Bybit: Lido Leads by Validator Count, EthereumPoW Announces Post-Merge Plan

Chart of the Day

The relief rally on Monday continues with BTC rising higher and finding concrete support above the $22k level. As of the time of writing, the largest cryptocurrency by market cap is changing hands above the former resistance near $22.3k and the 100-hour moving average, after posting a 2.81% increase in the last 24 hours. On the upside, a major resistance zone sits near the $22.5k level. Once cleared, BTC may even charge towards the $23k threshold at an accelerated pace. Alternatively, downside corrections may bring the price down to test its support at the $22k handle. Technical indicators are printing bullish signals while on-chain metrics are seeing a convergence of long-term and short-term investors’ cost bases, which often occurs during the late stage of a bear cycle. Bybit blog reports.

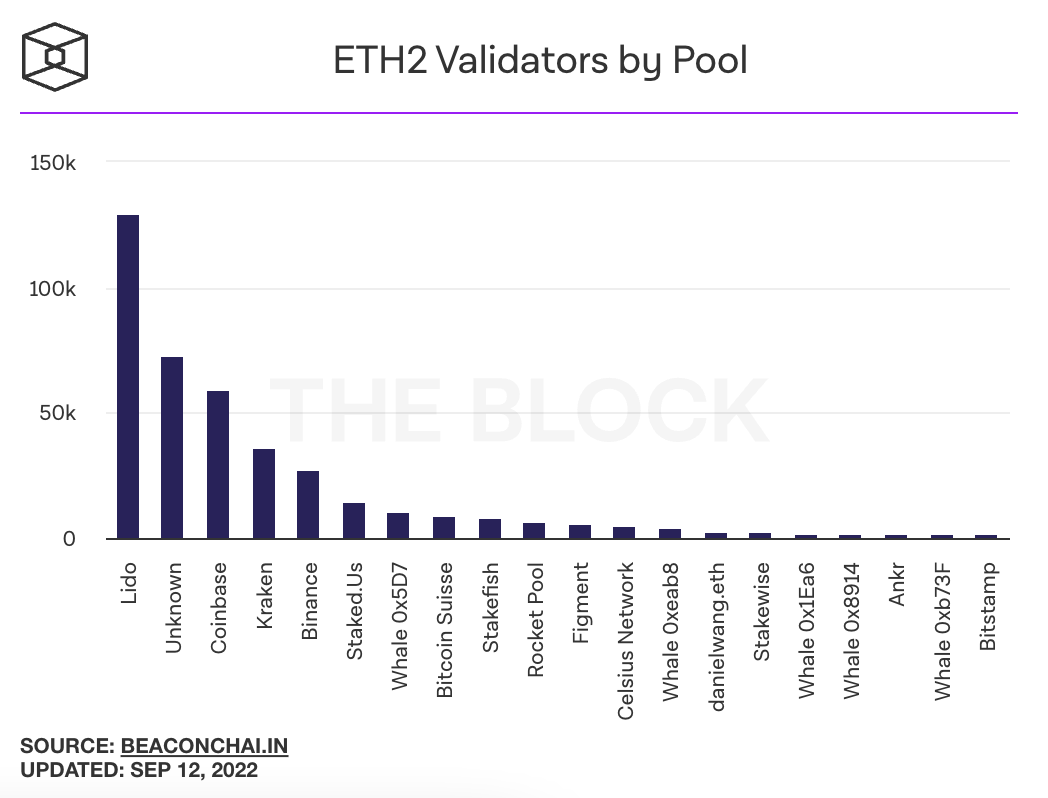

ETH fell slightly on Monday alongside several large-to-mid-cap altcoins. Despite the setback, the second-largest cryptocurrency by market remains well-bid above the $1,700 handle after posting a marginal loss over the same period. Meanwhile, Lido clinches the top spot as the staking pool with the highest validator count. The percentage of individual stakers in the top 20 chart points to the dominance of staking providers in the market. However, Some analysts anticipate a “sell the news” reaction as The Merge draws nearer, and speculate that the profit-taking activities among ETH holders may benefit BTC and other L1 tokens. Most major altcoins are largely in the green, with SOL leading the pack on double-digit percentage gains over a similar time frame.

