Bybit: Crypto Rallies as Stocks Rise From Ashes; NYDIG Bets Big on BTC

Chart of the Day

The broader market saw a minor rally in the early hours of Tuesday (Asian trading hours) after the stock markets rebounded from the worst September in two decades. Macro woes seem to ease slightly at the start of the new quarter, with U.S. Treasury yields halting a prolonged surge, and weak U.S. manufacturing data soothing concerns about the possibility of overtightening monetary policy. As of the time of writing, BTC is well-bid above the $19.5k region after experiencing a 2.6% jump in the last 24 hours. A key bullish trend line with support near $19.4k is taking shape on the hourly chart. The largest cryptocurrency by market cap will likely see extended gains once it establishes a stronger foothold above the $19.7k level.

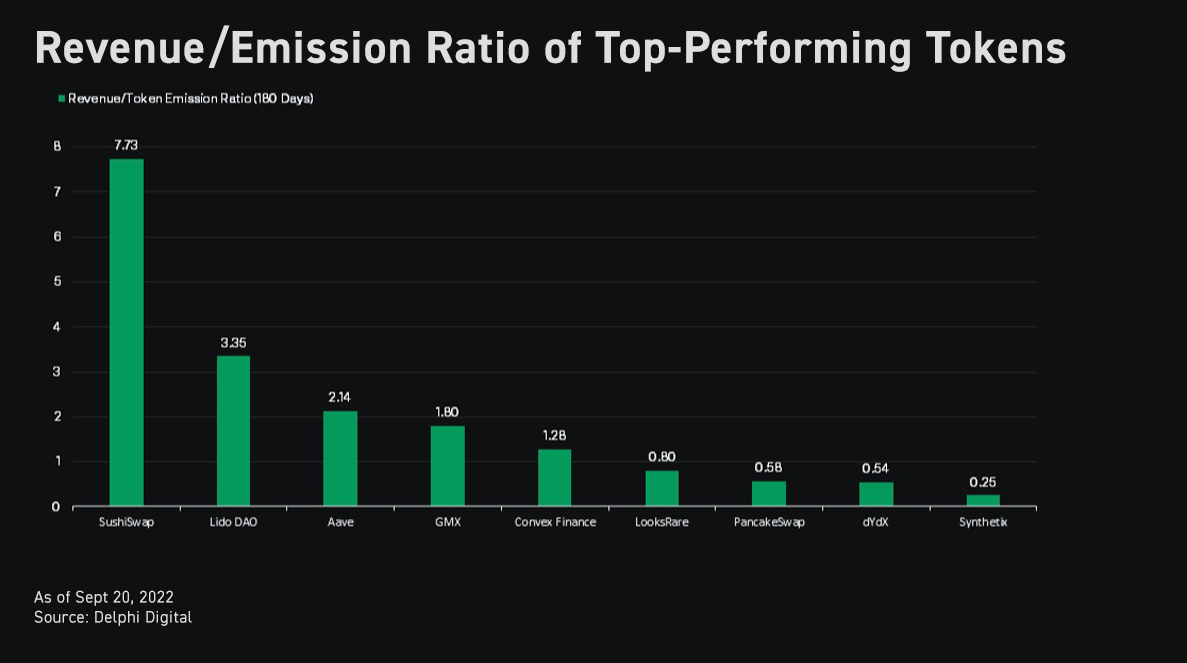

Similarly, ETH is changing hands above the $1,300 handle and the 100-hour moving average after posting a 2.8% increase in the same period. The second largest cryptocurrency by market cap has been gyrating within a narrow range for the past two weeks, and will likely pick up its upside momentum after closing above the immediate resistance level at $1,350. Mid-to-large cap altcoins have largely flipped green, with LINK and MATIC leading the recovery on 5% gains in a similar time frame. Despite the recent market slump, a number of crypto projects have generated decent revenue and simultaneously awarded their users on a longer horizon. Sushiswap, Lido, Aave, and GMX are among these tokens that have fared well over the last six months amid global risk aversion.

Talk of the Town

The New York Digital Investment Group (NYDIG) has raised $720 million for its institutional BTC fund, according to an SEC filing published last Friday. NYDIG’s BTC fund, originally dubbed the “Institutional Digital Asset Fund”, was first launched in 2018. It managed to amass $190 million by June 2020, and within four months, emerged as one of the biggest crypto custodians in the industry with more than $1 billion worth of digital assets under management. In December 2021, NYDIG successfully raised $1 billion at a valuation of more than $7 billion. Even at the height of the DeFi frenzy in 2021, the firm has followed through on its strategy of steering clear of the riskier sectors, which includes DeFi and uncollateralized lending. NYDIG continues to focus on the expansion of its institutional-grade BTC platform to include mining franchise and support for Lightning Network, smart contracts, and asset tokenization.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.