Bybit: BTC Spikes Above $20k, NFTs linked to 3AC Is on the Move

Chart of the Day

The crypto market continues to rise on Wednesday alongside U.S. stocks, with S&P 500 posting its largest two-day gain since April 2020. The broad-based rally was partly buoyed by the markets’ response to an unexpected drop in U.S. job openings, which sank to a 14-month low and somewhat allayed the Fed’s concern over a hot labor market. Major cryptocurrencies saw decent price movements in the past day. With a 3% rise in the past 24 hours, BTC has finally returned to the $20k psychological threshold after a week-long struggle. A connecting bullish trend line with support near the $20k handle is taking shape on BTC’s hourly chart. The largest cryptocurrency by market cap will likely pick up its pace after finding a solid foothold above this level. However, some analysts believe that a squeeze in the other direction is almost inevitable in a market that has seen too many one-sided liquidations lately. Bybit blog reports.

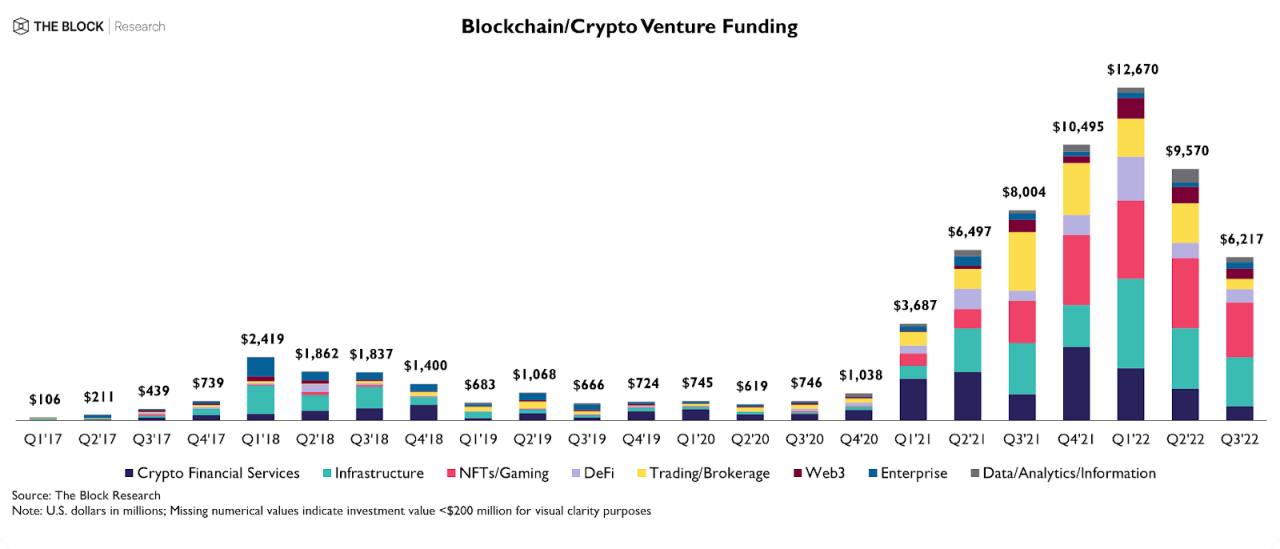

Similarly, ETH is changing hands above the $1,350 mark and the 100-hour moving average after rising by 1.66% in the same period. The second largest cryptocurrency by market cap is slowly inching toward the next resistance level at $1,370. A definitive breakout above this level may usher in more upside gains. Most major altcoins spent the day in the green, with DOGE leading the pack on a 7% increase in the same period, on the back of Elon Musk’s renewed Twitter bid. Meanwhile, The Block’s research shows that venture capital in the crypto space saw its inflow halved in Q3 compared to the first quarter of the year. DeFi, brokerage, and financial services are among sectors that have seen the most substantial decline in funding, as the broader crypto market unwinds from major institutional meltdowns amid global risk aversion.

