Bybit: BTC & ETH Reclaim Key Support, Meta Adds NFT Cross-Platform Posting

Chart of the Day

The broader crypto market saw a slight rebound on Monday as BTC and ETH climbed back to above key support levels. The rebound offered some relief to investors who were bracing for a broad-based capitulation after BTC dipped to $19.5k over the weekend. As of the time of writing, BTC is trading above the $20k threshold after posting a 2.1% increase in the past 24 hours. On the upside, the largest cryptocurrency by market cap is facing immediate resistance near the $20.4k to $20.7k region, and the 100-hour simple moving average. Failure to clear this resistance zone will likely trigger a fresh decline to test previous support levels near the $19.5k to $19.8k zone. Bybit blog reports.

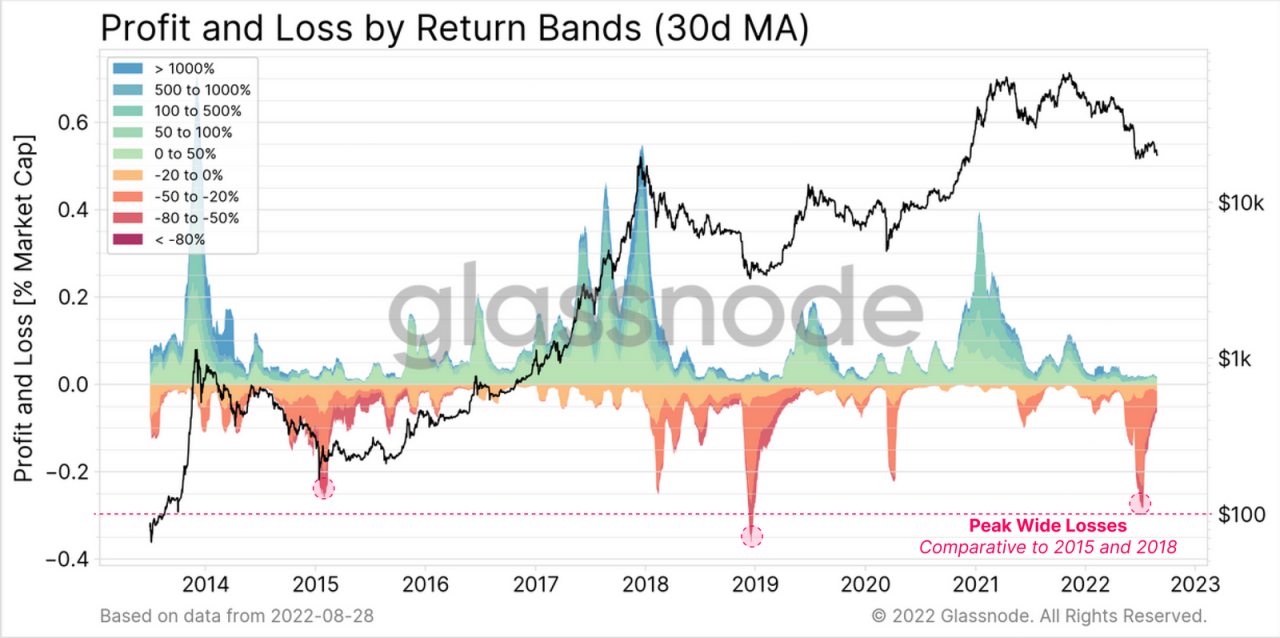

On-chain metrics show that long-term holders are locking in losses between 35% to 40% on average. Meanwhile, the magnitude of capital outflow over the last month reaches an alarming level, one that is only surpassed in scale by the massive capitulation event during the 2018 bear run. In the derivatives market, the futures OI leverage ratio for BTC soared to new highs, pointing to the existence of high leveraged positions in the market, while implying that further market squeezes are not a remote possibility. Price movements and macro signals in the next few days will likely determine whether the recent plunge is the precursor to a true bottom formation or a mere shakeout of excess leverage in the market.

ETH has staged a stronger comeback after a double-digit plummet over the weekend. The second-largest cryptocurrency by market cap is trading above the $1,500 mark after soaring by 9% in the same period. The Merge narrative seems to have a greater influence on short-term price actions. However, key data points in the derivatives market, such as perp funding rates, futures basis, and options IV, suggest that bearish sentiments prevail over a longer time frame. Most major altcoins have flipped green, with ATOM leading the pack on a double-digit percentage gain over the past day.

