Bybit: BTC aSOPR Recovers; ENS Monthly Revenue Remains Strong

Chart of the Day

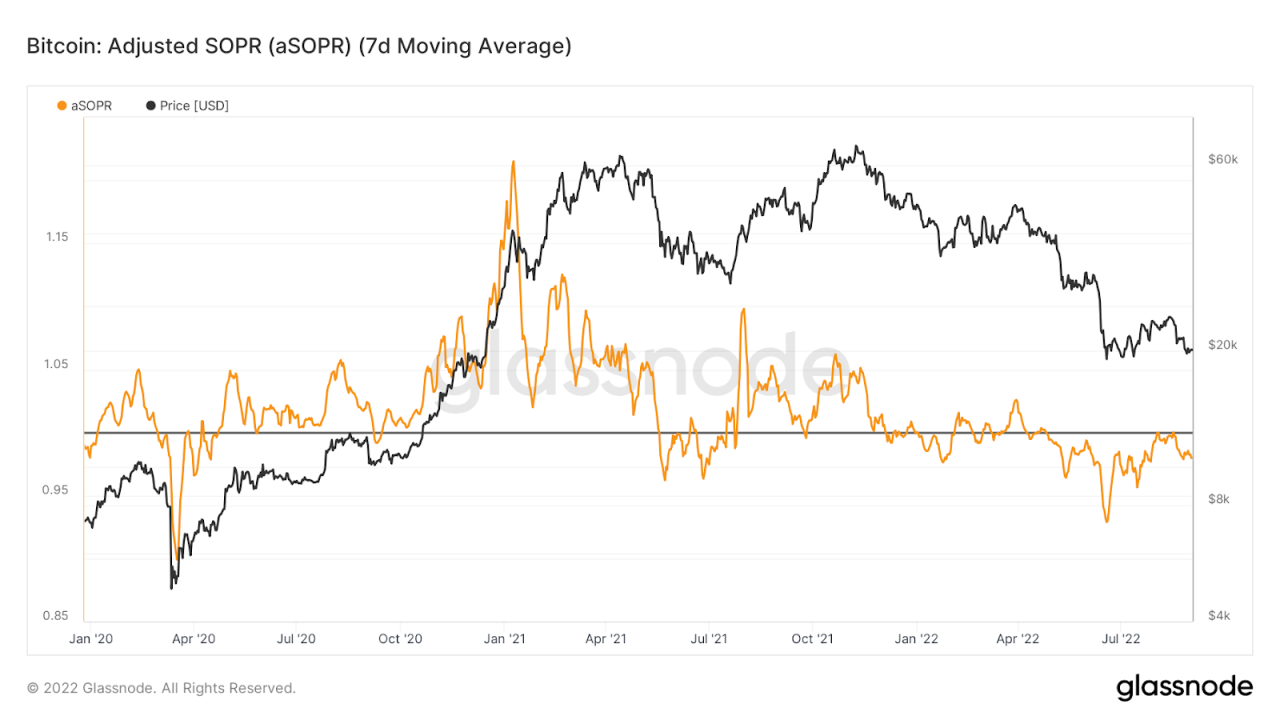

The broader crypto market remained relatively flat on Thursday. Major cryptocurrencies continue to dance around key support levels as investors await macro signals. As of the time of writing, BTC is trading above the $20k threshold after posting a 1% increase in the last 24 hours. The major resistance zone lies between $20.3k to $20.5k, and has been persistently pushing the price down during multiple breakout attempts. Despite a lack of upside momentum, BTC’s downside correction may be limited owing to strong support near the $19.5k level. BTC’s aSOPR value is slowly recovering from the recent dip. Looking at a longer time frame, the metric indicates that the downtrend since April is still pretty much in control. Bybit blog reports.

ETH is trading just below the $1,600 handle after posting a 3% increase in the same period. An increasing amount of ETH perpetual trades relative to spot is beginning to have a disproportional influence on short-term sentiment, leading to a predominant bias to the short side. Most major altcoins are in the green, with a few Layer 1 tokens leading the pack on less than 5% gains over a similar time frame.

Talk of the Town

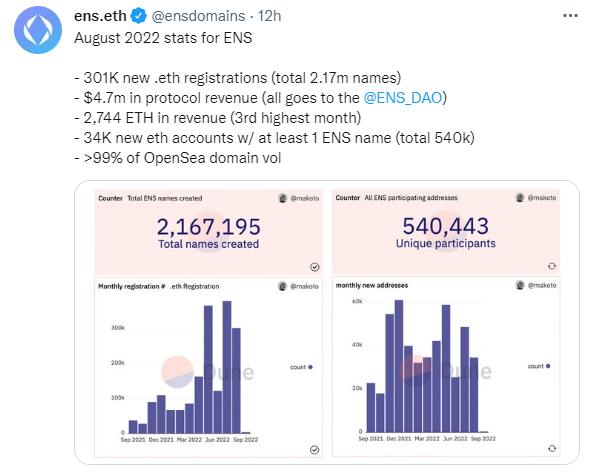

Crypto domain sales are seeing a continued lift as the Ethereum ecosystem approaches its major milestone. The Ethereum Name Service boasted a total of 2.17 million domain names created on the network and $4.7 million in protocol revenue in August, the third-highest month of revenue since inception. In a tweet announcing recent achievements, the firm claims that it has generated more than 99% of the domain sales volume on OpenSea.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.