EBRD raises growth forecast, warns of threats

High commodity prices exert inflationary pressures as Covid-19 cases rise

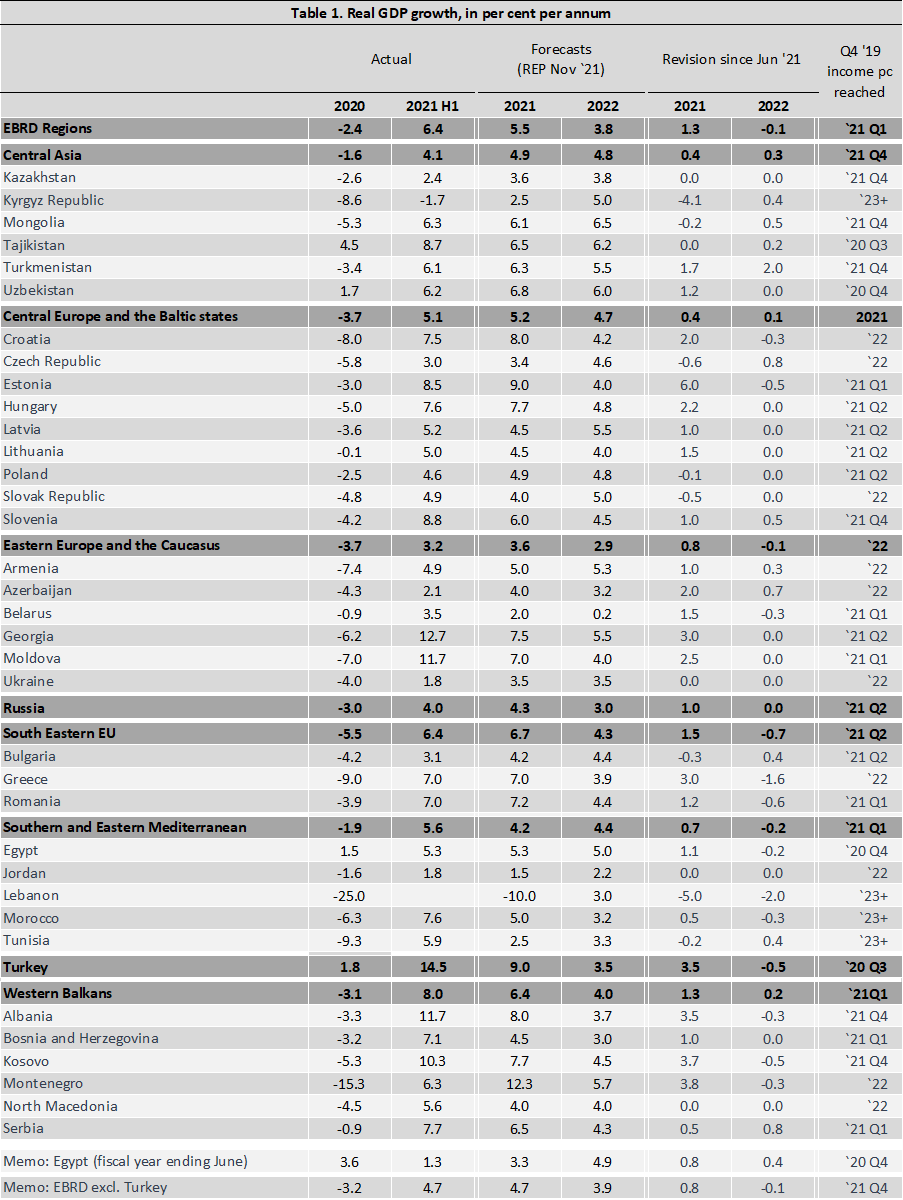

- EBRD raises growth forecast for its regions for 2021 to 5.5 per cent

- Output expanded by 6.4 per cent in first half of 2021

- Inflationary pressures, supply chain disruptions and spike in new infections impact recovery

The European Bank for Reconstruction and Development (EBRD) has raised its forecast for its regions for 2021 to 5.5 per cent in its latest Regional Economic Prospects report, published today.

