Bybit: Stablecoin Issuers Rise to Prominence in TradFi, Pudgy Penguins Floor Price Triples

Chart of the Day

Risk assets continue to fall as investors brace for hawkish rhetoric from Federal Reserve officials later this week. The equity market’s furious run-up since June is losing steam as the earnings season wraps up. Meanwhile, major tech indices underperformed as U.S. Treasury 10-year yields soared past 3%. The crypto market saw an abrupt end to the relief rally with the return of bearish sentiments. BTC found support near $20.7k amid the recent sell-off, and managed to stay atop the $21k threshold in Monday trading. As of the time of writing, the largest cryptocurrency by market cap is changing hands just below $21.5k, after posting a marginal loss over the last 24 hours. However, BTC’s price recovery is facing major hurdles near the 100-hour simple moving average and the $21.5k to $22k zone. If bears continue to persist at this zone, BTC will likely retrace to previous support levels near $20.8k. Bybit blog reports.

ETH is showing potentials of staging an early recovery, with its price buoying above the $1,600 market after a 1.3% increase over the same period. In the derivatives market, ETH open interest falls to the lowest levels in a month, but long positions are nonetheless building up at low price ranges, suggesting that The Merge narrative remains a key bullish sentiment driver. Most major altcoins saw mixed performances, with ETC and EOS thriving on The Merge rhetoric and hard fork related news, while others struggled to snap out of last week’s plunge.

