Bybit: BTC Hash Rate Reaches ATH, BNB Chain Halts Transactions Over Bridge Exploit

Chart of the Day

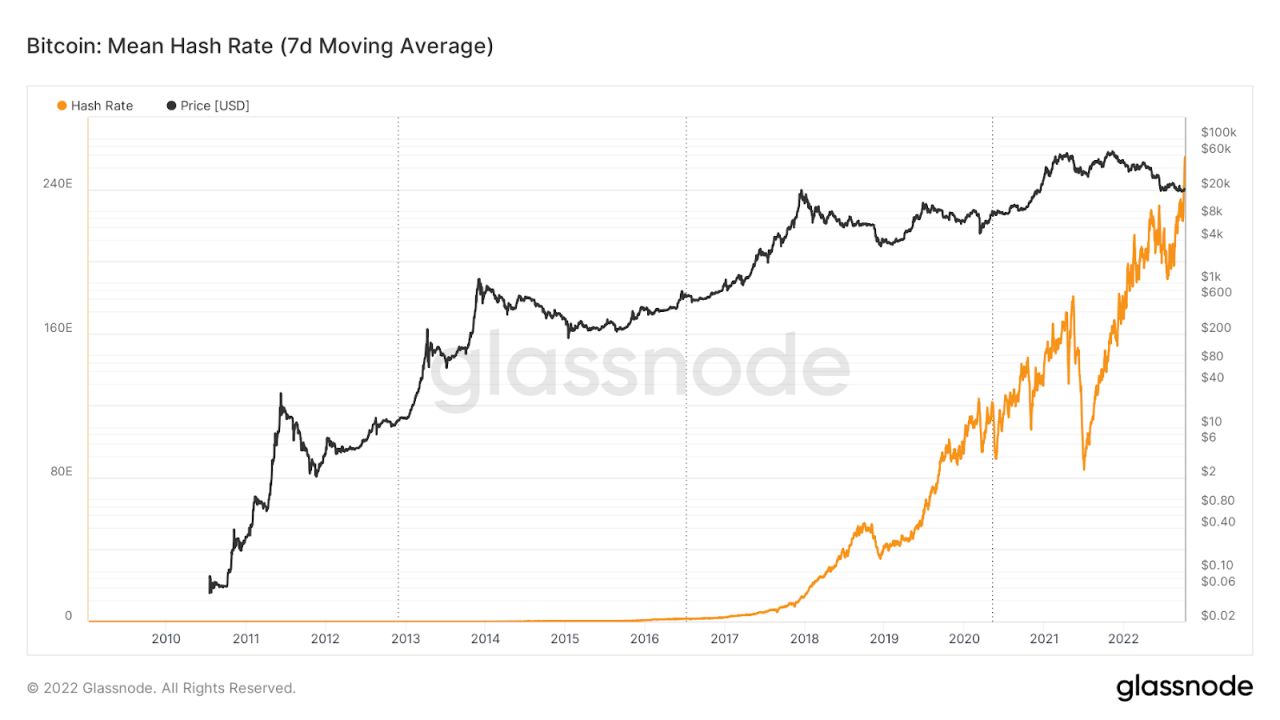

The broader crypto market struggled to sustain its latest rebound attempt prior to the release of the important U.S. job report, while major equity benchmarks slid on Thursday. BTC hovers near the $20k handle in its ongoing tango with the critical psychological threshold. As of the time of writing, the largest cryptocurrency by market cap is changing hands below $20k after dipping by 1.5% in the last 24 hours. Meanwhile, BTC mining hash rate soared to a new all-time high, driving up the cost of production not long after miners recovered from the recent capitulation. Bybit blog reports.

Similarly, ETH is trading near the $1,350 mark after posting a marginal loss over the same period. Major altcoins have flipped green with the exception of UNI and TRX, both of which posted marginal gains over the past day. BNB dropped roughly 3.6% following a bridge exploit on the Binance Smart Chain. At the same time, macroeconomic wariness weighs down on the price movements of major cryptocurrencies, as investors fear that an upside surprise of job gains and wage increases could mean a more aggressive stance to curb inflation, which may in turn coil the market.