Talk of the Town

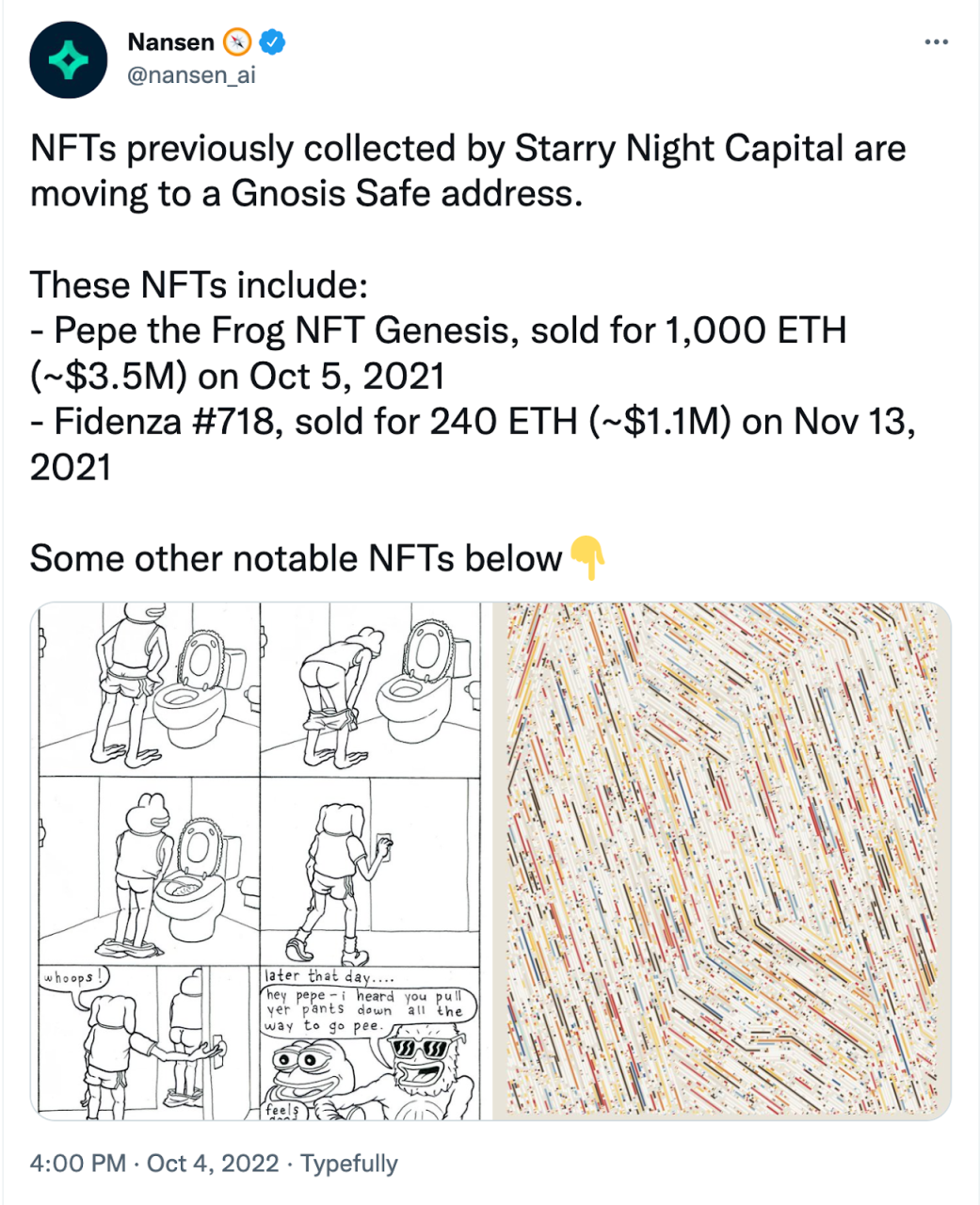

More than 300 NFTs were moved out of a wallet address associated with Starry Night Capital, an NFT-focused fund established by the co-founders of the now-insolvent crypto hedge fund Three Arrows Capital. The NFTs in question were moved to a Gnosis Safe account — a wallet that provides enhanced security with multiple signature requirements. According to a tweet by Nansen, some of the NFTs that were moved include notable collections such as “Pepe the Frog Genesis”, which was sold for 1,000 ETH in October 2021, and a trio of NFTs from pseudonymous artist XCOPY, which was priced between $1.4 million to $2.3 million worth of ETH per piece. The Starry Night Capital was founded at the height of the 2021 NFT hype, and according to Dune dashboards spent about $35 million worth of ETH on NFT purchases. The transfer on Tuesday may account for 625 ETH, or around $846k worth, but the actual value is hard to ascertain due to the low liquidity of these single-edition pieces.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.