Talk of the Town

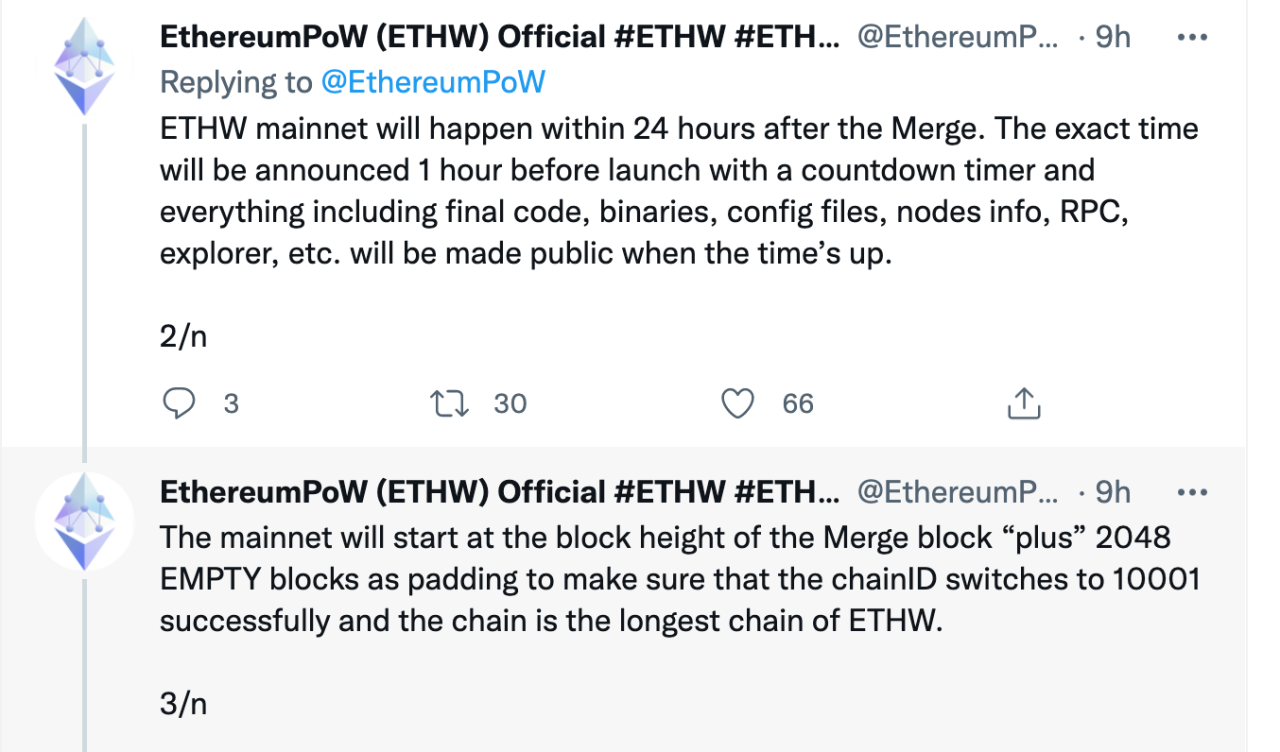

Despite a rocky start, the team behind the highly-debated EthereumPoW (ETHW) proposal, a proof-of-work fork that seeks to preserve Ethereum’s legacy of profitable mining, has finally announced a plan on what comes after the much-anticipated Merge on Sept. 15. The official EthereumPoW twitter posted that the “ETHW mainnet will happen within 24 hours after The Merge” with more detail including final code, binaries, and node information to be revealed one hour before the launch. The official account also says that the mainnet will start 2,048 empty blocks beyond the Merge block to ensure successful switches and prevent potential block duplication.