Bybit: Market Recovers After CPI Data; Uniswap V3 to be Deployed on zkSync

Chart of the Day

The much-anticipated U.S. consumer prices rose surprisingly to a 40-year high in September, pressuring the Federal Reserve to jack up rates more aggressively. Risky assets spiraled down as an initial knee-jerk reaction, before rallying to reclaim lost territory on speculations that the market may have bottomed out. Some analysts factor technical level into the bounce, as the initial plummet triggers massive programmed buying. Major equity benchmarks have partially recovered from the multi-day rout, and earnings season begins to see some better-than-expected results. Bybit blog reports.

The broader crypto market witnessed the return of volatility. The flash selloff triggered the liquidation of $250 million worth of leveraged positions in the first few hours following the revelation of inflation readings. However, BTC quickly recovered to regain the all-too-familiar $19k handle. As of the time of writing, the largest cryptocurrency by market cap is well-bid above the $19.5k level after posting a 3.65% increase in the last 24 hours.

Similarly, ETH reclaims the $1,300 mark with a 3% increase in the same period. However, the futures basis of ETH expiring in September 2023 is approaching -2%, suggesting long-term bearish sentiments. In the options market, the spread between IV and RV shows a sign of convergence, implying greater opportunities for volatility traders. Mid-to-large cap altcoins mostly flipped green, with UNI and HT leading the pack on double-digit percentage gains in a similar time frame.

Talk of the Town

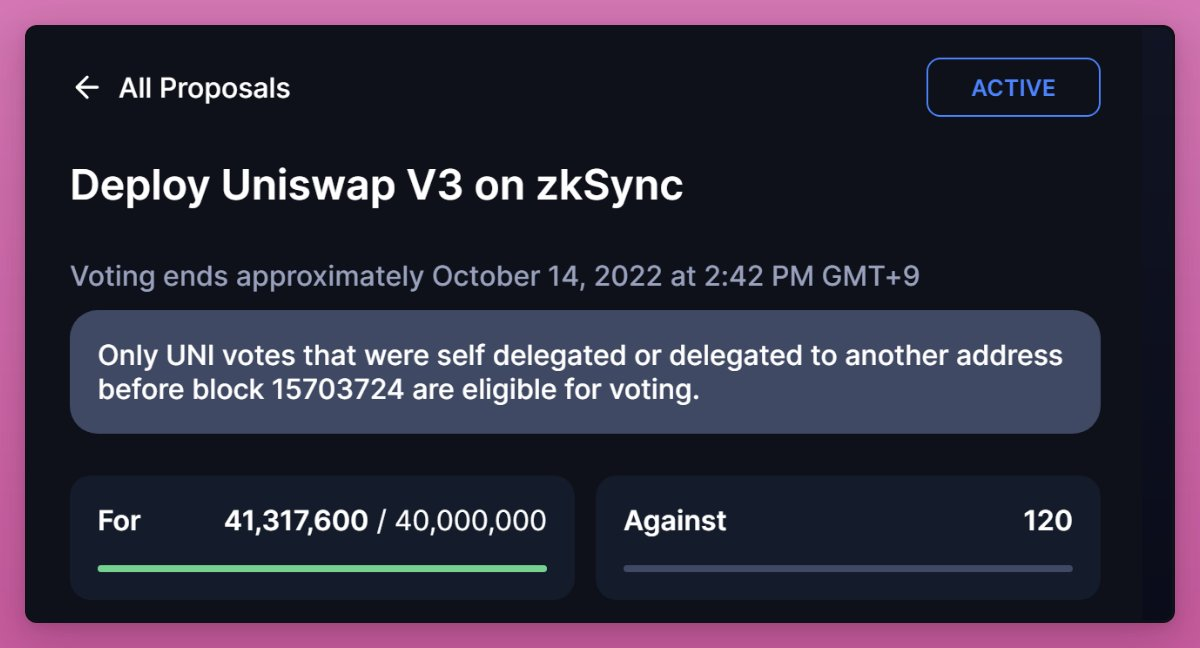

On Thursday, a governance proposal that sought to deploy Uniswap V3 on zkSync 2.0 was passed with overwhelming support. According to the proposal, the deployment will be handled by Matter Labs, the team behind zkSync, and the entire working process will take 4 to 6 weeks. Uniswap V3 is expected to go live after zkSync’s mainnet launch on Oct. 28. The deployment will support Uniswap’s cross-chain expansion, and facilitate future protocol development with more than 100 DApps and infrastructure partners built on zkSync. In addition, Uniswap has recently raised $165 million in a funding round led by Polychain Capital to advance Uniswap’s web app, developer tools, and NFT projects.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.