Bybit: ETHBTC Ratio Reaches Yearly High, IGO Announces Fiat Payment for NFTs

Chart of the Day

In line with the sideways movement of equities, Bitcoin largely remained range-bound between $23k to $25k. For four straight weeks, Nasdaq 100 hovered around $13.5k, as the second-quarter 13-F reports revealed that hedge funds are significantly cutting their long positions. Despite Bitcoin’s $25k rejection, margin traders remain bullish with favorable stablecoin borrowing, while option markets receive a neutral signal from volatility skew reading. Bybit blog reports.

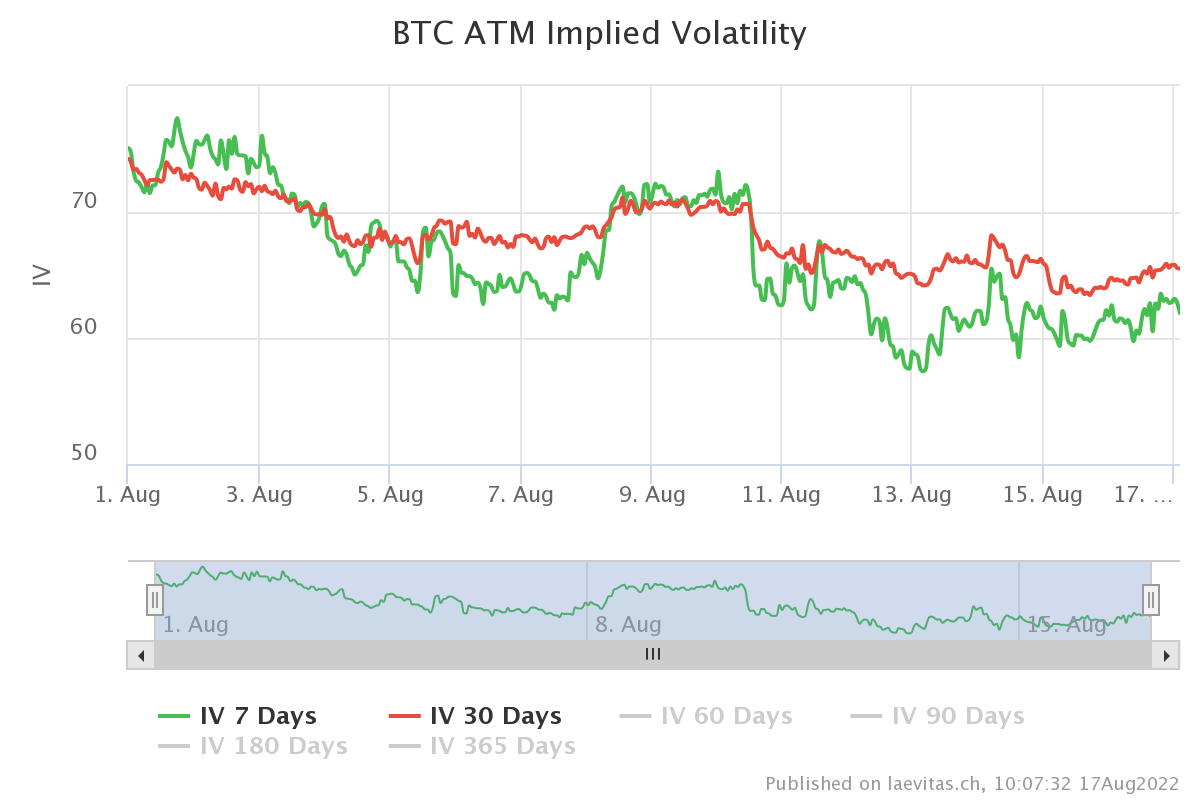

As of the time of writing, the largest cryptocurrency by market cap is oscillating around $24k, after posting a 1.52% increase in the last 24 hours. Meanwhile, Bitcoin has registered one of the least volatile seven-day periods, with 7-day and 30-day implied volatilities sitting at remarkably low levels.

In a similar vein, ETH sits just below $2000 after breaking the psychological threshold for the first time since June 2022. With The Merge around the corner, the ETHBTC ratio climbed toward a yearly high, as the open interest of Ethereum options continued to soar. Most major altcoins saw mixed performances, with memecoins DOGE topping the gainers’ chart on an impressive 8.2% gain over the last 24 hours, likely due to anticipation of its “dogechain” launch.

Talk of the Town

On August 15, 2022, the company behind Cardano, Input Output Global (IOG), announced their partnership with NMKR, a web3 protocol that aims to push for the adoption of blockchain and NFT technology. Their partnership promises an easy and accessible minting app and an option to make payment of NFTs using fiat money. This collaboration strives to enable an “across the globe” participation in NFT sales for all regardless of depth of understanding on crypto.