Bybit: NFT Sees Greater Interest Despite Recent Plummets; Hacker Returns Stolen Funds From Transit Swap Exploit

Chart of the Day

Despite the considerable odds in seasonality and the macroeconomic environment, the broader crypto market has weathered through September relatively well. However, the same cannot be said for global equity and bond markets, with U.S. stock indices breaching June lows, and the UK bond market narrowly escaping a drastic meltdown. As global risk assets grappled with surging volatility, major cryptocurrencies remain largely range-bound over the weekend. As of the time of writing, BTC is trading slightly above $19k after posting a 1.2% loss in the last 24 hours. The largest cryptocurrency by market cap continues its months-long struggle with muted demand, and is facing the final hurdles near the $19.4k to $19.6k zone before charging once again at the $20k psychological level. Failure to clear this zone will likely send the price to test support levels in the $18.5k to $19k region. Bybit blog reports.

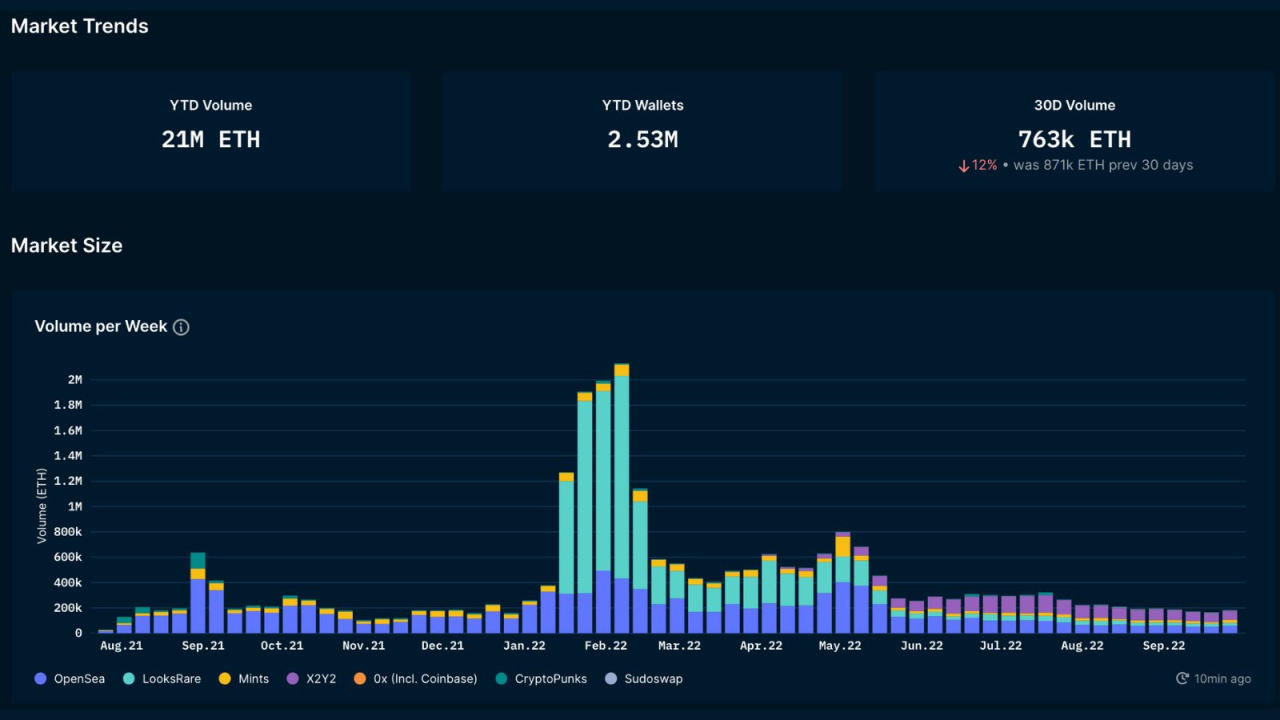

ETH is changing hands just under the $1,300 mark after similar losses over the past day. Mid-to-large cap altcoins are largely in the red, with CHZ leading the downside correction on a double-digit percentage loss in a similar time frame. In the NFT market, the quarter has registered a weekly 85% drawdown in ETH-based NFT volume (denominated in ETH) from its all-time high in May according to data from Nansen. However, the trading volumes over the past few weeks have been stabilizing with a week-on-week uptick of 28% towards the end of the quarter. In the Solana ecosystem, the weekly volume saw a 46% drawdown from its all-time high in May, but the past weeks have seen an increase in both interest and trading volume.

Back to (the) Futures

The derivatives market saw little impact from the massive notional expiry on Friday, Although volatility has trickled into the equities and bond markets, BTC’s price actions have resumed a sideways movement within its months-long range. The release of the U.S. non-farm payroll this week may be a potential catalyst that nudges the market to pick a direction. Funding rates across major centralized exchanges are trending up, suggesting that investors are likely entering October with a slightly lightened heart. However, the annualized basis of BTC’s 3-month futures, which is hovering at a level significantly lower than the norm in a healthy market, seems to suggest a possible lack of interest from investors. In the options market, BTC’s implied volatility continues to slide lower.

Talk of the Town

On Sunday, decentralized exchange Transit Swap announced on Twitter that it has lost $21 million to an exploit after a hacker took advantage of an internal fault in its swap contract. The multi-chain DEX also revealed that it had worked in conjunction with on-chain security audit firms to track down relevant information on the hacker. The team later confirmed that the hacker had returned 70% of the stolen funds owing to “the joint efforts of all parties”.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.