Bybit: BTC Cost Basis Crossover Reveals Accumulation Opportunity; Disney Seeks Lawyers for Upcoming Web3 Plans

Chart of the Day

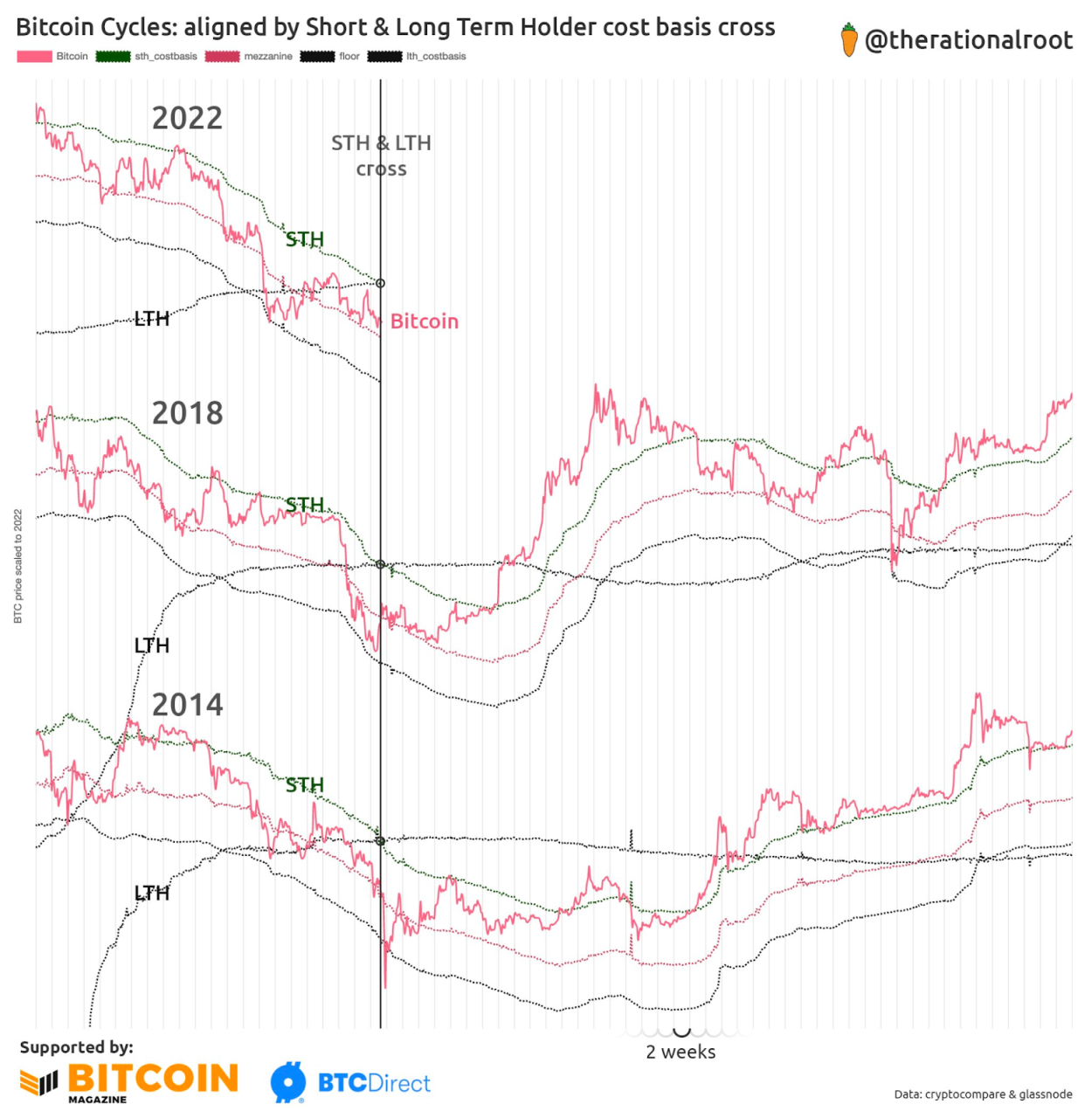

The 75 bps rate hike last week, although not utterly unexpected, signals that the U.S. Federal Reserve will hold rates higher to curb inflation. Many central banks joined the chorus of global rate hikes to combat inflation. These hikes trickle into yield curves and exacerbate the risk-averse sentiment plaguing the global markets. The broader crypto market did not hold up well in the face of surging volatility and souring sentiments. Most major cryptocurrencies spent much of the weekend in the red, with BTC hovering around the $19k threshold and ETH sticking near $1,300. As of the time of writing, the largest cryptocurrency by market cap is changing hands above the $19k mark after posting marginal gains over the last 24 hours. The immediate major resistance for BTC sits near the $19.5k region. A clear move above this zone will likely usher in new upside momentum to charge towards the $20k psychological threshold. A confluence of on-chain metrics presents a crossover of cost bases of long-term and short-term BTC holders. In previous cycles, the crossover has been the prelude to a strong bullish comeback. Meanwhile, BTC’s reserve risk indicates good accumulation opportunities on the mid-to-long horizon. Bybit blog reports.

