Bybit: BTC Rises Above $21k as Market Flips Green, Aave Proposes GHO Stablecoin

Chart of the Day

On Wednesday, the broader crypto market rose significantly alongside major stock indices after the release of the FOMC minutes. BTC broke above the $21k resistance level in a matter of hours, and briefly surpassed the $22k hurdle before facing a downward correction. The largest cryptocurrency by market cap is now trading in the upper region of the $21k zone after posting a 7.5% increase in the last 24 hours. The next major hurdle for BTC sits near the $22.5k to 22.8k region. A close above this zone may open the door to greater upside momentum. Bybit blog reports.

In a similar vein, ETH rallied more than 6% in the last 24 hours. As of the time of writing, the second-largest cryptocurrency by market cap is consolidating gains above the $1,200 handle and the 100-hour moving average. Most major altcoins saw extended upside gains, with MATIC leading the pack on a double-digit percentage gain within a similar time frame.

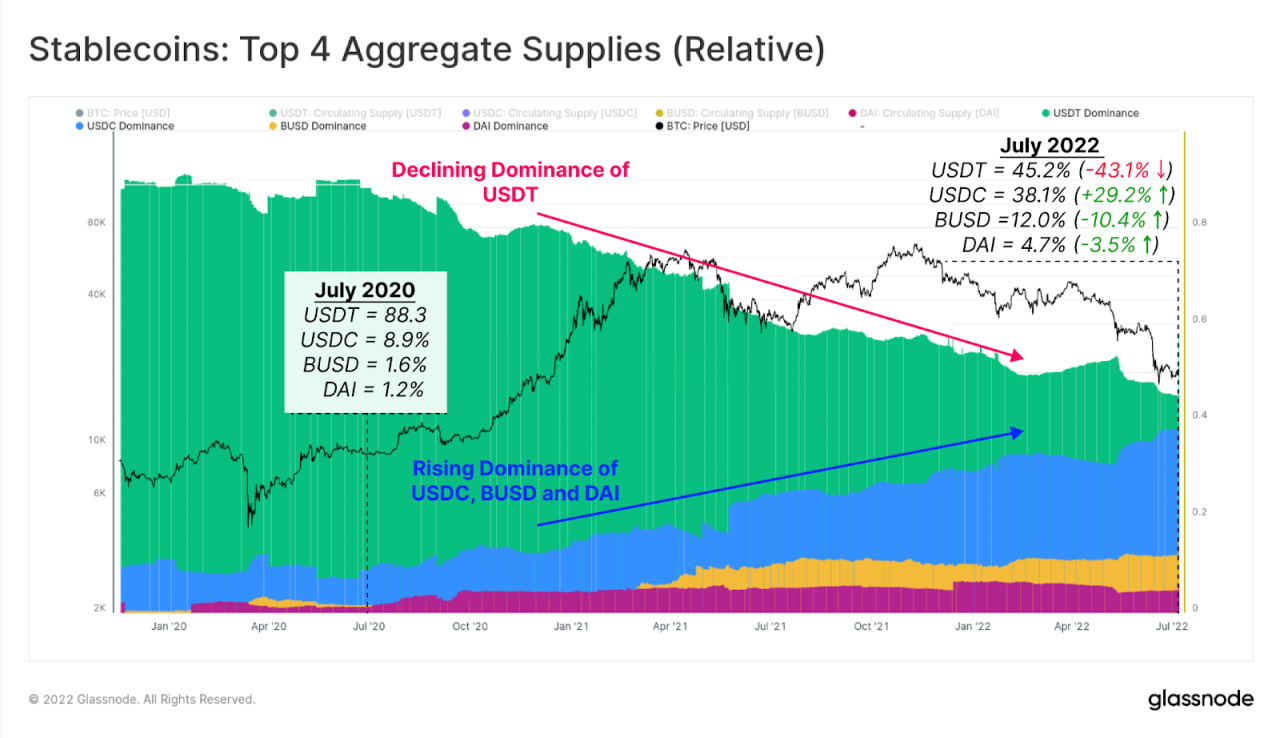

The stablecoin market is still recovering from the collapse of Terra’s UST. However, the larger trend remains that USDT’s market cap dominance has been on the decline since the beginning of 2020. Recent events have merely accelerated the process, where USDT only commands less than half of the stablecoin market shares. Meanwhile, the market cap dominance of USDC and DAI has quadrupled during the same period.

Talk of the Town

Aave Companies, the centralized entity that helms the Aave lending protocol, proposed a new dollar-pegged stablecoin on Thursday. The news comes as stablecoins are under increased scrutiny after the collapse of Terra’s UST in May. The GHO stablecoin would be minted by borrowing against assets locked as collateral on Aave. According to the governance proposal, GHO would be “backed by a diversified set of crypto-assets chosen at the users’ discretion”. At the same time, borrowers could still earn yields on their deposit assets. GHO seeks to allow more liquidity for decentralized stablecoins in the market, thus generating more volume and fees for Aave and Curve, and in turn, rendering DeFi more attractive than CeFi. A DAO consisting of all AAVE token holders will vote on the proposal after a feedback period.