Talk of the Town

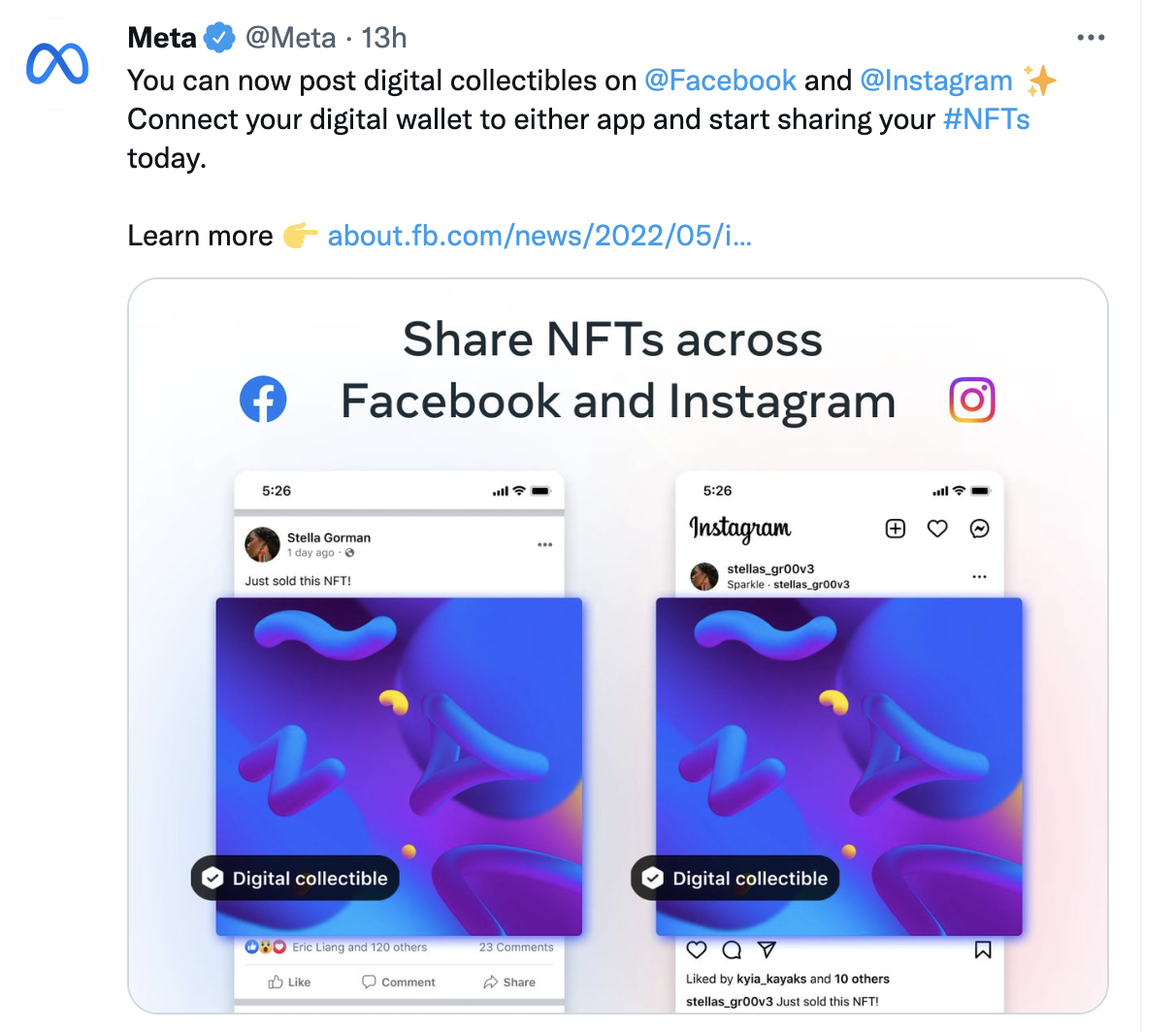

Social media giant Meta announced on Monday that it will allow users to post their NFTs across Facebook and Instagram. The added functionality enables users to connect to a number of digital wallets including Rainbow, MetaMask, and Dapper Wallet to showcase their prized digital collectibles minted on Ethereum, Polygon, and Flow. Since the announcement of NFT integration in March this year, the rapid rollout of new functionalities demonstrated that the tech conglomerate has more ambitious plans for its NFT options. Apart from cross-platform display, Meta is also working on custom animations for NFT posts to deliver its promise of enabling Spark AR-compatible NFT displays through Instagram stories.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.