Bybit: BTC On-Chain Activities Fall Back; Stablecoin Landscape Shifts as Conversion Begins

Chart of the Day

U.S. equities rallied on Wednesday after BOE’s intervention, with S&P 500 snapping the six-day rout that followed the FOMC’s rate decision. The 10-year Treasury yield dropped after topping 4% on the back of the Fed’s reaffirmed hawkish stance earlier this week. As the traditional financial markets pipe down after a volatile week, the crypto market manages to regain some lost ground on Wednesday. BTC rebounds above the $19k handle and the 100-hour moving average after posting a 4% increase in the last 24 hours. A short-term channel with support near the $19.3k zone is taking shape on BTC’s hourly chart. The price resilience of the largest cryptocurrency by market cap shows some promise of an imminent rally, barring any macroeconomic headwinds.

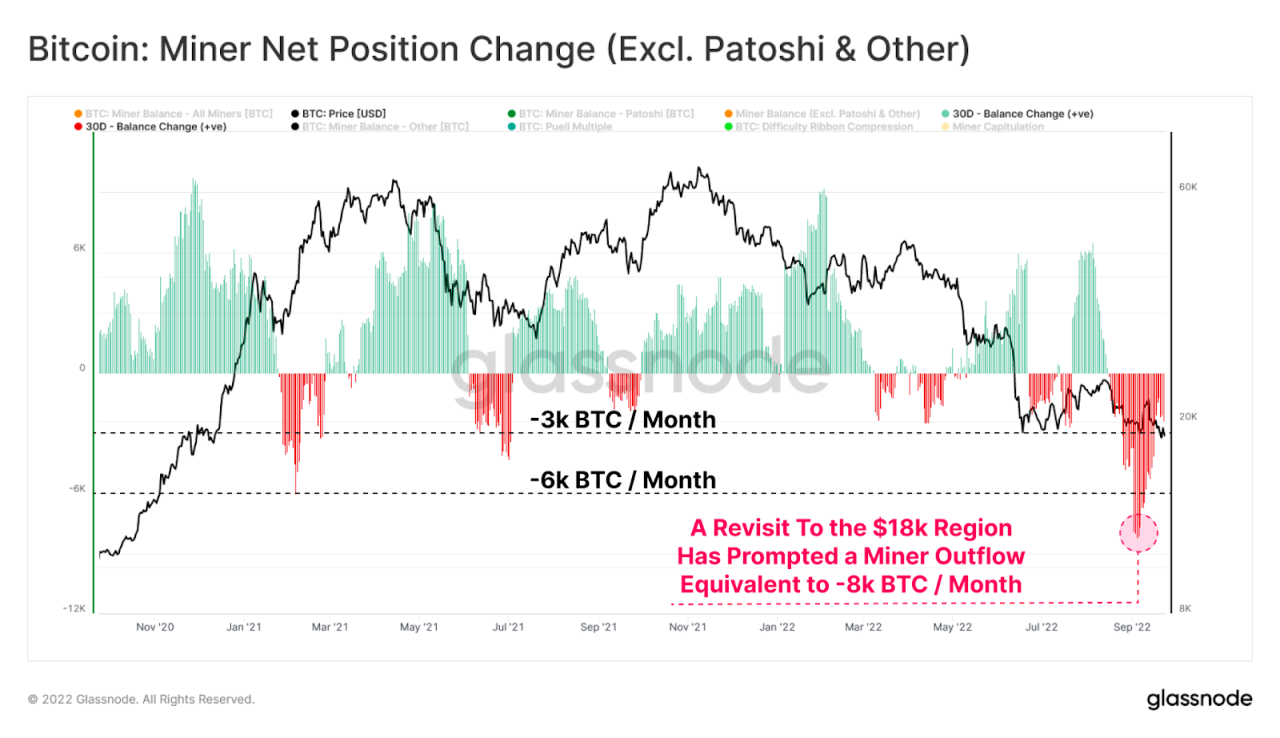

BTC’s on-chain activities have returned to uninspiring levels after last week’s slight rebound. Mining difficulty fell by 2.14% and hash rate dipped by 2%, indicating that decreasing mining economics is gradually phasing out less cost-efficient rigs. Meanwhile, miner balance has seen large outflows since the price rejection from the local peak of $24.5k. Although miner profitability remains under immense pressure, profit-taking behaviours to cover USD-denominated losses have tapered significantly since the massive sell-off in August.

