Bybit: BTC Old Coins on the Move, Temasek Leads Animoca’s $100M Funding Round

Chart of the Day

The broader crypto market remains largely range-bound after the equity market dipped for a third consecutive day amid the looming prospect of another 75 bps hike in September. Risk aversion mode is full-on, but the Asian market seems to have a slightly more optimistic outlook, which has fueled a minor rebound during Asian trading hours. As of the time of writing, BTC is trading above the $20k threshold and the 100-hour simple moving average after posting a marginal loss over the last 24 hours. A bearish trend line with resistance near $20.3k is taking shape on the hourly chart. The largest cryptocurrency by market cap must clear hurdles in the $20.3k to $20.5k zone to open the door to more upside momentum. Bybit Blog reports.

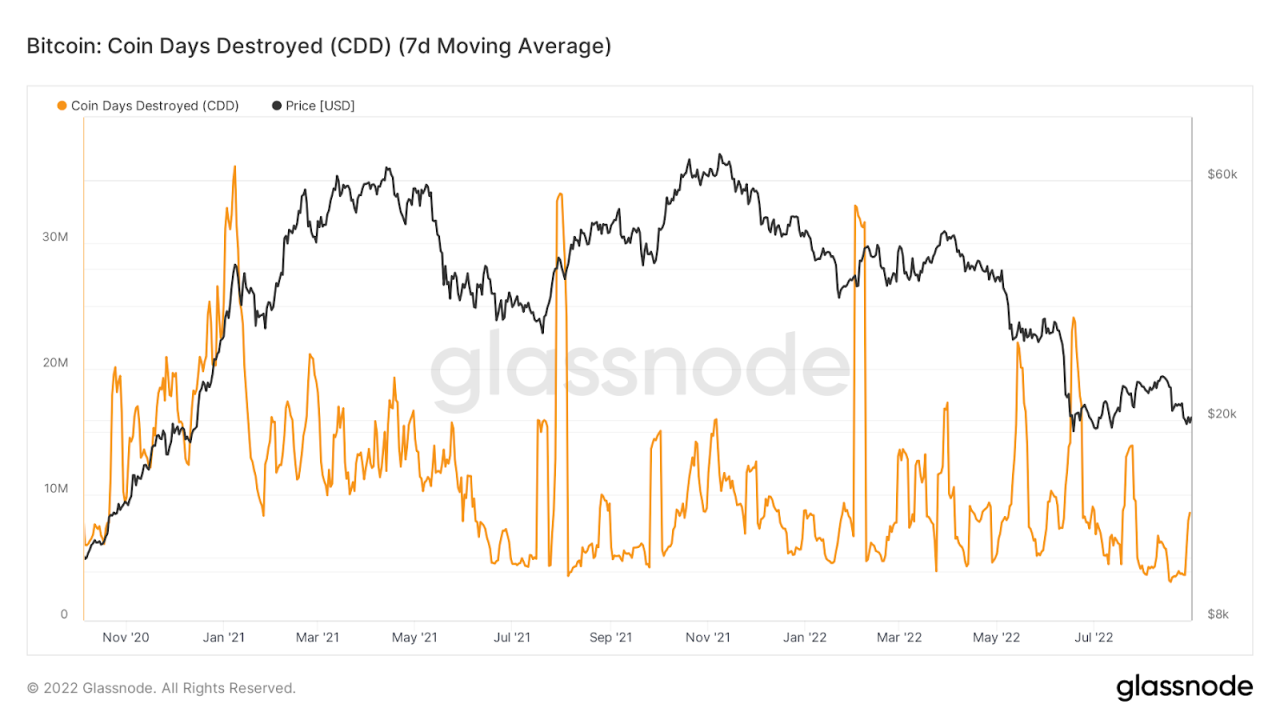

In the derivatives market, the weighted funding rate for BTC has returned to the neutral level. Yet, long-term prospects remain bleak as the premium for BTC’s far-month futures continues to fall. On-chain metrics reveal that around 10,000 dormant coins aged between seven to ten years moved in the last few days. Given that Mt. Gox creditors are inching closer to repayments, it may be helpful to monitor this data point for its impact on the broader market.

ETH has picked up its pace during Asian hours, climbing back to the $1,600 handle after a 1.8% gain over the last 24 hours. A key rising channel with support near the $1,510 level is forming on the hourly chart. Should the momentum sustain, the second-largest cryptocurrency by market cap may be seeing gains above the $1,625 level in no time. Most major altcoins saw mixed performances, with NEAR topping the gainers’ chart on one hand, and others posting 1-2% losses on average over a similar time frame.

Talk of the Town

Hong Kong-based web3 gaming pioneer, Animoca Brands, rose to prominence by assembling 240 finance, gaming, and social media companies in a span of five years. It has recently secured another $100 million in funding with Singapore state investor Temasek leading the round. Now valued at $6 billion, the Hong Kong startup has raised $359 million from renowned venture capitalists including George Soros and the Winklevoss twins, and added another $75 million in the same round earlier this summer amid a $2 trillion market meltdown. The firm aspires to challenge the dominance of big tech firms by creating decentralized, blockchain-powered virtual worlds.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.