Talk of the Town

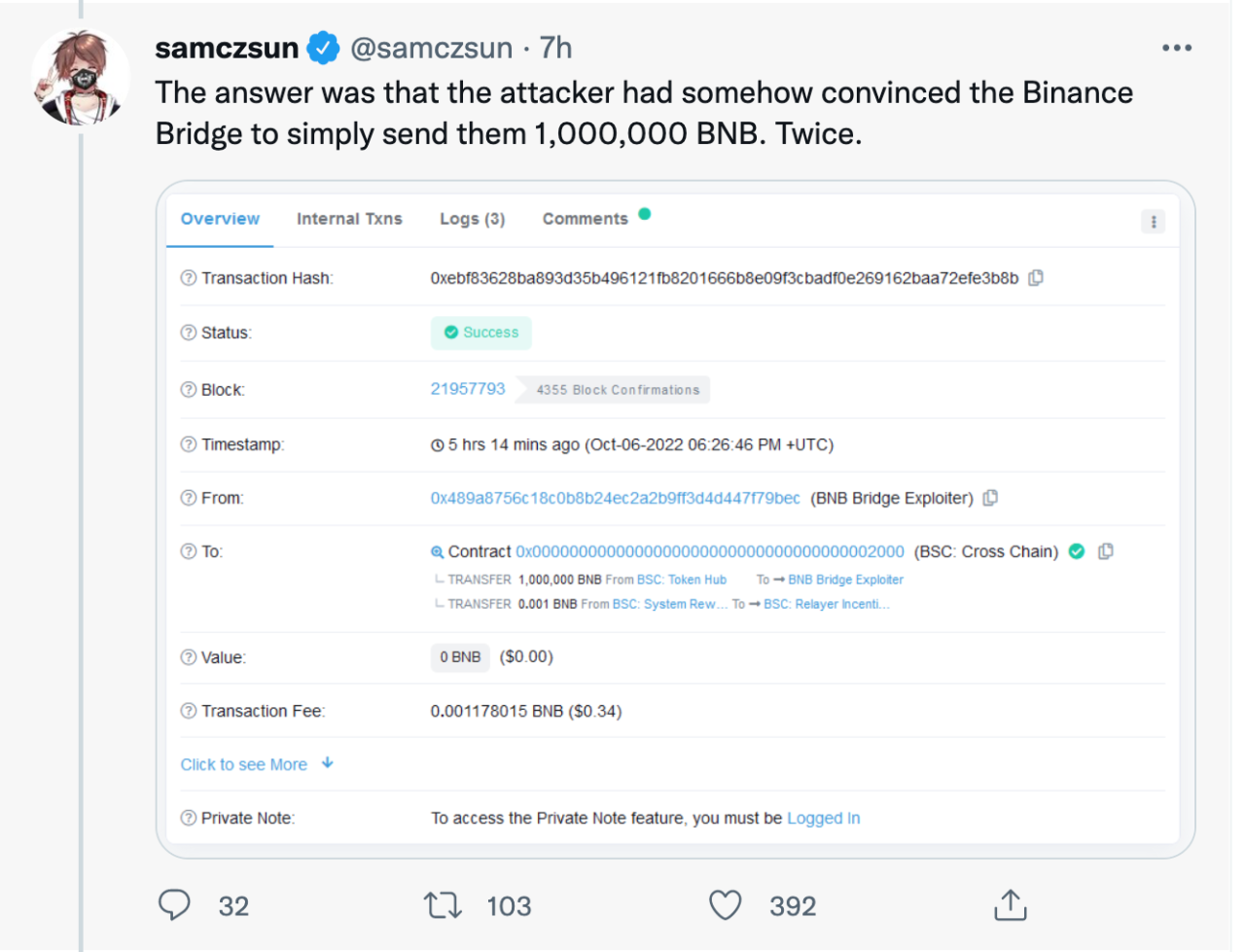

Transactions have been suspended on the BNB chain after the discovery of an exploit on a cross-chain bridge. Sam Sun, a researcher at Paradigm, claims that the attacker used a bug in the Binance Bridge to forge arbitrary messages and convince the bridge to send out two million BNB tokens. BNB Chain assured the community that $7 million in assets had been frozen before it could be transferred, but acknowledged that $70 million to $80 million in funds had been stolen from BSC. According to blockchain security firm SlowMist, the hack may have resulted in the theft of more than $570 million in digital assets, although the ultimate amount involved has yet to be determined.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.