While this represents an upward revision of 1.3 percentage points over its June forecast following a strong performance in the first half of the year, the Bank warns of serious threats ahead.

High commodity and energy prices, tight labour markets, supply chain disruption and currency depreciations in some EBRD economies have begun to push up inflation even before the latest spike in Covid-19 infection cases. On average, inflation in the EBRD regions exceeded its end-2019 levels by 3 percentage points in September 2021. In response, a number of central banks in the EBRD regions have raised policy interest rates.

In some EBRD economies tight labour markets added to inflationary pressures with a strong rebound in vacancies in lower-medium skilled occupations. In other economies, considerable slack in labour markets remains. Unemployment increased by 1.4 percentage points on average between February and August 2020, while labour force participation fell by half a percentage point on average.

EBRD Chief Economist Beata Javorcik said: “This is a bittersweet recovery. The first half of 2021 brought a robust rebound. But we are now seeing growing cause for concern. While high commodity prices benefit exporters, they weigh heavily on the trade balances of importers. The supply of affordable energy as we enter the winter period is becoming a serious worry, especially since governments’ headroom is limited.”

Following large stimulus packages in response to the Covid-19 crisis, public debt in the EBRD regions has increased by an average of 13 percentage points of GDP since the end of 2019. While borrowing costs remain below their pre-crisis levels in most economies, they have risen sharply in some countries.

The recovery gathered pace in the EBRD regions in the first half of 2021 when output grew by 6.3 per cent year-on-year. Mobility recovered earlier than in other parts of the world, while industrial production and retail sales rebounded. Exports of goods and services increased despite temporary supply chain disruptions. Remittances also grew in the second quarter of 2021, in some cases surpassing 2019 levels. Tourist arrivals exceeded expectations, but remained significantly below their 2019 levels in most EBRD economies.

In 2022, as economies recover, growth is expected to moderate to 3.8 per cent in the EBRD regions. This is 0.1 percentage point lower than expected in June 2021. However, forecasts are subject to high uncertainty, reflecting risks associated with the future path of Covid-19, possible worsening of external conditions and weaker growth in trading partners.

More widespread inflationary concerns may bring forward policy tightening in advanced economies, making debt burdens more expensive to service, the report warns. Travel restrictions and lingering fears of contagion continue to weigh on the outlook for the tourism sector. While bankruptcies have so far remained contained, further vulnerabilities may surface once policy support is reduced.

Output in central Europe and the Baltic states is expected to increase by 5.2 per cent in 2021 and 4.7 per cent in 2022, reflecting better-than-expected results in the first half of 2021, although supply chain disruptions weighed on growth in some economies.

In the south-eastern European Union GDP is expected to grow by 6.7 per cent in 2021 and 4.3 per cent in 2022. These figures reflect a significant upward revision to growth in Greece, although tourist arrivals remain below their 2019 levels.

Output in the Western Balkans is expected to grow by 6.4 per cent in 2021 and 4 per cent in 2022. The region saw significant upward revisions, reflecting better-than-expected performance in the first half of the year, including in the tourism sector, as well as strong export demand from the EU market.

Output in Russia is expected to grow by 4.3 per cent in 2021 and 3 per cent in 2022, boosted by public spending programmes facilitated by higher commodity revenues.

In eastern Europe and the Caucasus output is expected to grow by 3.6 per cent in 2021 and 2.9 per cent in 2022, reflecting strong results in the first half of the year, although there are signs of momentum slowing in the third quarter.

Economies in Central Asia are expected to grow by 4.9 per cent in 2021 and 4.8 per cent in 2022 on the back of higher commodity prices and recovering remittances.

Turkey’s economy is expected to grow by 9 per cent in 2021 and 3.5 per cent in 2022, supported by a post-lockdown rebound in domestic demand and strong exports benefiting from currency depreciation. Risks to macroeconomic stability have, however, increased.

Output in the southern and eastern Mediterranean is expected to grow by 4.2 per cent in 2021 and 4.4 per cent in 2022, reflecting strong pick-up in economic activity in Egypt in particular in the second quarter of 2021.