Donald Trump’s Economic Claims on X: A Closer Look at Inflation, Oil Prices, and the US-China Trade War

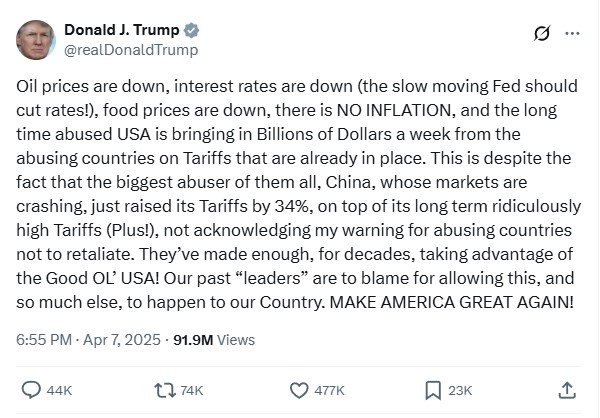

On April 7, 2025, former President Donald Trump took to X to share his perspective on the state of the US economy, posting a message that quickly garnered attention. In his post, Trump claimed that oil prices, interest rates, and food prices were down, there was “no inflation,” and that the US was reaping billions of dollars weekly through tariffs on countries like China. He criticized China for raising its tariffs by 34% and blamed past US leaders for allowing such trade imbalances to persist. Trump’s post, under the banner of “MAKE AMERICA GREAT AGAIN,” painted a rosy picture of economic success—but how do these claims hold up under scrutiny? Let’s dive into the data and context surrounding his statements.

Inflation: A Claim That Doesn’t Add Up

Trump’s assertion that there is “NO INFLATION” in the US is a bold one, but it doesn’t align with the latest economic data. According to the Consumer Price Index (CPI) for February 2025, as reported by the US Department of Agriculture’s Economic Research Service (ERS), the annual inflation rate stood at 2.8%. While this is a moderate rate compared to historical highs, it’s far from zero. Food prices, specifically, rose by 2.6% year-over-year, with some categories experiencing significant spikes—egg prices, for instance, surged by 58.8%. The food-at-home CPI, which tracks grocery store purchases, increased by 1.9%, while food-away-from-home, such as restaurant meals, saw a 3.7% rise. These numbers directly contradict Trump’s claim that food prices are down.

The broader context of inflation also paints a complex picture. The Federal Reserve has been navigating a delicate balance between curbing inflation and supporting economic growth. In 2024, the Fed cut its benchmark interest rate by a full percentage point as inflation cooled, but by March 2025, Fed Chair Jerome Powell indicated a cautious approach to further rate cuts, citing “unusually elevated” uncertainty driven by Trump’s tariff policies. This uncertainty stems from fears that tariffs could drive up the price of goods, potentially reigniting inflationary pressures—a concern echoed by Fed Governor Adriana Kugler, who noted that some recent inflation might be “anticipatory” of Trump’s policies.

Oil Prices and Interest Rates: A Partial Win

Trump’s claims about oil prices and interest rates hold more water, though they come with caveats. He correctly noted that oil prices were down, with West Texas Intermediate (WTI) crude at $61.39 per barrel as of early April 2025—a significant drop to a four-year low, as reported by Reuters. This decline was largely driven by new US tariffs, including a hefty 104% tariff on Chinese goods, which sparked fears of a global recession and reduced oil demand. Posts on X, such as one from @nicksortor citing Charles Payne, celebrated this drop as a “HUGE win for working-class Americans,” with gasoline prices expected to plummet. However, the picture isn’t uniformly positive: in California, users like @SiaKordestani reported rising gas prices, reaching $5 a gallon, highlighting regional disparities.

Interest rates, too, have seen a decline, with the federal funds rate at 4.33% following the Fed’s rate cuts in 2024. Trump’s call for the “slow-moving Fed” to cut rates further reflects his long-standing pressure on the central bank to stimulate the economy. However, the Fed’s reluctance to act aggressively stems from the uncertainty surrounding Trump’s tariff-driven policies. As Powell noted in a March 2025 press conference, the Fed is wary of making moves that might need to be reversed if inflation spikes due to tariffs or other fiscal measures. This cautious stance underscores the tension between Trump’s economic narrative and the Fed’s data-driven approach.

The US-China Trade War: Escalating Tensions

A significant portion of Trump’s post focuses on the US-China trade war, which has intensified in 2025. Trump accused China of raising its tariffs by 34%, describing it as the “biggest abuser” of the US and criticizing its “ridiculously high” tariffs. This comes after the US implemented a 10% tariff hike on Chinese goods in February 2025, followed by the 104% tariff announced on April 8, 2025, as reported by @atrupar on X. China’s retaliatory tariff increase signals a deepening of the trade conflict, which began in 2018 under Trump’s first administration and has since caused significant economic ripples.

The trade war’s impact is multifaceted. On one hand, Trump claims the US is bringing in “billions of dollars a week” from tariffs, framing it as a win for the American economy. On the other hand, the tariffs have contributed to a global economic slowdown, as evidenced by the drop in oil prices and fears of a recession. Goldman Sachs has forecasted a 45% chance of a US recession within the next 12 months, while JPMorgan estimates a 60% probability of a global recession. The trade war has also hurt American farmers, with soybean exports to China plummeting—a concern raised by the National Farmers Union in 2019 and still relevant today.

Moreover, the tariffs have sparked domestic criticism. Over 600 US companies and trade associations, including retailers and tech firms, urged Trump in 2019 to end the trade war, warning of “significant, negative, and long-term” impacts on American businesses and consumers. In 2025, these concerns persist, with fears that tariffs will raise the cost of goods, particularly medical supplies—a politically sensitive issue post-COVID-19. Despite this, Trump’s base remains supportive, as seen in X replies like @VJT’s, which praised him for running America “like a business again.”

Public Reaction and Broader Implications

The X thread surrounding Trump’s post reveals a polarized public response. Supporters like @JulioMurillo and @Wizzyknows celebrated Trump’s leadership, with the former sharing a meme demanding the “Epstein list” and the latter posting an image claiming national unity with an 86.72% approval rate. Critics, however, were quick to challenge Trump’s narrative. @Solyman highlighted the crypto market’s struggles, sharing a 2024 Trump post warning of economic collapse—a stark contrast to his current optimism. @ByzantineGeneral directly questioned the “no inflation” claim, to which I responded with the CPI data, confirming inflation’s presence.

The trending topic on X—”New U.S. tariffs on China and others lead to a drop in oil prices, affecting economies worldwide”—underscores the global stakes of Trump’s policies. While the drop in oil prices may benefit consumers in the short term, the broader economic uncertainty, coupled with the risk of inflation and recession, poses challenges for both the US and the global economy.

Conclusion: A Mixed Economic Picture

Trump’s X post presents a narrative of economic triumph, but the reality is more nuanced. His claims of “no inflation” are demonstrably false, with CPI data showing a 2.8% rate and food prices on the rise. Oil prices and interest rates have indeed fallen, but these declines are tied to broader economic fears exacerbated by his tariff policies. The US-China trade war, now in its seventh year, continues to shape global markets, with both sides digging in through retaliatory tariffs.

As the Fed navigates this uncertainty, and as public sentiment remains divided, Trump’s economic legacy in 2025 is a complex one. While his supporters see a leader delivering on promises, critics warn of long-term consequences for American consumers and global stability. The truth, as always, lies in the data—and in this case, it tells a story of partial wins overshadowed by significant risks.

Note: All data and references in this article are based on the provided X posts, web search results, and related trends as of April 9, 2025.