Bybit: BTC Whales’ Cost Basis Estimated at $15k; GoldenTree Discloses $5.3M Stake in SushiSwap

Chart of the Day

On Wednesday, major stock indices took a breather after registering substantial gains over the past few days, with S&P 500 heading south following a dramatic bounce triggered by a large options trade. The broader crypto market followed a similar trajectory as major cryptocurrencies resumed sideway movements. Although many attributed the recent rally to narratives on the Fed’s potential pivot, fundamentally speaking, little has changed to nudge the U.S. Central Bank towards a more moderate stance to prevent a hard landing. In fact, some Fed officials have demonstrated unyielding resolve to tame inflation. Bybit blog reports.

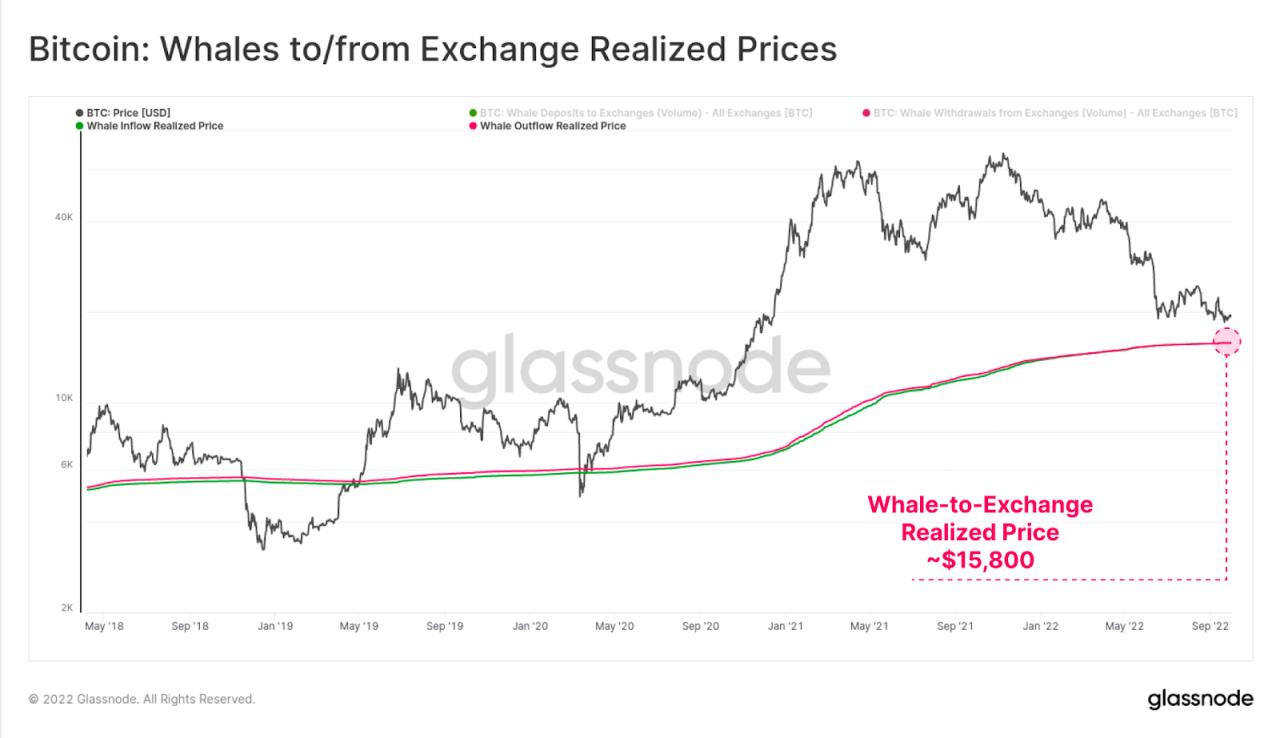

As of the time of writing, Bitcoin is changing hands above the $20k psychological threshold after posting a marginal gain in the last 24 hours. A key bullish trend line with support near $20.1k is taking shape on BTC’s hourly chart. The largest cryptocurrency by market cap will likely gain more momentum if it can clear the immediate resistance level at the $20.5k region. Meanwhile, on-chain metrics demonstrate that the exchange inflow and outflow of entities with more than 1k BTC holdings) can be used to determine the cost basis of these whales. Since January 2017, there has been a gradual but notable increase in the average realized price of whale deposits and withdrawals, which is currently sitting near the $15.8k region.

Similarly, ETH is trading in the upper region of the $1,300 handle after rising by 1.8% in the same period. The second-largest cryptocurrency by market cap will likely pick up its pace once it establishes a solid foothold above the $1,370 region. The majority of mid-to-large cap altcoins are in the green, with XRP and UNI leading the pack on 5% increases in a similar time frame. More notably, popular meme token DOGE is up 1.5% after spending most of Wednesday in the red.

Talk of the Town

GoldenTree, an asset management firm with an AUM of around $47 billion, recently revealed a $5.3 million stake in SushiSwap’s governance token. The firm outlined its purchase alongside the broader strategy concerning SushiSwap and the crypto market in general, in a post on SushiSwap’s community forum. GoldenTree recognized Sushi’s immense potential and proposed to offer their expertise in introducing novel proposals on Sushi’s tokenomics, general protocol design, as well as cross-chain strategies. Institutions are also expressing increasing interest in participating in crypto protocol staking, as Alluvial’s executive Mara Schmiedt projects significant growth in the adoption of staking protocols in the coming years.

Crypto & blockchain articles are created with the support of ByBit – leading crypto platform.