Bybit: BTC Active Supply Approaches Historic Lows, PancakeSwap to Deploy on Aptos

Chart of the Day

Stocks experienced another day of decline as Treasury yields climbed further on the back of hawkish remarks from Federal Reserve officials. Wariness around macroeconomic uncertainty introduced much volatility to the global market, which shows no sign of subsiding ahead of another round of corporate earnings reports. Bybit blog reports.

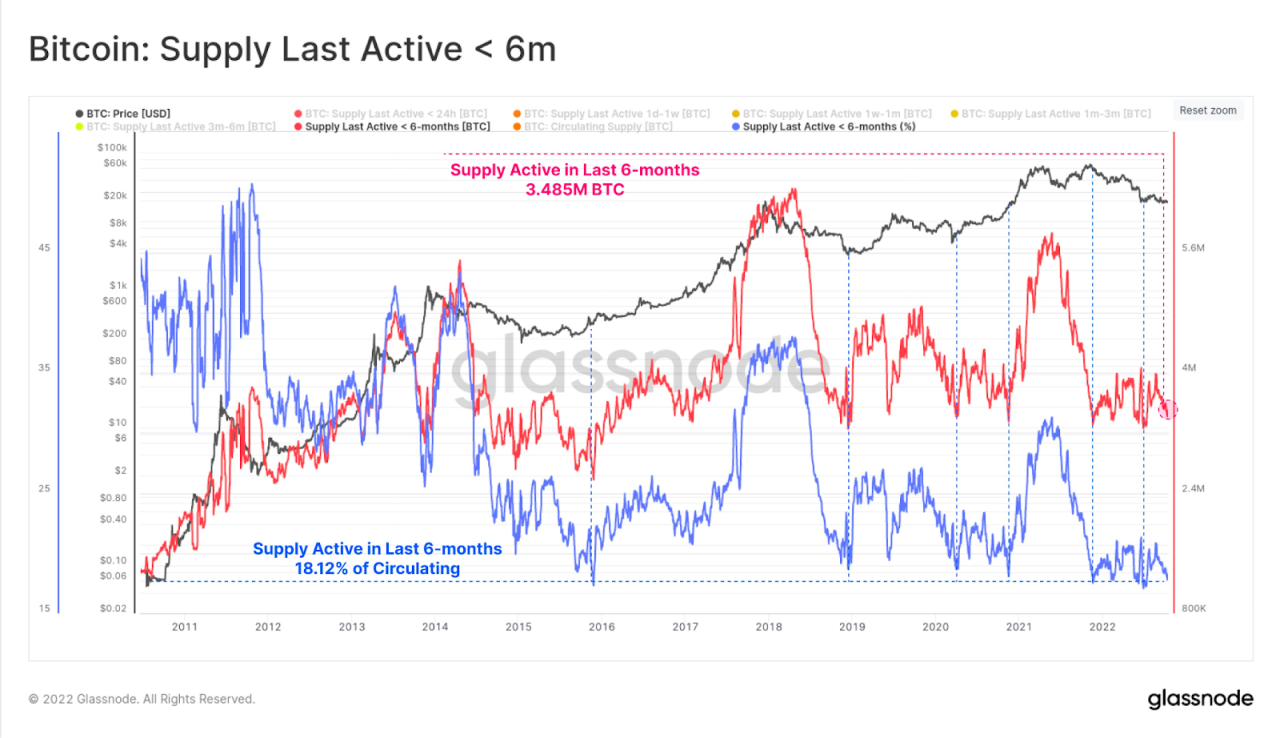

However, things turned out differently in the crypto market. BTC came to a standstill amid the lowest volatility the market has ever seen in two years. As of the time of writing, the largest cryptocurrency by market cap is clinging to the $19k pivot level, despite moving marginally into the red in the last 24 hours. Several on-chain metrics reach historic lows. BTC’s active supply in the last six months, for one, is sliding to an all-time low, representing a little over 18% of the circulating supply. Historically, low active supply often occurs after a prolonged bear run.

In a similar vein, ETH drifts further away from the $1,300 handle after posting marginal losses over the same period. In the futures market, the stabilizing spot price level may have somewhat flattened the futures basis curve for ETH, which is now moving away from the -2% mark. Mid-to-large cap altcoins have mostly flipped red, with UNI leading the downside correction on a 7% loss in a similar time frame.

Talk of the Town

The team behind the decentralized exchange PancakeSwap has proposed to expand to the newly launched Aptos blockchain following its recent integration with Ethereum. The proposal seeks to deploy its main features, including swaps, farms, pools, and initial farm offerings, expeditiously to the blockchain to take hold of the market share. The move came just weeks after the DEX’s expansion to Ethereum as part of its multi-chain strategy. PancakeSwap, which started out on the BNB chain, is now the second-largest DEX by trading volume, and its TVL trails just behind Curve and Uniswap.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.