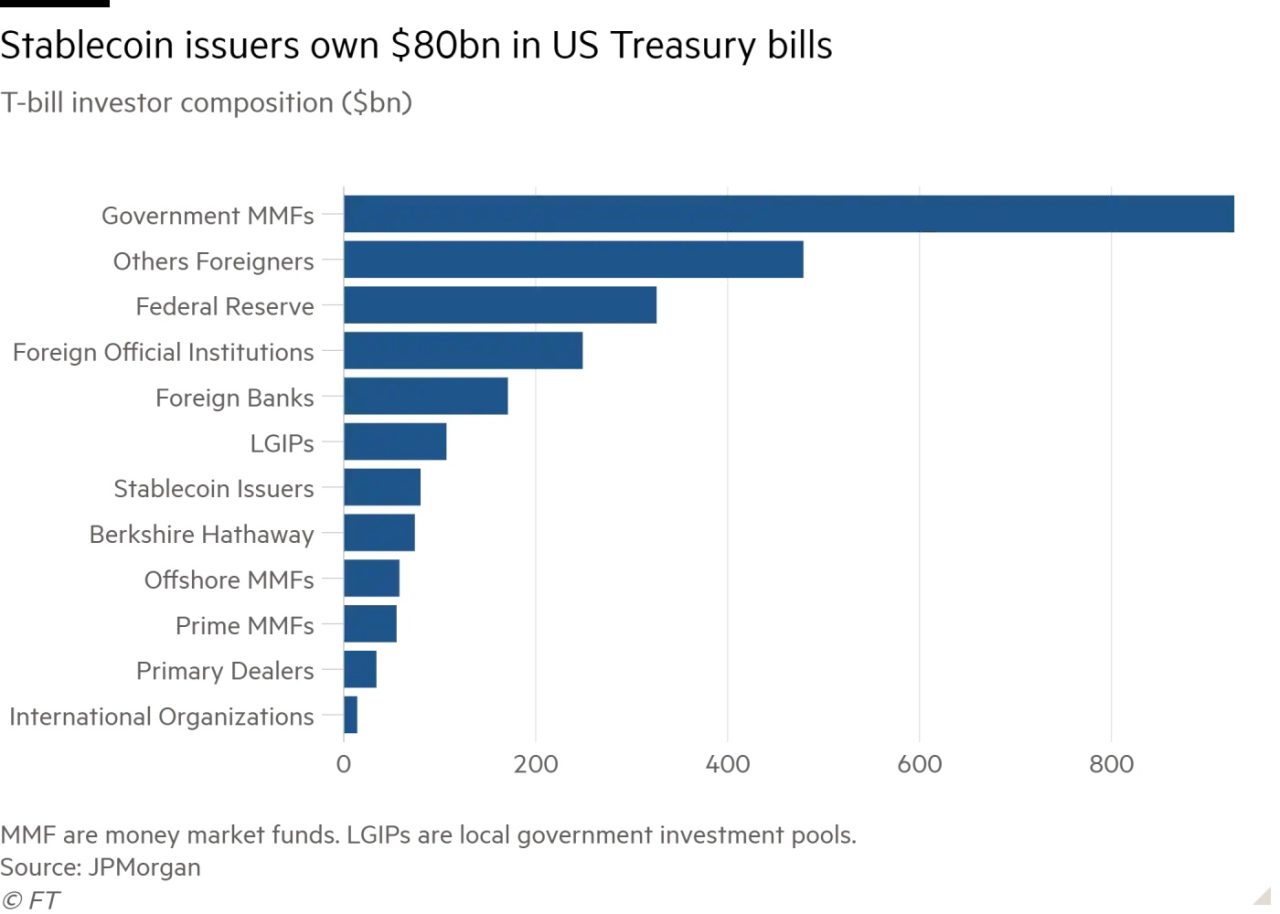

On a separate note, top stablecoin issuers are rising to prominence in a sphere that is historically dominated by traditional, less risk-seeking players. Tether and its fellow stablecoin issuers now hold $80 billion worth of short-term US government debt, which accounts for 2 percent of the market. Collectively, they have overtaken investment behemoth Berkshire Hathaway in terms of the portion of Treasury bills owned. The expanding role of digital asset players in the traditional financial market points to greater opportunities and increasing regulatory scrutiny ahead.

In the crypto sphere, the Uniswap treasury value has increased by 59% since April this year amid market turmoil to reach a staggering $3.9 billion. BitDAO is trailing behind with a $1.4 billion treasury.

Talk of the Town

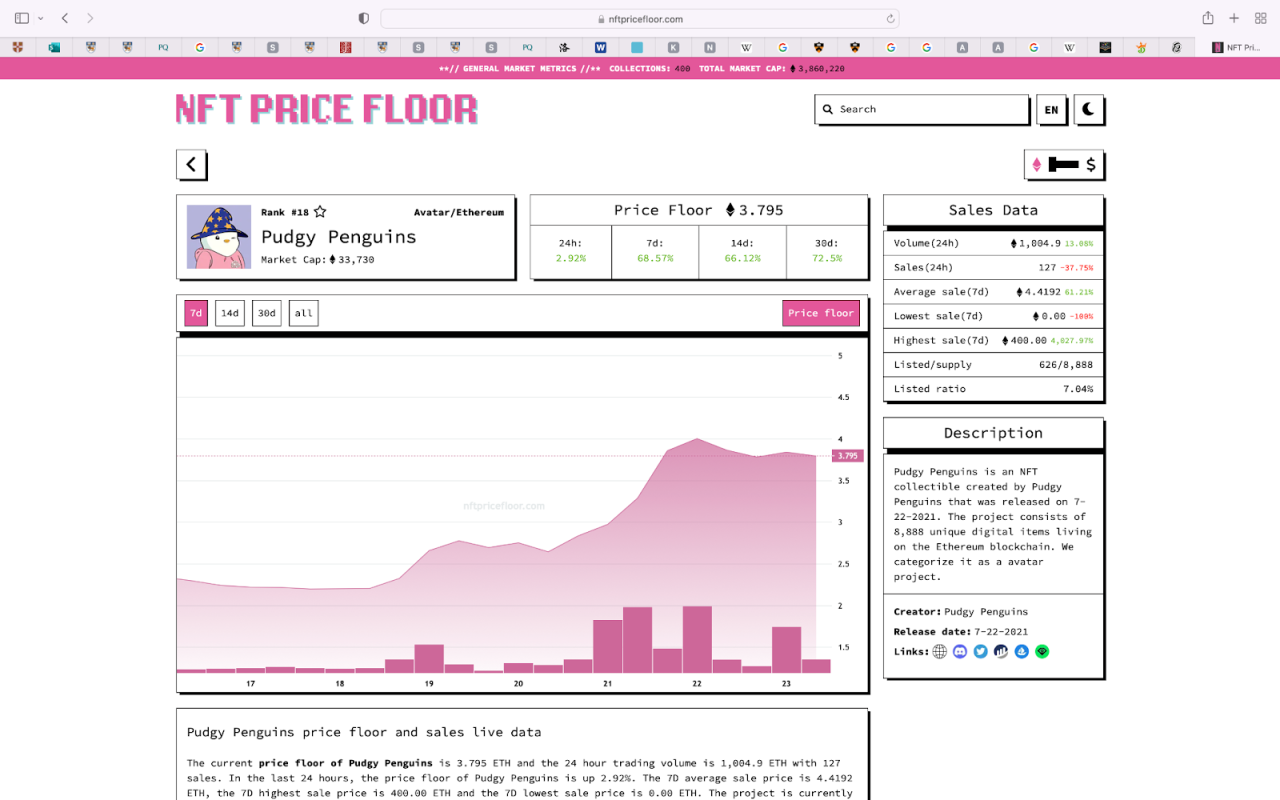

Pudgy Penguins’ efforts in releasing its own marketplace and expanding its brand presence seem to have paid off. The floor price of the collection, which had its fair share of pitfalls earlier this year on the back of rugpull accusations, tripled in the past weeks. Over the weekend, the NFT collection continued its hot streak after the announcement of tech industry heavyweights and executives joining the advisory board. On Monday, the rarest Penguin sold for 400 ETH, completing the highest sale the collection has seen so far.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.