Bybit: BTC Leverage Ratio Reaches Multi-Year High, Crypto Custodian Copper Raises $196M

Chart of the Day

Rising rents and shelter costs are the likely key drivers behind the jump in September’s consumer prices. Inflation data, which will be released later today, is expected to have risen 0.4% in September. CPI, alongside the annual rate of core inflation, which is estimated at 6.5%, will be major data points to consider before preempting the Federal Reserve’s next move. U.S. stocks tanked as investors braced for the impact of the inflation readings on later today. Bybit blog reports.

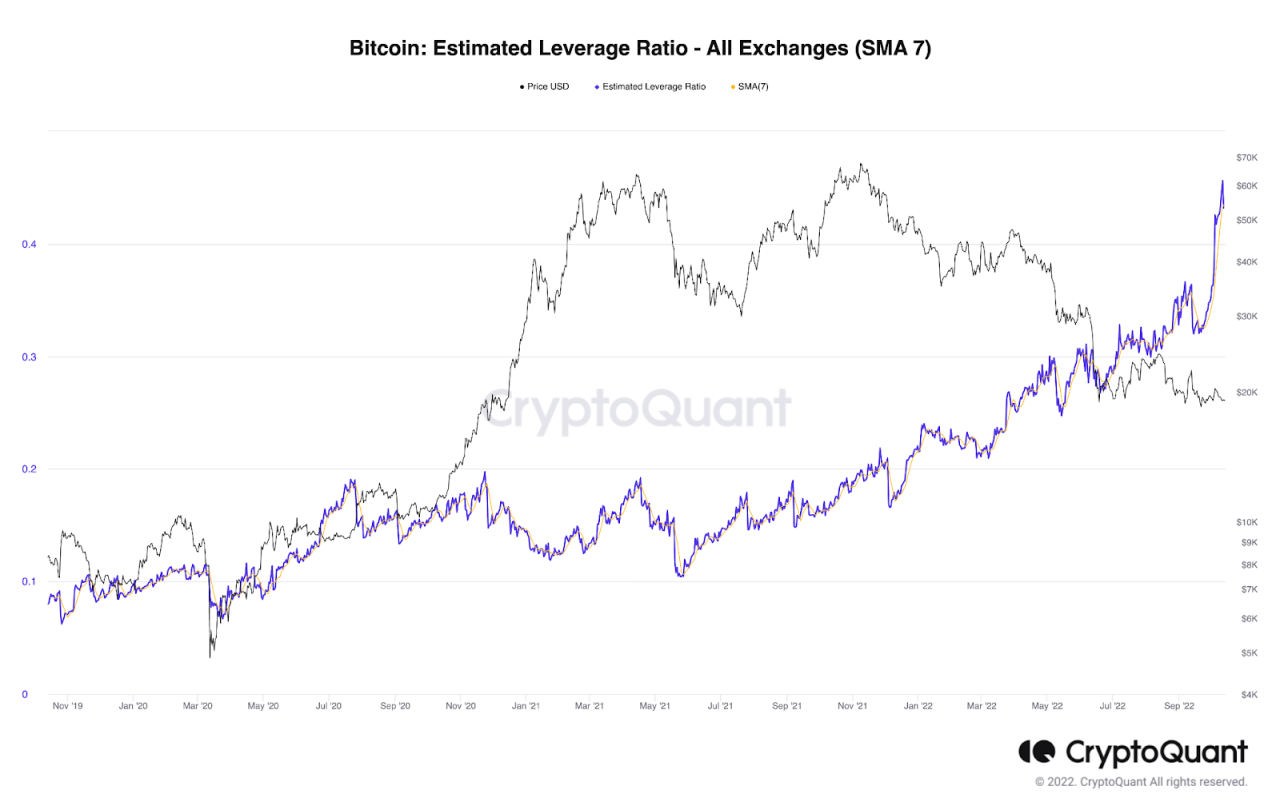

Despite major equity benchmarks capping multi-day losses, the broader crypto market continues its sideways movements as major cryptocurrencies stay pretty much where they were at the start of the week. As of the time of writing, BTC is changing hands just above the $19k handle after posting marginal gains in the last 24 hours. BTC’s trading volume remains tepid, falling below the 20-day average, while volatility plummets to local lows. However, BTC futures open interest is reaching another record high amid much inertness in the market. Leverage ratio soars to a multi-year high, indicating that the market is close to picking a direction.

Similarly, ETH is still trading below the $1,300 mark with minimum activities. Mid-to-large cap altcoins mostly flipped red, with the exception of Huobi Token, which is still up 10% on the back of a fresh capital injection.

October has officially become the month with the largest hacking activities this year. Eleven accounts of exploits took place in less than two weeks, and collectively resulted in more than $718 million funds being stolen from DeFi protocols.

Talk of the Town

London-based crypto custody firm Copper has raised $196 million in an ongoing Series C funding round, amid severe plummets in two consecutive quarters in the VC space — a rare occurrence last seen in 2018. The funds include a convertible $15 million loan note, and $181 million in fresh capital, according to company filings published this week. However, the company has declared widened losses of £14.4 million, approximately $15.96 million, in 2021, a significant increase from the previous year’s shortfall of £3.7 million.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.