In a similar vein, ETH is currently trading slightly under the $1,300 handle after shedding 2.3% of its market value in the same period. Most major altcoins remain in the red except ATOM, which resumes its market-defying momentum with a 3.7% increase over a similar time frame.

Back to (the) Futures

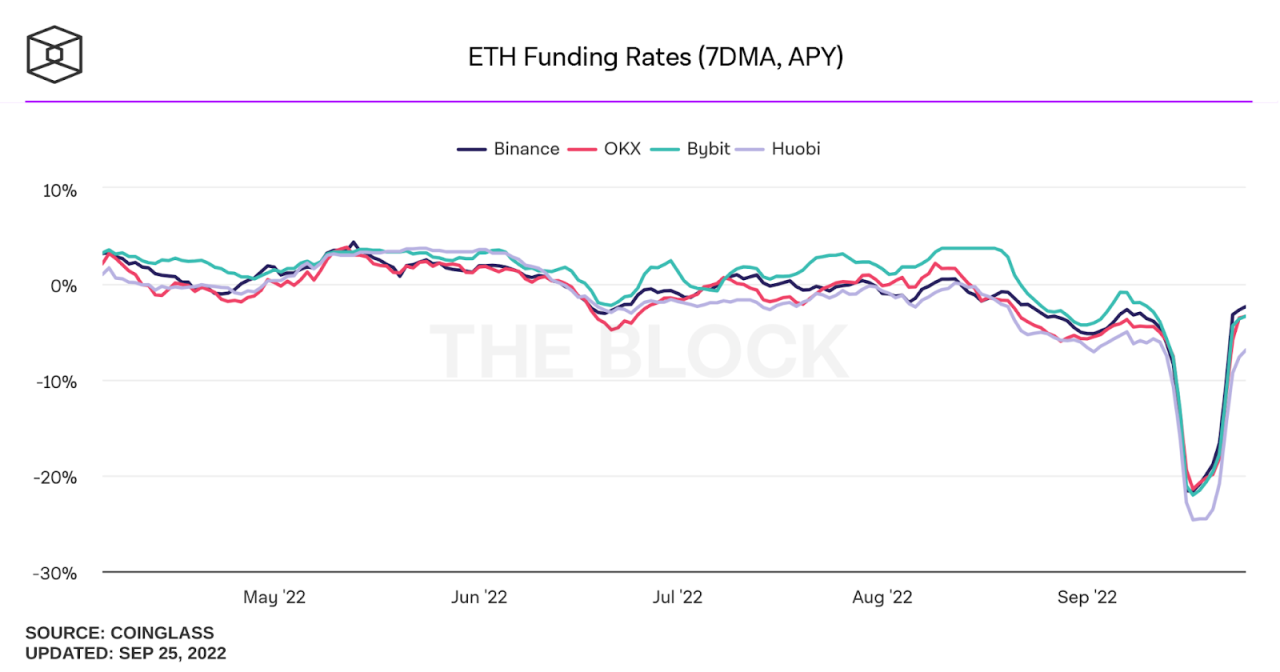

In the derivatives market, the futures-to-spot volume ratio for BTC is well below 1, continuing a downward trend since the 50 bps rate hike in June. This indicates less confidence and speculative behavior under the current market conditions. BTC Funding rates across major centralized exchanges show signs of a slight recovery, but remain largely in the neutral region. On the other hand, ETH’s funding rates rose significantly over the past week, as short-term sentiment improved with The Merge dissolving into a non-event. In the options market, notwithstanding a turbulent week, BTC volatility remains rather steady, suggesting that the market is grinding lower as opposed to plunging headlong into a sea of red. However, short-term volatility is still susceptible to a number of external factors including political uncertainty and geopolitical tension, not to mention that the market is entering the last week of September, where about $3.8 billion of notional will expire and moderate price actions will have a notable effect on market volatility.

Talk of the Town

Entertainment conglomerate Walt Disney is looking to hire a transaction lawyer to explore opportunities in emerging technologies, according to a job posting on Linkedin. The job posting details that the role would entail working closely with “business teams” to facilitate “new global emerging technology projects” across burgeoning segments such as the metaverse and decentralized finance. The post also outlines the expectation of the hire to work at an “accelerated and aggressive timeline”, hinting towards Disney’s rapid expansion in web3 with “next-generation storytelling”.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.