Bybit: Crypto Market Rallies on Favorable CPI Readings, Ethereum Final Test Merge Goes Live

Chart of the Day

The broader crypto market rallied immediately after the release of the July inflation readings, which signals a step closer to the return of liquidity to the market. As of the time of writing, BTC has surpassed the $24k handle after posting a 6% increase in the last 24 hours. The favorable CPI readings have fueled a breakout above a key bearish trend line with resistance near the $23.5k zone on BTC’s daily chart. The largest cryptocurrency by market cap is eyeing an overhead resistance level at $24.5k. Alternatively, it may move down to test previous support zones in the $23.5k to $24k range. In the derivatives market, shorts are squeezed, but the magnitude is nowhere comparable to the massive liquidation events in June. BTC options IV saw a slight uptick but remained generally stable, indicating minimal impact from the easing of inflationary pressure. Bybit reports.

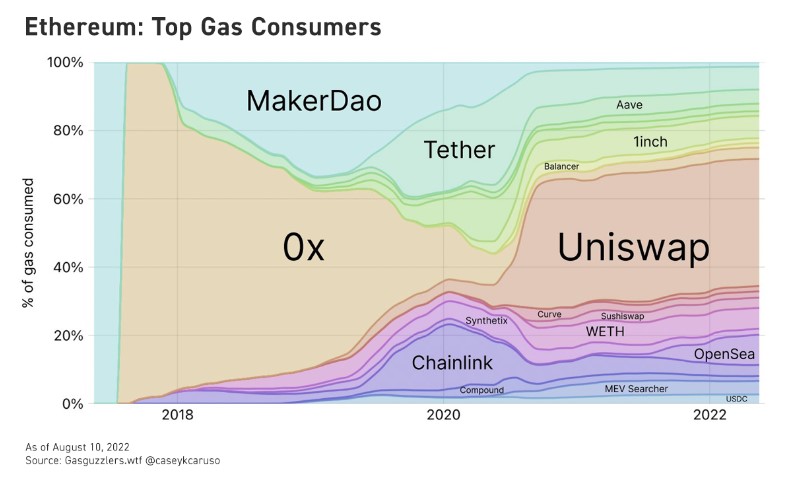

ETH is fast approaching the $2,000 mark after surging 12% in the last 24 hours. The second largest cryptocurrency by market cap is facing major resistance near the $1,950 level. If the bulls remain active, ETH could be eyeing the $2,120 resistance zone in the near future. Many digital assets that are tied to the Ethereum ecosystem have gained more traction during this period. For one, L2 scaling solution Optimism has been riding the Merge-inspired rally, with its TVL skyrocketing by a whopping 240% within a month. A visualization of the evolution of top ETH gas guzzlers since 2018 may point to protocols and coins that stand to benefit from the current rally. Meanwhile, major altcoins are in the green, with SOL and UNI leading the pack on double-digit percentage gains.

Talk of the Town

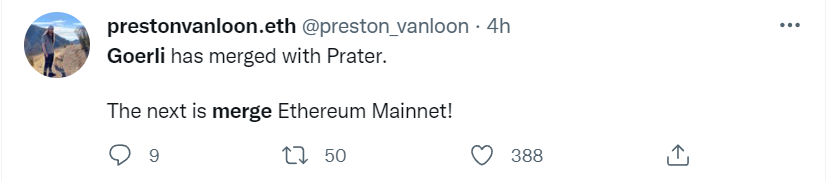

The third and final test merge on the Goerli testnet has been finalized, marking the completion of all dress rehearsals before the eventual mainnet Merge, which is scheduled in September. While the Goerli merge has been executed, the success of The Merge, especially the test of smart contract interactions, will be determined after a comprehensive evaluation of the upgraded network.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.