Bybit: Market Stays Flat Amid Stocks Decline, Nethermind Warps Uniswap Onto StarkNet

Chart of the Day

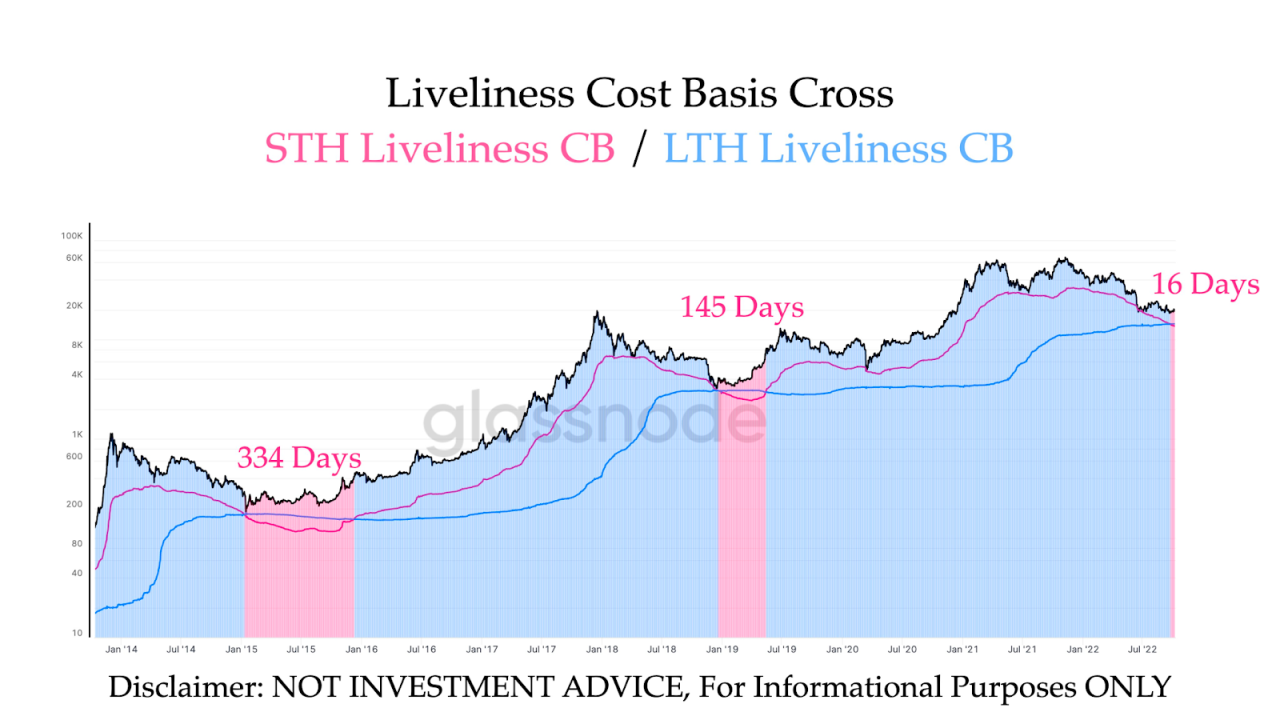

The broader crypto market outperformed major stock benchmarks by staying flat over the weekend, following the release of the U.S. non-farm payroll last Friday. BTC rallied briefly early last week on the back of encouraging numbers that hinted toward tapering inflation, but eventually failed to defend the $20k threshold as employment figures dashed all hopes of a Fed pivot in the near term. As of the time of writing, the largest cryptocurrency by market cap is changing hands below the $19.5k handle after posting marginal gains over the last 24 hours. BTC will need to establish a stronger foothold above this handle to keep the possibility of any upside momentum alive. Meanwhile, on-chain metrics indicate a prolonged struggle with unfavorable macro conditions and muted demand. In previous cycles, the uphill battle to regain a sustained bullish momentum often takes hundreds of days before the second crossover of short-term and long-term liveliness cost basis occurs. We are currently 16 days into the first crossover. Bybit blog reports.

