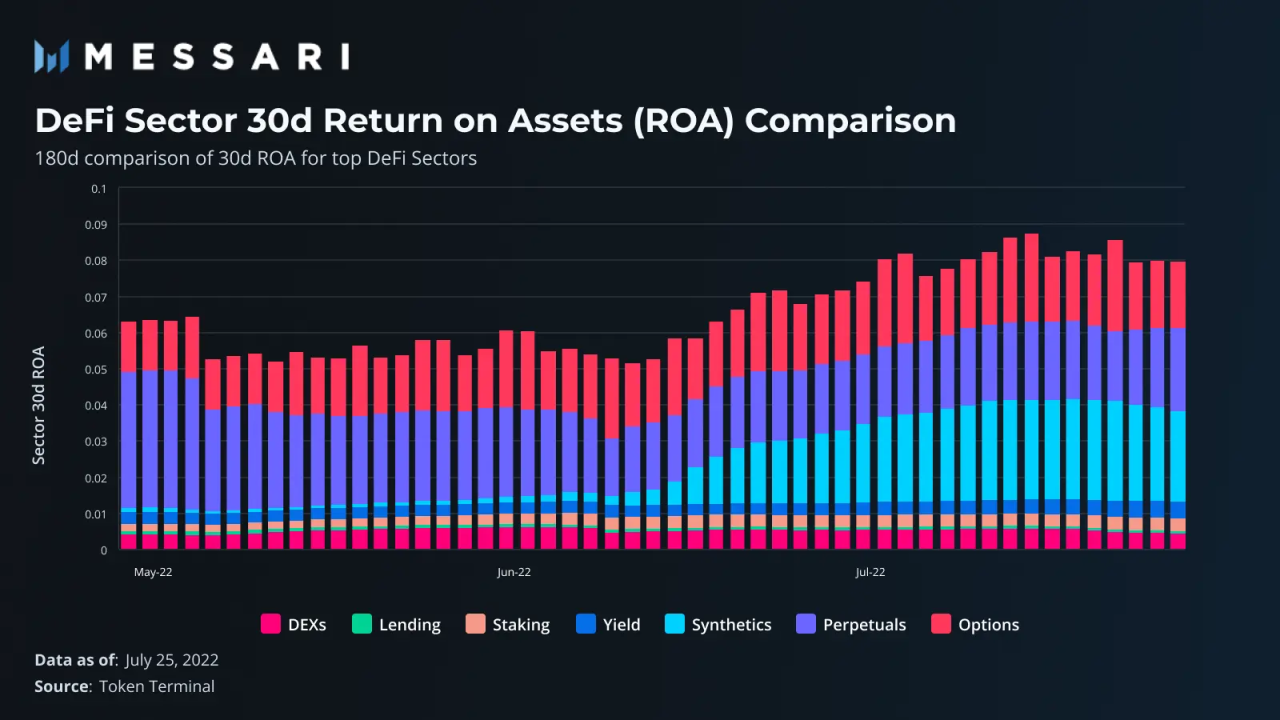

In a similar vein, ETH is trading above the $1,700 level with a 2.4% rise over the same period. On-chain metrics for the second-largest crypto by market cap point to an emerging pattern of growing demand should The Merge go well. Major altcoins are in the green, with FLOW leading upside price actions on a double-digit percentage increase. Despite recent implosions, the DeFi sector, particularly the synthetics category, may witness the beginning of a new growth cycle on the back of Synthetix’s recent protocol integration.

Back to (the) Future

Muted activities in the BTC derivatives market are likely stemming from market participants focusing on narratives around The Merge. However, BTC’s funding rates across major exchanges have seen wide fluctuations, possibly in anticipation of the Mt. Gox distribution in August, which piles onto the uncertainty in the market. ETH’s futures market is seeing an overall discount, with the 3-month basis rate in the negative territory and backwardation in the term structure. ETH’s options volume has yet to return to normal levels despite the open interest hitting a new all-time high amid the bustling around The Merge. The put/call ratio drops to new lows, suggesting heavy betting on a massive rally into September with downside well hedged.

Talk of the Town

Beanstalk, the credit-based stablecoin, has rebooted on the one-year anniversary of its launch, four months after suffering a devastating $182 million exploit. In a statement on the protocol’s website, the team says that its “belief in the possibilities for a permissionless fiat stablecoin is unwavering”, although “it’s impossible to predict how it will perform.”

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.