ETH is well-bid above the $1,300 handle after gaining 3.6% in its market value in the same period, showing similar resilience in its price actions. Mid-to-large-cap altcoins have mostly flipped green, with UNI and BNB leading the pack on less than 5% increase in a similar time frame.

Talk of the Town

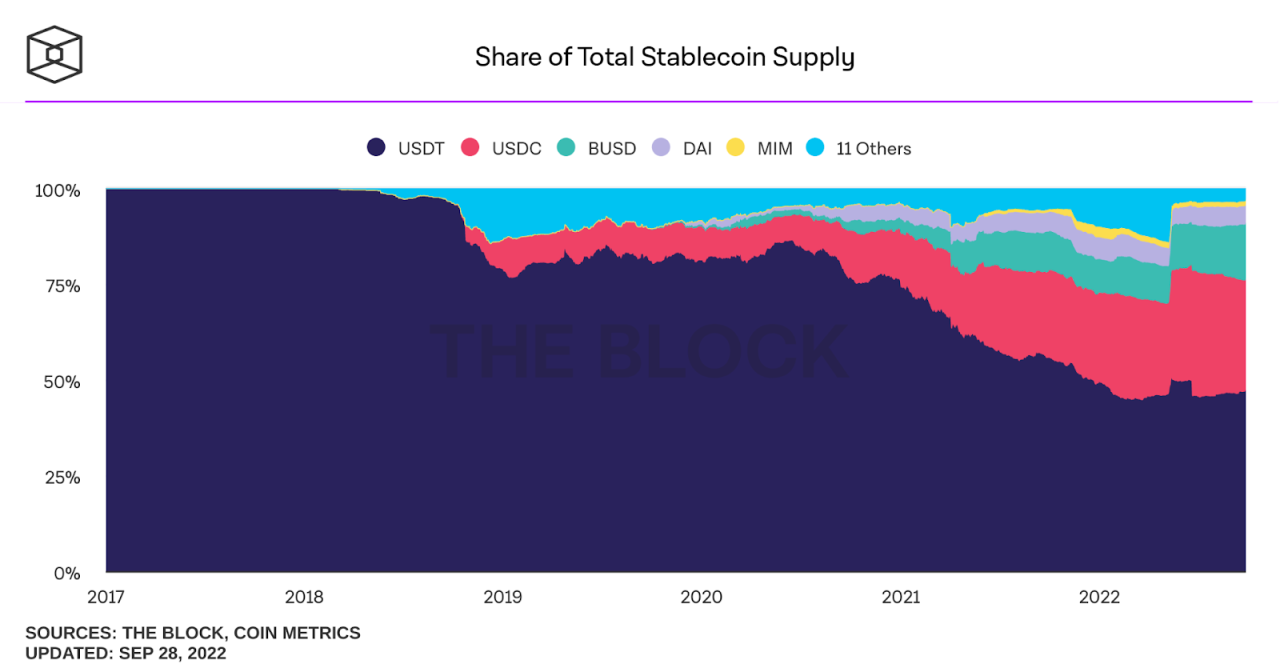

Following the announcement earlier September, several exchanges have proceeded with the conversion of a handful of stablecoins, including Circle’s USDC, Paxos’ Pax Dollar, and TrueUSD, to their own exchange stablecoin. Prior to the conversion, USDC has ended 2021 on a strong note. It has also managed to hold onto the 2021 momentum in the first half of 2022, with its market share increasing from 27% in January to 35% in June. Recognising USDC’s immense potential, Bybit joined hands with Circle in August to support the growth of USDC by promoting products such as spot trading, perpetual contracts, and options. We will also enable instant, auto-conversion between the dollar and USDC and other Circle-issued stablecoins.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.