Similarly, ETH continues to fluctuate within its narrow trading range between $1,250 and $1,400. The technical overhaul of the Merge eases into sideways movements for the second-largest cryptocurrency by market cap, but will likely have a positive impact on its price actions on a longer horizon. Mid-to-large cap altcoins have flipped green, with MATIC and TRX leading the pack on 3% gains over a similar time frame.

Back to the Futures

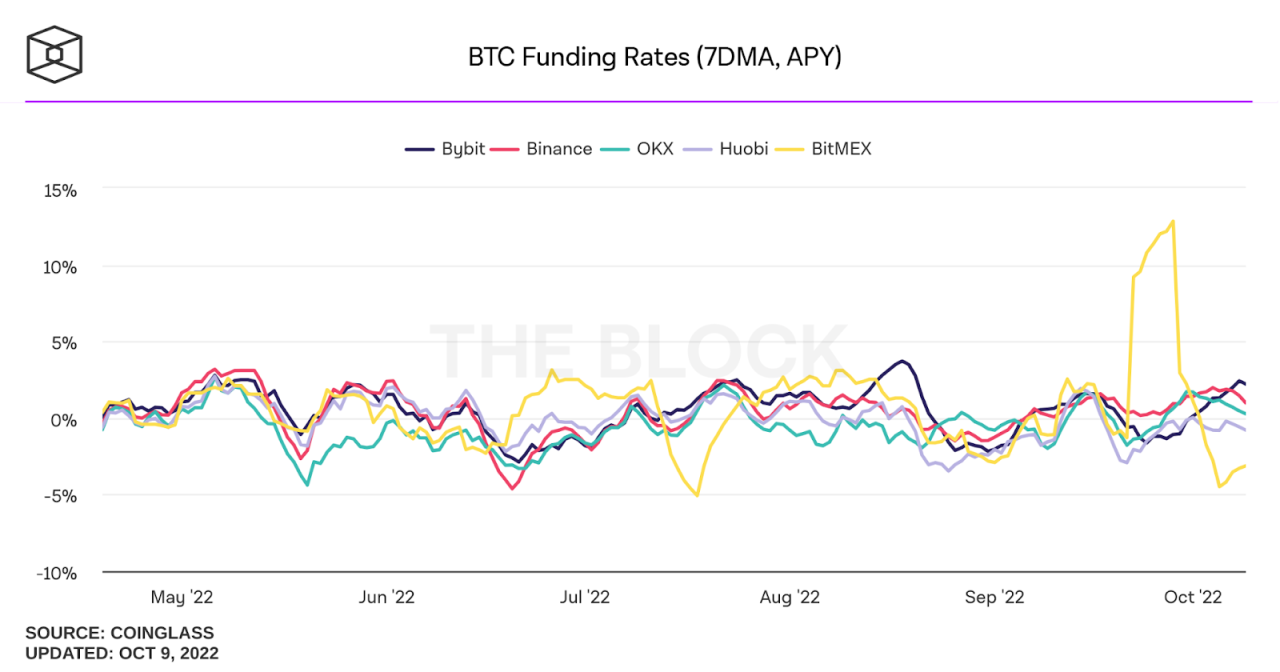

The implication of two consecutive weeks of flat spot price movement begins to surface, as realized volatility continues to elude the derivatives market. Despite uninspiring price actions, funding rates across major centralized exchanges are inching into positive territories, while BTC futures open interest denominated in BTC continues to reach a new local high, notwithstanding a subpar 3-month rolling basis. In the options market, BTC’s term structure entered a steep contango as the 7-day implied volatility hit a monthly low. ETH’s IV is also heading lower due to the lack of buying pressure. As bearish sentiments persist, investors will continue to price in the impact of macro events, including the release of the FOMC minutes and CPI readings later this week.

Talk of the Town

Nethermind, an Ethereum development company, has successfully warped the decentralized exchange Uniswap onto the Ethereum Layer 2 network StarkNet. The deployment of Uniswap by an unaffiliated team onto StarkNet is made possible through the Warp Project. This project seeks to make leading Ethereum DApps and protocols available and accessible on StarkNet, and in turn, improve the robustness of the network. According to a blog post by the team lead Jorik Schellenkens, the plugin is still under development and more is to come on the testing front. He also added that the team will continue working to replicate the success with a few other popular protocols.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.