Bybit: BTC Accumulation Softens; MakerDAO Founder Calls to Drop Dollar Peg

Chart of the Day

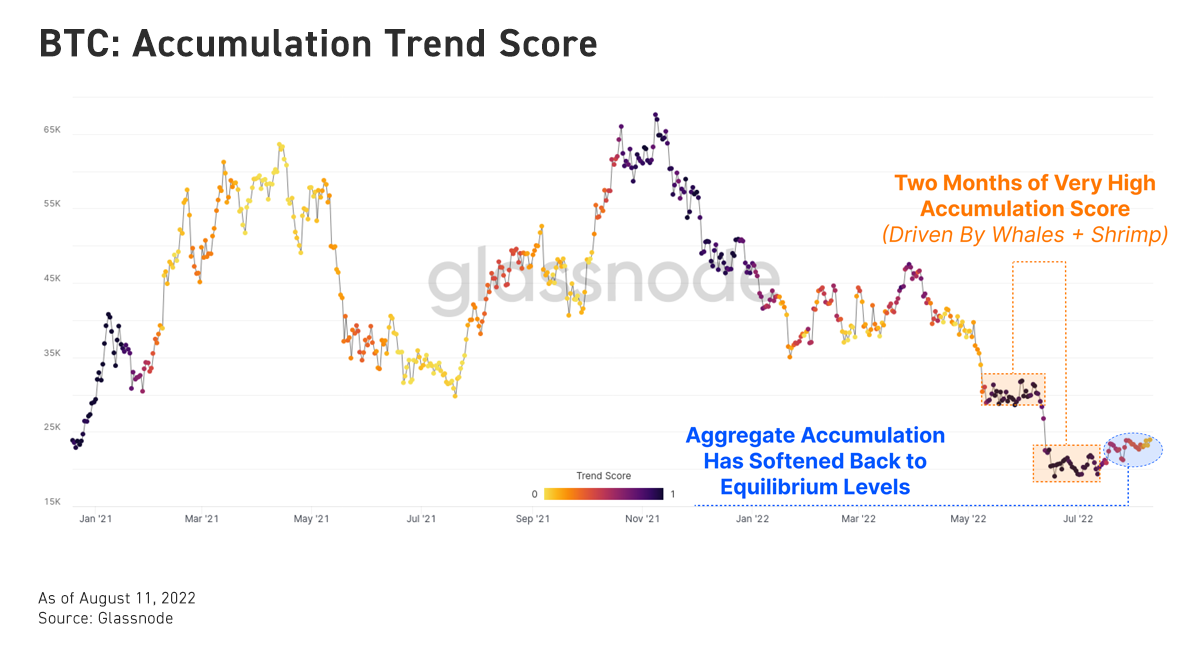

A notable drop in U.S. PPI in July confirmed that inflation may, in fact, have peaked. Yet, the prospect of another 75 bps rate hike in September is not completely ruled out. Nonetheless, optimistic sentiment prevailed in the crypto market as major digital assets reached new local highs amid a broad-based Merge-inspired surge. BTC briefly flirted with the $25k handle, before experiencing a 1.5% downward correction in the last 24 hours. As of the time of writing, BTC is consolidating losses slightly below the $24k handle. The largest cryptocurrency by market cap must stay atop the $23.5k support before it can challenge major resistance in the $24.2k to $24.5k zone. On the flip side, BTC may move down to test support near the $23k handle. On-chain accumulation trend score indicates that accumulation behaviors among whales and retailers have significantly cooled after two months of aggressive balance increases.

On the other hand, ETH’s strong upside momentum, fuelled by the completion of the third and final testnet merge before the final act, has propelled the price to smash the $1,900 ceiling for the first time since late May. The second-largest cryptocurrency by market cap is attempting to establish a stronger foothold above the $1,900 handle, to lay the foundation for the charge towards the psychological barrier at $2,000. Altcoins are correcting their gains across the board, with the exception of ETC, which saw a 7% gain partly on the back of speculations related to a potential Ethereum PoW fork.

Talk of the Town

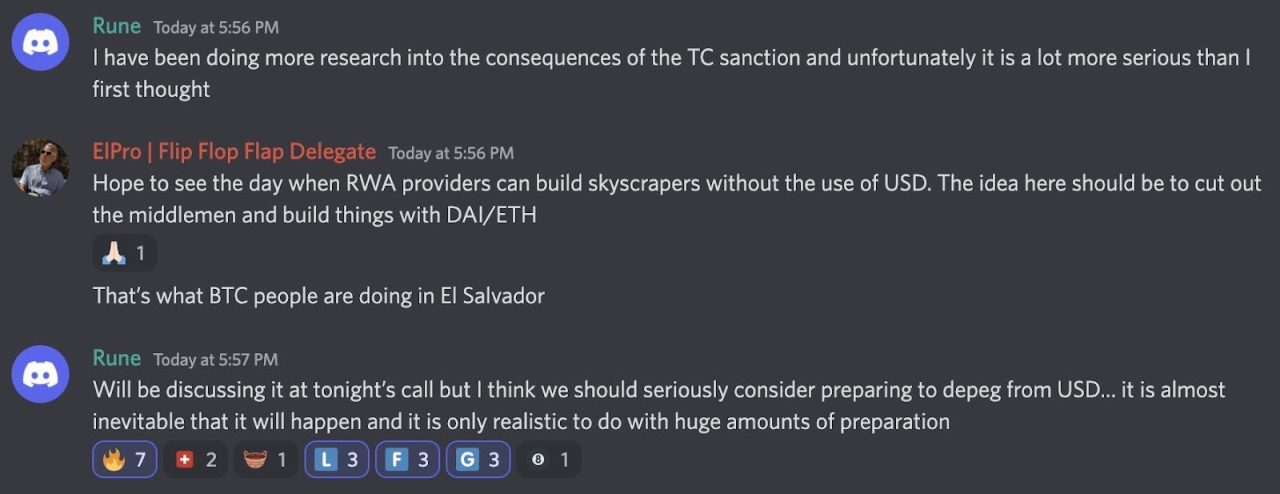

The U.S. Treasury Department’s jaw-dropping decision to ban Tornado Cash, a leading privacy solution in the crypto industry, has pushed many market participants to reconsider their exposure to centralized products within regulatory authorities’ reach. Among the growing list is DeFi protocol MakerDAO, whose founder, Rune Christensen, disclosed via Discord that the organization will consider discussions about de-pegging DAI, its native, decentralized stablecoin, from Circle’s USDC. The move comes as a reaction against Circle’s decision to blacklist 38 wallets in connection with Tornado Cash. The process, deemed inevitable by MakerDAO’s founder, would require “huge amounts of preparation” as DAI is currently heavily collateralized by USDC.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.